|

8,000

China's international patent applications totaled nearly 8,000 cases in 2009—the fifth most in the world, said the State Intellectual Property Office.

34.62 billion

China's lottery sales reached 34.62 billion yuan ($5.07 billion) in the first quarter, up 24.5 percent from a year ago, said the Ministry of Finance.

TO THE POINT: Ignoring the economic recovery, the stock market bleeds as investors speculate more monetary tightening policies. The manufacturing sector shines in the first quarter of this year though cost inflation looms large, and listed companies also report handsome profits. Automakers turned out more wheels as sales picked up in April. Recovering from the impact of the tainted formula scandal, dairy makers turn loss into profit in 2009. Foreign credit rating agencies take root in China, casting an ominous shadow over financial interests of the country.

By HU YUE

Stock Market Woes

The benchmark Shanghai Composite Index has retreated more than 12 percent so far this year as lingering concerns over tightening monetary policies keep the mood subdued.

On May 4, the first trading day after the central bank announced a reserve requirement ratio hike for the third time this year, the Shanghai Composite Index dropped by 1.29 percent to a seven-month low.

Unlike mature markets where institutional investors focus on fundamentals, the fledgling Chinese markets are dominated by retail investors driven by speculation. As a result, government policies have easily tipped the balance of the market to the bearish side, said Pan Xiangdong, an analyst with the Everbright Securities Co. Ltd.

Investors' jitters are rooted in the fear that more aggressive tightening moves are drawing near though the latest hike in reserve requirement ratio possibly delays an interest rate adjustment, said Pan.

Worries also abound that corporate profit growth could slow down this year, making stock valuations less attractive, added Pan.

With a bear market awakened from its slumber, the question on investors' minds is when it will start to bottom out, the prospect of which is not so promising.

Among the pessimists are the stock funds, which held back on stock exposure, leaving an average of 78 percent of their funds in stocks in April, down from 90 percent by the end of 2009, said a report by the Beijing-based Desheng Fund Research Center.

Though in part intended to meet redemption requests, the funds' sell-off has only added to liquidity concerns clouding the market, said Pan.

Manufacturing Strength

If China is one of the few countries in the world that shows an economic pulse, the manufacturing sector deserves much of the credit.

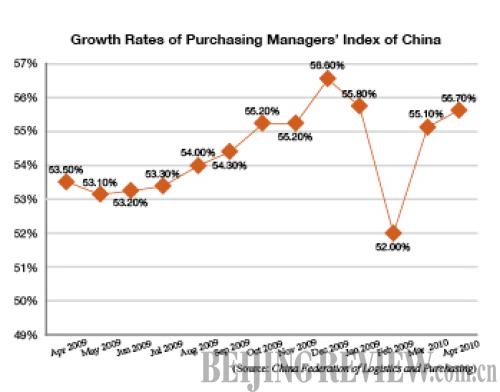

The Purchasing Managers' Index (PMI), a gauge of manufacturing activities across the nation, came in at 55.7 percent in April, up from 55.1 percent in March and 52 percent in February, said the China Federation of Logistics and Purchasing (CFLP).

A reading above 50 percent indicates expansion, and this was the 14th straight month the index had registered above the threshold.

Among the 20 sectors surveyed by CFLP, only four reported an index under 50 percent, including non-ferrous metal, tobacco, pharmaceuticals and petroleum processing and coking.

The continued growth in manufacturing provides fresh evidence of vibrant domestic demands, which have effectively made up for a fall-out in exports, said Zhang Liqun, a CFLP analyst.

But pressures facing enterprises are building up as the prices of raw materials creep higher, said Zhang.

Corporate Growth

The net profit of China's 1,837 companies listed on the Shanghai and Shenzhen bourses hit 345.03 billion yuan ($50.52 billion) in the first quarter, witnessing both year-on-year and quarter-on-quarter rises, according to a report of the Shanghai Securities News.

The Industrial and Commercial Bank of China Ltd., the nation's biggest lender, raked in the most with a net profit of 41.55 billion yuan ($6.1 billion) in the first quarter. China Construction Bank Corp., the second largest lender, and PetroChina Co., the country's largest oil producer, followed, both earning a net profit of more than 30 billion yuan ($4.4 billion).

Papermaking and printing companies, in particular, fared well, with their net profits up around 500 percent year on year.

|