|

While an overall weakness in the world economy drains steam out of China's export sector, domestic worries proliferated about withering real estate investments and financial woes of small businesses.

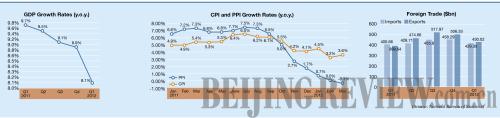

During the January-to-March period, China's exports totaled $430.02 billion, up 7.6 percent year on year, while imports edged up 6.9 percent to reach $429.35 billion. The trade surplus stood at $670 million.

"The trade data show the global economy is recovering, albeit slowly," said Zhou Hao, an economist with ANZ Bank in Shanghai.

"Given that China had a trade surplus in the first quarter versus a deficit in the same period of last year, it indicates a positive contribution to GDP growth." he said.

"But the export prospect looks dim due to clouds gathering over the world economy and souring domestic business environment," Zhou said.

Meanwhile, uncertainties are hanging over the cooling property markets, with home price growth softening and developers offering discounts to bump sales.

"The nation's home prices may decline 10 percent by June from a year earlier, while sales volume is expected to be little changed or may even slip in 2012," said Bei Fu, a Hong Kong-based analyst with the S&P. "Many developers may be at increased risk of refinancing due to weaker property sales, high funding costs and tightened liquidity."

"A major cause for the ongoing slowdown is a stringent clampdown on the real estate industry," said Ba.

"But policymakers are less likely to take their foot off the brake as they attempt to bring soaring house prices back to a reasonable level," he said.

Slower property investment is likely to cut into growth for 2012 in the world's second biggest economy, Bei said.

Industrial enterprises above designated size—sales revenue exceeding 20 million yuan ($3 million)—generated 606 billion yuan ($96.2 billion) in profits for the first two months of 2012, dropping 5.2 percent year on year, said the NBS.

Woes of small businesses are no less acute, as capital strains, labor shortages and lackluster demand make a dent to their competitive edge. Newspapers are constantly filled with reports of factories in Guangdong and Zhejiang provinces operating on slim profit margins or failing to hire enough workers.

"The small and medium-sized enterprises may face more daunting challenges than in 2008 when China felt the ripple effect of the financial crisis," said Zhu Baoliang, a research fellow with the State Information Center.

"In addition to that, the country will have to properly deal with simmering dangers of waning property investments, piling debts of local governments, as well as financial risks caused by private lending," he said.

Bank of America Merrill Lynch expects China's economic growth to slow from 9.2 percent in 2011 to 8.6 percent in 2012.

The major risks are the euro-zone debt crisis and the falling property fixed-asset investment under the current tightening measures, said the bank in a recent report.

"Over the long-term, China could experience a gradual slowdown due to an aging population, falling returns on capital investment and lack of gains from institutional reforms," it said.

Email us at: huyue@bjreview.com |