|

|

|

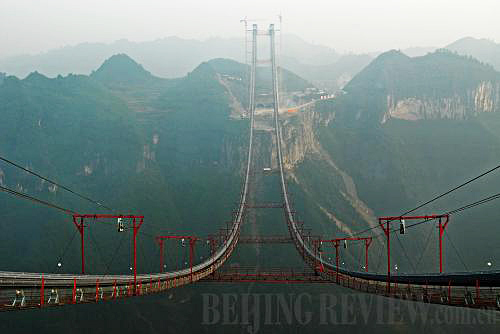

BRIDGING HUNAN: Construction on the Aizhai Suspension Bridge in Hunan Province makes major progress in October. The bridge, at a cost of 920 million yuan ($138 million), is expected to come into use by the end of 2011 (FAN JUNWEI) |

Numbers of the Week

628.72 billion yuan

China's fiscal revenue stood at 628.72 billion yuan ($94.7 billion) in September, up 12.1 percent from a year earlier, said the Ministry of Finance.

7.58 billion yuan

China's box office reached 7.58 billion yuan ($1.14 billion) in the first three quarters of 2010, compared with 6.2 billion yuan ($929.5 million) for the entire year of 2009, said the State Administration of Radio, Film and Television.

TO THE POINT:

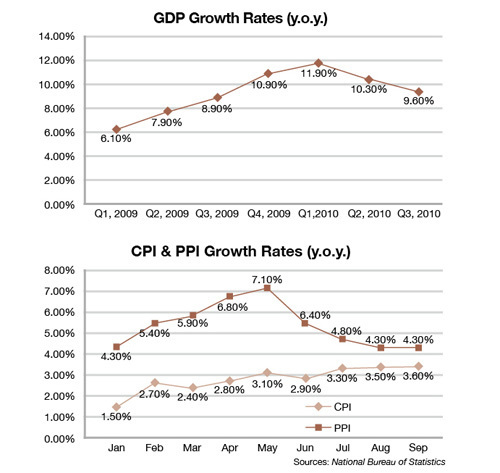

The National Bureau of Statistics released economic data for the third quarter of this year, painting a pleasant picture of the Chinese economy. GDP went up 9.6 percent in the third quarter year on year, but the consumer price index is causing concerns about inflation. The central bank raised interest rates for the first time in three years. Meanwhile, the country maintains its appeal to foreign investors as FDI grows. China bought $21.7 billion in U.S. Treasury securities in August. The aviation sector thrives thanks to a surge in air traffic.

By HU YUE

Q3 Economic Figures

GDP

China's GDP grew 9.6 percent in the third quarter from the same period last year. The growth rate slowed down from 11.9 percent in the first quarter and 10.3 percent in the second quarter.

GDP in the first three quarters grew 10.6 percent year on year, 2.5 percentage points faster than one year ago.

CPI and PPI

The consumer price index (CPI), an effective gauge of inflation, grew 3.6 percent in September. This represented a 23-month high and was 0.1 percentage point higher than in August. The index for the first three quarters increased 2.9 percent.

In September, the producer price index (PPI), a major measure of inflation at the wholesale level, was on par with August at 4.3 percent. The PPI for the January-September period increased 5.5 percent.

Investment in fixed assets

The investment in fixed assets stood at 19.22 trillion yuan ($2.88 trillion) in the first three quarters, surging 24 percent from a year earlier. The real estate investment was 3.35 trillion yuan ($502.41 billion) from January to September, soaring 36.4 percent year on year.

Retail sales

China's retail sales of consumer goods leapt 18.3 percent year on year to reach 11.1 trillion yuan ($1.66 trillion) in the first nine months.

Residents' income

The per-capita disposable income of urban residents came in at 14,334 yuan ($2,149) for the first three quarters, up 10.5 percent year on year. The per-capita cash income of farmers grew 13.1 percent from the previous year to 4,869 yuan ($730).

Money supply

The broad money supply (M2), which covers cash in circulation and all deposits stood at 69.6 trillion yuan ($10.43 trillion), at the end of September, representing a growth of 19 percent year on year, said the central bank.

Interest Rate Hike

The People's Bank of China, the central bank, on October 19 announced to raise the benchmark one-year lending and deposit rate by 0.25 percentage points.

The one-year deposit rate will be 2.5 percent, and the one-year lending rate will stand at 5.56 percent, effective on October 20.

This is the country's first interest rate hike since December 2007, and the surprise move is widely considered an effort to cushion growing inflationary pressures and dampen the real estate market.

The move is reasonable since the consumer price index has been hovering at a relatively high level, said Li Daokui, a member of the Monetary Policy Committee of the central bank and a professor at the Tsinghua University's School of Economics and Management.

In addition, the Chinese economy has steered a steady course of growth, leaving room for the policymakers to fight inflation, he said.

Zuo Xiaolei, chief economist at the Beijing-based China Galaxy Securities Co. Ltd., believed the monetary tightening will put a freeze on investments in the property sector.

|