|

|

|

BEST DEBUT: Gu Yongqiang, founder and CEO of Youku.com, poses at the New York Stock Exchange on December 8, 2010. Youku's stock price almost tripled on its first trading day (BLOOMBERG) |

Video-sharing website Youku.com, the Chinese equivalent to YouTube, and online retailer Dangdang.com, debuted on the New York Stock Exchange (NYSE) on December 8, ushering in a dazzling and busy year-end for Wall Street.

The two Internet companies' share prices soared within hours of being listed—Youku almost tripled its $12.8 offering price to end its first day of trading above $33 a share, the best debut on the U.S. market since Chinese-language search engine Baidu jumped 354 percent in 2005.

On the heels of their spectacular debuts, five more China-based businesses were listed by the end of 2010, such as movie distributor Bona, mobile application seller Sky-mobi, and software outsourcing company iSoftStone.

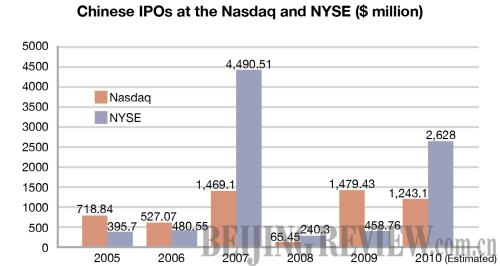

Last year, 41 Chinese companies completed IPOs at the Nasdaq and the NYSE, raising nearly $3.9 billion, China's best performance yet in the U.S. market, which even outnumbered the 29 in 2007, according to the Beijing-based equity investment consulting company Zero2IPO Group.

The Chinese companies also made up a quarter of the total of the U.S. IPO market last year. But investors were advised to exercise caution over a possible new dot-com bubble amid high market sentiment toward Chinese stocks, as profitability is not expected in the short term for some of these companies.

And the U.S. Securities and Exchange Commission (SEC) began investigating Chinese listings too, focusing on accounting violations, lax auditing practices and IPOs through "reverse takeovers," or back-door mergers with dormant shell companies.

An IPO is the beginning of a new journey. "Chinese companies have to prove they can live up to their names after being successfully listed," said Fang Sanwen, founder of Imeigu.com, a website dedicated to information about U.S.-listed Chinese companies.

IPO frenzy

Last year marked a fourth IPO craze for China-based businesses in the U.S. market since the 2000 dot-com bubble burst. The previous three, respectively in 2000, 2004-05 and 2007, made Web portals Sina and Baidu, instant-messaging giant Tencent, and e-commerce platform Alibaba big names among American investors.

As usual, companies in the TMT (technology, media and telecommunications) sector were leaders and delivered the most stunning first-day performances this time. The 12 IPOs in the TMT sector totaled $1.5 billion, contributing 38.5 percent of the total, said Zero2IPO statistics.

Last year's second best debut, ChinaCache International, an Internet content and application delivery provider, surged 95 percent on its first day in October. Dangdang posted an 87 percent first-day gain and online real estate service provider SouFun a 73 percent gain.

Dangdang and Youku raised $272 million and $202 million, respectively, ranking second and third largest among Chinese companies' IPOs last year, next to the $350 million raised by new energy company MingYang WindPower.

The energy sector followed in terms of total IPO volume and numbers, but education and retailing delivered better first-day performances—stock prices of TAL Education and Country Style Cooking Restaurant Chain, which were listed at the NYSE in October and September, all surged more than 50 percent on the first day.

|