|

Numbers of the Week

2.63 trillion

China's tax revenue rose 33.2 percent year on year to 2.63 trillion yuan ($384.77 billion) in the first four months, said the State Administration of Taxation.

331.64 billion

China's electricity generation rose 21.4 percent year on year to 331.64 billion kilowatt-hours in April, said the National Bureau of Statistics.

TO THE POINT: The release of economic figures for April stoked inflation fears again. The CPI rose 2.8 percent in April, challenging the government's goal of keeping inflation below 3 percent. Bank lending in April brought new loans in the first four months to half of the designated loan target cap for the whole year. House prices defied the government's tough policies and continued to increase to a record high in April, but analysts say tightened policies need time to take root. Foreign banks in China face increasing competition from their local rivals, as illustrated by a survey from PricewaterhouseCoopers.

By HU YUE

Figures in April

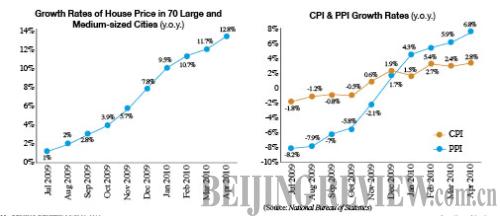

CPI and PPI

The consumer price index (CPI), the main gauge of inflation, rose 2.8 percent year on year in April, hitting an 18-month record, said the National Bureau of Statistics (NBS).

Yao Jingyuan, chief economist of the NBS, said April's CPI growth was mainly due to rising food prices, particularly vegetables. Food prices, accounting for about one third of the CPI's weight, gained 5.9 percent in April.

"The government should be vigilant and take action now to prevent the price hikes from spreading to the overall stock of food and commodities," Yao said.

Yao said the index would continue to rise year on year given the low base in 2009. It was difficult but still possible to keep CPI growth around 3 percent for the whole year, he said.

The producer price index (PPI), an indicator of inflation at the wholesale level, grew 6.8 percent in April, 0.9 percentage points higher than in March.

But Lu Zhengwei, chief economist with the Industrial Bank Co. Ltd., said the surge in the PPI may not feed into the CPI since enterprises engaged in fierce competition are less likely to pass cost pressures to consumers.

Foreign trade

China's exports in April totaled $119.92 billion, up 30.5 percent from a year ago, while imports reached $118.24 billion, soaring 49.7 percent year on year, said the General Administration of Customs. The trade surplus was $1.68 billion in April, down 87 percent from a year earlier.

From January to April, exports totaled $436.05 billion, up 29.2 percent and imports soared by 60.1 percent to $419.94 billion. Trade surplus in the first four months was $16.11, a slump of 78.6 percent.

It seems Western consumers have opened their wallets again, said Zhang Yansheng, Director of the Institute for International Economic Research at the National Reform and Development Commission. But the exports are not without uncertainties as the European debt crisis threatens to pummel the global economy, he said.

Money supply

Central bank figures showed the broad money supply (M2), which covers cash in circulation and all deposits, increased 21.48 percent year on year to about 65.66 trillion yuan ($9.62 trillion) by the end of April.

New loans

Newly added loans denominated in renminbi reached 774 billion yuan ($113.35 billion) in April, compared with 510.7 billion yuan ($74.89 billion) in March, said the People's Bank of China, the central bank. It was also an increase of 182.2 billion yuan ($26.7 billion) from the same month last year.

The April figure brought new loans in the first four months to more than 3.37 trillion yuan ($493.6 billion), nearing half the 7.5-trillion-yuan ($1.1-trillion) total China has targeted for the full year.

Ha Jiming, chief economist at the China International Capital Corp. Ltd., said the bank lending in April was unexpectedly robust, but the pace will continue to even out as the country gears up to absorb excessive liquidity.

|