|

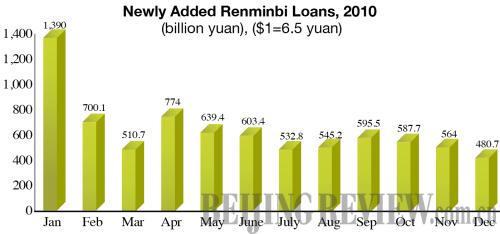

As the economic recovery solidifies, the tone and language of policy guidance will be increasingly cautious on inflation, she said.

Property conundrum

Another test to the nerves of policymakers was the real estate craze that priced urban houses beyond the reach of most working-class families.

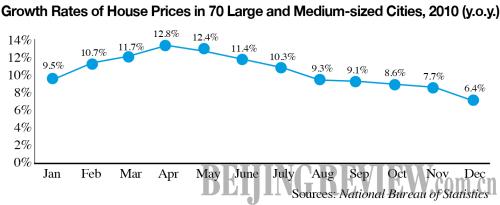

Home prices in 70 large and medium-sized Chinese cities grew 6.4 percent in December 2010 year on year, despite a slowdown from the peak of 12.8 percent in April last year. Sales of commercial houses totaled 5.25 trillion yuan ($807.7 billion) last year, skyrocketing 18.3 percent from 2009.

Attempting to let air out of the property bubble, the government put various measures in action to dampen speculation. The State Council on April 16 issued 10 rules, stipulating down payments must not be lower than 50 percent and mortgage rates must be raised to 1.1 times the benchmark lending rate for a second-home purchase.

On September 29, the government ordered all first-home buyers to pay at least the 30-percent down payment, up from the previous 20-percent requirement. In addition, the government also required commercial banks to suspend loans to third-home buyers.

But after several months of market gloom, prospective buyers are jumping off the sidelines. In big cities like Beijing, newspapers are once again filled with reports of thousands of homebuyers cramming into sales offices of new housing projects, snapping up hundreds of available apartments in a matter of hours. Prices of newly built commercial houses surged 42 percent last year in Beijing, according to data from the China Real Estate Information Corp.

Without any other safe investment channels, many consumers tend to park their money in the property market to hedge against inflation, said Gu Yunchang, Deputy Director of the China Real Estate and Housing Research Association.

Pessimists see risks in the overheating market. "An enormous bubble is in the making as many speculative investors hoard empty flats to make a quick profit," said Andy Xie Guozhong, an independent economist.

|

|

SUSTAINABLE FUTURE: Steel slabs are produced at a factory of Shougang Group, a major steelmaker in Caofeidian, Hebei Province. The group has made progress in energy efficiency and environmental protection (YANG SHIYAO) |

A key to the market regulation is to properly implement the already-issued policies, said Jiang Weixin, Minister of Housing and Urban-Rural Development.

The government will continue to keep a handle over the market and strengthen supplies of affordable houses for needy groups, he said.

Continued growth

"The economic slowdown is likely to continue into this year due to diminishing gains from institutional reforms and loss of demographic dividends," said Lu Ting, a senior economist with the Bank of America-Merrill Lynch.

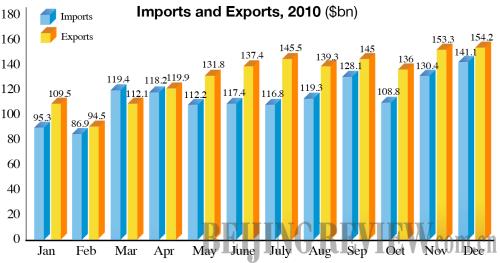

Investments will probably slow in 2011, but remain supported by government expenditures on housing and public projects. A fall in export growth, because of a higher comparative base and weak recovery in major developed economies, would also take steam out of the economy, he said.

"But two drivers are also helping to arrest the slowing trend: innovation as a result of rising research and development spending and industrial relocation to China's poorer inland areas," Lu said.

In a recent report, the World Bank expected the Chinese economy to grow 8 percent this year, providing a source of growth for the global economic recovery. Growth in China is likely to ease from the near 10-percent pace of 2010—due in part to the unwinding of fiscal stimulus, restrictions placed on over-heating sectors and a general tightening of monetary conditions in the face of rising inflation pressures, said the report.

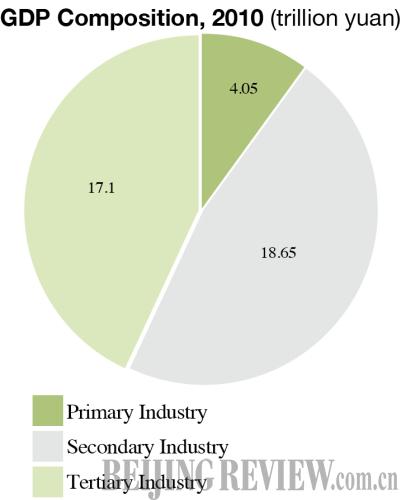

Nevertheless, industry-led, capital-intensive growth is likely to keep GDP gains near 8.5 percent in 2011, with net exports contributing smaller shares of growth than in the pre-crisis years. China's economy is becoming stronger to some extent, with industrial output some 34 percent above pre-crisis peak levels, said the World Bank report.

Ha Jiming, managing director of Goldman Sachs Group's investment banking division, predicted the economy will enjoy 10-percent growth in 2011, but slowing seems inevitable.

"More economic vitality will come from within with consumption booming," he said. "From the long-term perspective, inland areas will replace coastal cities to become a pillar force of the economy as labor and enterprises move inward."

|