|

Numbers of the Week

55,362

Sony (China) Ltd. recalled 55,362 Vaio laptops in China starting July 1, produced between December 2009 and February 2010, citing over-heating problems.

400

The Shanghai Government will build 400 charging stations for electric vehicles in 2010, as part of the city's effort to promote awareness concerning alternative-energy vehicle use.

TO THE POINT: Chinese stock markets plunged along with their global counterparts—the benchmark index lost 26.82 percent in the first half of this year, the worst performance among nations worldwide. China's manufacturing sector slowed and was clouded by a sense of pessimism as the June purchasing managers' index dropped by 1.8 percentage points compared with May. Electronic manufacturer Foxconn plans to build a new large-scale plant in Henan Province to cut costs. Ping An Insurance tries to merge two banks to establish a stronger banking presence. Shanghai topped other cities as the most important financial center in China and a growing world financial hub.

By LIU YUNYUN

Stock Market Nightmare

A bearish mood dominated the Chinese stock markets in the first half of this year with the benchmark Shanghai Composite Index dropping 26.82 percent by June 30.

On June 30, the Shanghai Composite Index fell to 2,398 points, the lowest in 14 months, on concerns of tightening measures in the real estate market and on money supply.

"Stocks will decline further," said Li Jun, a strategist at Central China Securities Holdings Co. "We'll soon see not-so-optimistic economic data in July and there's no sign of a reversal in the tightening policies."

Agricultural Bank of China Ltd. (ABC), the last "big four" state-owned commercial bank that has not been listed, started issuing shares in Shanghai and Hong Kong stock markets on July 1. It is expected to be the biggest initial public offering in the country, and will absorb $21.5 billion-23.8 billion.

The scale of the listing triggered fears of an investment shortage in other stocks, as many investors have sold shares to buy ABC stocks.

But some analysts believed the timing of the massive market loss is just right. Chinese stocks are still the most "overvalued" in Asia, excluding Japan, even after a drop in the market's premium, says Credit Suisse Group AG.

Morgan Stanley, BNP Paribas SA and Nomura Holdings Inc. expected a stock rally citing China's June 19 decision to end the yuan's two-year peg to the dollar, which could help curb inflation and asset bubbles.

Manufacturing Slows

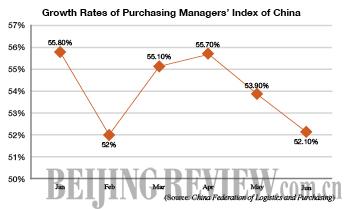

The Purchasing Managers' Index (PMI) for China's manufacturing sector stood at 52.1 percent in June, down 1.8 percentage points from the figure in May, said the China Federation of Logistics and Purchasing.

The PMI index slowed for the second consecutive month, indicating a moderation in the pace of China's manufacturing expansion, said the China Galaxy Securities Co. Ltd.

The PMI includes a package of indices to measure manufacturing sector performance. A reading above 50 percent indicates economic expansion, and below 50 percent indicates contraction. This was the 16th straight month that the index was above 50 percent.

"Since the PMI is based on firm-level surveys, the draconian property tightening measures in China, and the European debt crisis could weigh on manager sentiment. This could in turn impact the survey results," said Lu Ting, an economist of the Bank of America-Merrill Lynch.

"The June index indicates China's economic growth is at a key stage, turning to stabilization. The foundation for a new round of sustainable growth is forming, and this needs to be consolidated," said Zhang Liqun, a researcher with the Development Research Center under the State Council.

Foxconn's New Plant

Foxconn International Holdings, the manufacturer for global electronic giants like Apple Inc., Panasonic and Dell, plans to set up a plant in central China's Henan Province.

Foxconn, which came into the spotlight after 13 in-plant suicides since the beginning of this year, currently has operations in south China's prosperous Shenzhen in Guangdong Province.

A recruitment announcement published on the government website of Hebi City in Henan has caught the attention of workers nationwide—Foxconn needs 100,000 employees for its new factory in the province. Cities in Henan are already competing for the plant's site.

Workers at the new plant can expect a monthly salary comparable to their Shenzhen peers, between 2,500-3,000 yuan ($366-439), according to the recruitment notice. The notice also said overtime work would be no more than three hours a day and a one-day break is guaranteed each week.

|