|

--

TO THE POINT: China scooped up Japanese government bonds in a bid to diversify its holdings of foreign exchange reserves. The gold market gained a chance to shine while stocks and properties lost their fizz. Despite concerns over intensifying competition, European companies showed confidence in the Chinese market in a survey conducted by the European Union Chamber of Commerce in China. Hot money is leaking into China, though no signs of torrential flows have been found. After surviving industry fallout, U.S. auto giants seek refuge in the booming Chinese market.

By HU YUE

Numbers of the Week

114.3 %

China's coal imports surged 114.3 percent year on year to 68.98 million tons in the first five months of this year, said the Ministry of Industry and Information Technology.

$443.2 billion

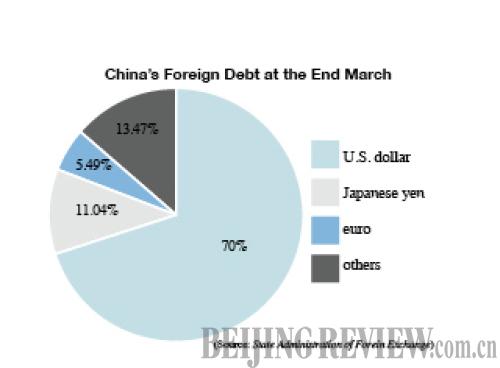

China's foreign debt stood at well over $443.2 billion at the end of March, said the State Administration of Foreign Exchange.

Buying Spree

China has boosted its buying of Japanese government bonds this year, snapping up a net $6 billion of mostly short-term notes between January and April, double the record amount logged for all of 2005, said the Ministry of Finance of Japan.

In April alone, China bought a net 197.8 billion yen ($2.25 billion) of Japanese government bonds, the second biggest after Britain among foreign buyers, said the ministry.

The purchases do not indicate a shift in China's long-term investment strategies, said Guo Tianyong, Director of Research Center of China's Banking Industry of the Central University of Finance and Economics.

It was mostly a short-term move to seek safety in the yen while concerns proliferate over the euro, he said.

The euro has plunged more than 14 percent in value against the U.S. dollar this year due to the European sovereign debt crisis.

In a recent statement, China's State Administration of Foreign Exchange said the country would continue to diversify investments of foreign exchange reserves and Europe remained one of its key investment markets.

Gold Bonanza

The gold market glitters with vitality amid other faltering markets. Now the question is: How much longer will this boom last?

Prices of gold futures at the Shanghai Gold Exchange have gained more than 11 percent so far this year while the Shanghai Composite Index dived 27 percent.

Meanwhile, the country's gold output rose nearly 6 percent year on year to 127.34 tons in the first five months, said the Ministry of Industry and Information Technology. Gold firms reported a combined net profit of 7.95 billion yuan ($1.17 billion) in the first five months, up 76.8 percent from last year.

Risk aversion came to the fore as fears about the European sovereign debt and global economy rattled investors, said Jiang Shu, a senior analyst at the Industrial Bank Co. Ltd.

But the long gold rally also is stoking fears of a bubble. Many fret that the market is bound for some corrections given rampant speculation. The precious metal will also receive a blow from volatility in international markets. Gold for August delivery dropped 1 percent to finish at $1,195.1 an ounce on July 6 at the COMEX Division of the New York Mercantile Exchange, after touching $1,189.5, the lowest price since May 24.

But with the consumer price index creeping higher in China, gold will maintain its appeal as a hedge against inflation, said Yang Yijun, chief analyst at the Chengdu-based Wellxin Consulting Co. Ltd.

In addition, physical demand for the yellow metal is also on the rise as Chinese consumers dig deeper into their pockets for gold jewelries, he said.

Investment Destination

European companies remain optimistic about China's surging economic growth, but are concerned about uncertainties in the business environment, said the European Union Chamber of Commerce in China in a recent report. The report is based on a survey of more than 500 European companies in China.

The survey shows that the Chinese market has recovered well and European companies anticipate that this impressive performance will create opportunities for their own industries. Some 78 percent of respondents see a bright outlook in their sector over the next two years while 49 percent reported that China has become an even more important element of their global business strategies.

|