|

|

|

(CFP) |

When Wang Bowen, 24, graduated with a master's degree at Tsinghua University in Beijing in July, she had more on her mind than her fresh diploma.

Already having secured a spot as a reporter at the state-run Xinhua News Agency, Wang wasn't anxious about landing a job. She was, however, anxious about her savings, locked up in deposit accounts capped by a government-mandated return rate of around 3 percent. With the cost of living in Beijing skyrocketing and inflation denting low-yielding accounts, Wang was looking for a financial alternative.

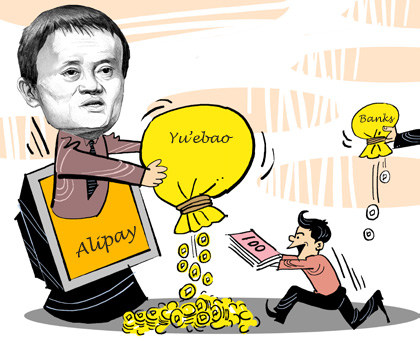

Enter Yu'ebao, launched in mid-June. It's Alibaba's wildly popular online-finance platform that works through Alipay, Alibaba's third-party-payment arm, to deposit idle Alipay funds into a comparatively high-yielding money market fund.

Given Yu'ebao's current annual interest rate of 4.5 percent, its lack of a minimum deposit requirement, and the ability to transfer and withdraw funds easily without paying a commission, Wang says it was a no-brainer to invest in what has become China's biggest online investment service.

"Using Alipay to deposit money into Yu'ebao is very easy, and the redemption of Yu'ebao is fast" Wang said. "I can enjoy the liquidity of the money and a higher rate of return at the same time."

She was not alone. In just one week, the online platform that works through Alibaba's online finance arm Alipay (a Chinese version of Paypal) and partners with Tianjin-based Tianhong Asset Management Co. Ltd., had attracted 1 million users. A month after it was unveiled, in mid-July, it had 4 million users and more than 10 billion yuan ($1.6 billion) in deposits.

Yu'ebao's popularity has skyrocketed in large part, because of consumer confidence in its parent company, Alibaba, and its link to the company's online payment platform, Alipay, which claims close to 600 million active worldwide users (800 million registered accounts according to the company's website).

Big player

Hangzhou-based Alibaba, which runs Taobao, Tmall, and a host of other e-commerce sites, accounted for 70 percent of package deliveries in China last year, with sales reaching $163 billion, or 2 percent of China's GDP, according to statements released by Yahoo. The American tech giant currently owns a 24-percent stake in Alibaba.

"Chinese trust Alibaba as an established brand with the finances to sustain products like this. If all did go pear shaped, they'd be confident that their money would be returned," said Mark Tanner, Managing Director at Shanghai-based China Skinny, an online market-research firm.

In preparations for a possible public listing in the months to come, some financial analysts have estimated Alibaba's worth at more than $100 billion, rivaling Facebook's $104 billion valuation last year before its $16 billion IPO—the largest ever for a tech company, and the third largest of all time.

Analysts are able to justify the sky-high valuation because of the explosive growth in China's online retail sector. McKinsey's estimates the Chinese online retail economy, with Alibaba's operations as a core engine, will reach $420 billion to $650 billion by 2020, eclipsing the United States to become the world's largest market. China is currently the second largest market in the world, with online retail sales reaching $210 billion in 2012, and an annual growth rate of 120 percent since 2003.

In announcing Alibaba's intention for Yu'ebao and Alibaba's foray into financial services to Chinese media, the company's founder and chairman, Jack Ma, said, "China's financial industry, especially the banking industry, only serves 20 percent of clients, and I see there are 80 percent of the clients (who) are not covered. Financial services should be about serving the layman, rather than playing inside your own circles and making money for yourself."

|