|

Numbers of the Week

$2.3992 trillion

At the end of 2009, China's foreign exchange reserves stood at $2.3992 trillion, according to the People's Bank of China.

340 billion yuan

During the Chinese Lunar New Year holiday (February 13-19), retail sales of consumer goods totaled 340 billion yuan ($49.78 billion), rising 17.2 percent compared with the same period last year, said the Ministry of Commerce.

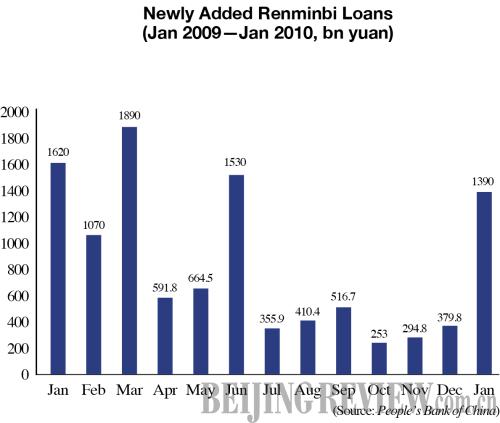

TO THE POINT: Robust economic figures for January 2010 showed the Chinese economy had rebounded to pre-financial crisis levels. Inflation indexes, CPI and PPI, were both within a positive territory. Foreign trade recently took off, with imports growing much faster than exports. Foreign direct investments in China have resumed positive growth. But skyrocketing housing prices, partly jacked up by excess liquidity in the market, pose an imminent risk to economic stability and development. China's sovereign wealth fund has started buying stocks in traditional companies, like hi-tech and media, instead of merely investing in financial institutions to diversify its portfolio. China will build more nuclear power reactors this year as part of its green efforts.

By LIU YUNYUN

Major Economic Figures In January 2010

CPI

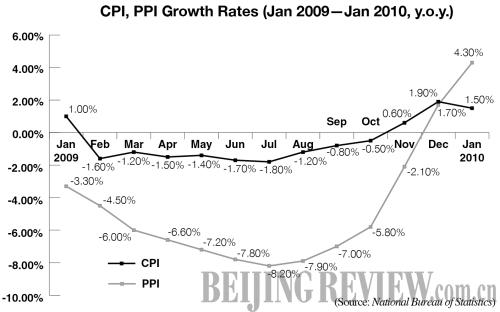

In January, the consumer price index (CPI), a main gauge for inflation, rose 1.5 percent from a year earlier, the highest growth in nearly two years.

The price increase of food, rent, fuel and auto parts contributed most to the CPI growth.

Analysts estimated CPI growth would accelerate in the middle of this year when the economic recovery was reassured.

The mild CPI growth lowered people's expectations on imminent interest rate hikes. At present, the nominal one-year benchmark interest rate is 2.25 percent, still in the positive territory adjusted for inflation.

PPI

In January, producer price index (PPI), an inflation measurement at the wholesale level, grew 4.3 percent.

The upward trend of PPI indicated that the profits of enterprises would increase rapidly, said Wei Fengchun, a macroeconomy analyst with China Securities Co.

The domestic price reform of major resource products and rising international commodity prices accelerated the PPI growth. The crude oil producer price soared 69.7 percent year on year in January, a major propellant for PPI growth.

Prices of ferrous metals and related products dropped 1.4 percent, led by price decreases in rolled steel plates and other rolled steel products.

Foreign trade

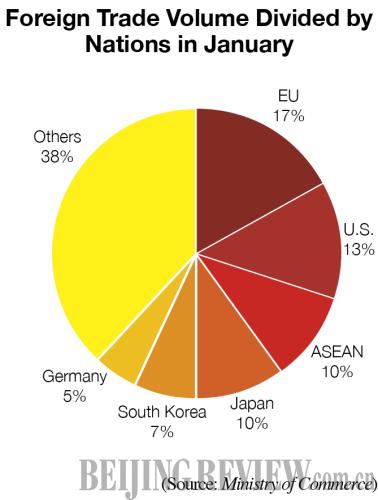

In January, China's foreign trade shrugged off the influences of the dismal global economy and picked up momentum of its own.

|