|

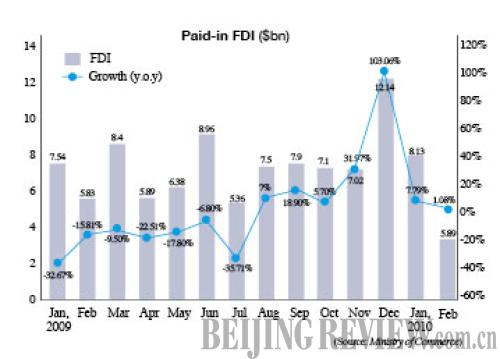

TO THE POINT: Answering the U.S. threat to classify China as a currency manipulator, Chinese Premier Wen Jiabao said China will maintain the yuan at a relatively stable level and on a reasonable basis, while any trade protectionism under the guise of currency manipulation should be condemned. China's sovereign wealth fund made another major investment in a U.S. power company in addition to its previous interest in financial institutions. Foreign direct investment in China rose slightly in the first two months of this year. Google remains unresolved in its decision to leave or continue operating in China. Netizens strongly opposed the construction of a maglev train connecting Shanghai and Hangzhou, complaining that the project was a waste of money.

By LIU YUNYUN

Numbers of the Week

20.4%

China's fiscal revenue in February rose 20.4 percent year on year to 494.497 billion yuan ($72.4 billion), according to the Ministry of Finance.

250.3 billion

The profits of state-owned enterprises totaled 250.3 billion yuan ($36.6 billion) in January and February, rising 88.9 percent year on year, said the Ministry of Finance.

Defending the Yuan

Recent complaints from the United States about the Chinese yuan have escalated. Chinese Premier Wen Jiabao said China is an advocate of free trade and opposed the idea of taking aggressive measures to force another country's currency to either depreciate or appreciate.

Facing mounting pressure from Western countries, relevant ministries have reportedly implemented a stress test over labor-intensive export-oriented industries, which bear the full brunt of yuan appreciation as their profitability has already been squeezed out by penny-pinching Western buyers.

Wang Qianjin, an analyst at Webtextile.com, said the average profit of the textile industry in China is around 3-4 percent. A 5-percent appreciation of the yuan—an increase that exceeded what a company could sustain and would force thousands of smaller factories to close—would mean 30 billion yuan ($4.39 billion) in profit losses for big textile companies, Wang said.

The Google Question

Internet search engine giant Google Inc. remained under the spotlight after it threatened to withdraw from the Chinese market in January. Recent Western media reports about Google's "99.9 percent" possibility of leaving China ignited fears that the censorship dispute would escalate into a fight that neither side could win.

Ministry of Commerce (MOFCOM) spokesman Yao Jian said on March 16 the two Google-owned companies registered in China had not sent any withdrawal reports to MOFCOM. Yao said China strongly opposed politicizing the business disagreement.

Ministry of Foreign Affairs spokesman Qin Gang said at a March 16 press conference that Google's decision is an individual act of the company. Qin said if Google retreats it would neither affect the Chinese investment environment nor change the fact that most American companies in China are reaping profits.

Qin insisted all companies operating in China should obey Chinese laws and regulations.

Currently, Google holds up nearly one third of the mainland Internet search market, while homegrown Baidu.com took up the remaining market share. Since Google's withdrawal intention was made public, share prices of Baidu have been on the rise. On March 15, Baidu's NASDAQ-traded shares closed at $576.84, surpassing Google's for the first time.

"Once Google closes its China operation, the Internet search industry will lose its development gauge, thus diminishing Baidu's creativeness," said Lu Bowang, President of China IntelliConsulting Corp.

|