|

Numbers of the Week

45.17 billion

China suffered economic losses of 45.17 billion yuan ($6.6 billion) in May due to natural disasters including floods, snowstorms and earthquakes, said the Ministry of Civil Affairs.

10%

The China Investment Corp. (CIC), the country's sovereign wealth fund, recorded a 10-percent loss in market value in May, due to market slump in the United States and Europe, said Wang Jianxi, Deputy General Manager of the CIC.

TO THE POINT: China sets criteria for a second housing mortgage, dealing a heavy blow to speculators. Signs emerge that the auto market boom has peaked as sales in May fell month on month. The Industrial and Commercial Bank of China lent more than 55 billion yuan ($8.05 billion) in trade finance to small businesses from January to April. Baosteel lowers prices for July delivery as overall demand weakens. Group buying websites mushroom across the country, but concerns arise as the sector becomes overcrowded.

By HU YUE

Property Market

Home prices in 70 large and medium-sized Chinese cities rose by 12.4 percent year on year in May, said the National Bureau of Statistics. It was only 0.4 percentage points lower than the record high growth rate in April.

In its latest attempt to force speculators out of the property market, the Chinese Government has ordered banks to analyze the mortgage and home purchase records of people applying for second mortgages.

It's the first time China has included home ownership records in determining second home mortgages.

Previously, banks only defined homes based on mortgage records—so if a buyer already purchased two homes but only turned to the bank once for a loan, application for a third home would be deemed a second-home mortgage.

Under the new rule, such an application would be defined as a third-home mortgage and would be much harder to get.

The new measure means speculative buyers can no longer bypass higher interest rates or down payment requirements when seeking housing loans.

On April 15, the State Council announced tougher policies on second home purchases, with the down payment ratio rising from 40 percent to 50 percent and mortgage rates 1.1 times the benchmark lending rate.

The new rule also stipulated that out-of-town home owners who haven't paid income tax or social security funds in the previous 12 months in places where they are buying homes will also face the tougher requirement.

The government also recommended banks to halt lending to people seeking to buy a third home in places where prices had been soaring or were already too high.

As the austerity policies gain traction, house sales have fallen nationwide. China Vanke Co. Ltd., for example, said its house sales revenues dived 20.2 percent in May year on year.

Auto Sales

After a bumper year in 2009 for China's auto makers, worries are proliferating that a pothole-filled path lies ahead.

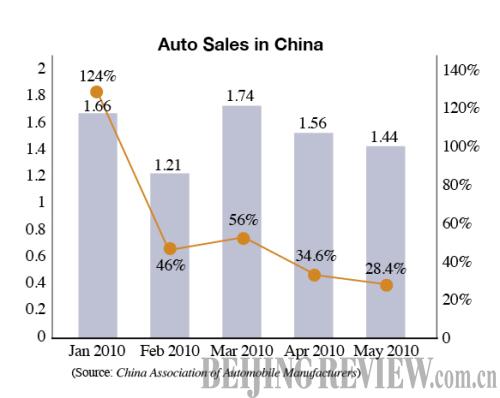

Auto sales across the country grew 28.35 percent year on year to reach 1.44 million units in May, much slower than 34.61 percent in April. On a monthly basis, the May sales dropped a hefty 7.5 percent, said the China Association of Automobile Manufacturers.

The May figure brought total sales during the first five months to 7.6 million units, up 53 percent from a year earlier.

China's auto market flourished last year as policy initiatives helped put cars within reach of many consumers for the first time. The buying rush even left many carmakers scrambling to expand their production capacities to prevent consumers from fleeing to rival companies.

"The auto boom seems to be losing some fizz as the generous incentives have brought most potential buyers to the table, leaving little room for growth this year," said Zhao Hang, Director of the China Automotive Technology & Research Center.

This year buyers must pay a 7.5-percent tax for purchases of small-capacity cars instead of the 5-percent rate of 2009, though still less than the normal rate of 10 percent.

|