|

|

|

BREAKING THE PRICE MONOPOLY: Iron ore imports are unloaded at Lianyungang Port, Jiangsu Province. In the first nine months of this year, China imported 1.95 million tons of iron ore from Venezuela (WANG JIANMIN) |

China's oldest steel producer is looking to South America to fulfill its iron ore needs in the face of rising prices from its usual providers. On November 16, Wuhan Iron and Steel (Group) Corp. (WISCO) issued a statement on its website that it had established a long-term iron ore purchasing contract with Venezuela's Corp. Venezolana de Guayana (CVG), the South American nation's lone iron ore producer. WISCO said the Venezuelan prices were lower than last year's long-term benchmark prices set by Japanese mills and the big three ore miners of Rio Tinto Group, BHP Billiton Ltd. and Cia. Vale do Rio Doce. WISCO has yet to provide details of the prices.

WISCO also said the purchasing agreement with CVG would not only alleviate COA (contract of affreightment) shipping pressures, but more significantly it was the first price established for China's advantage, which indicates the Chinese steel industry will no longer be constrained by the big three ore suppliers.

Wuhan Steel will buy the steel making material at "China prices," which will differ from the benchmark rates set yearly by the world's top three suppliers, the Hubei-based company said on its website.

WISCO, the first large-scale iron and steel conglomerate established after the founding of the People's Republic of China in 1949, began operating in 1958 after three years of construction. Covering 21.17 square km, it is located in the eastern suburbs of Wuhan, capital of Hubei Province. As an important base for fine steel plate production in China, WISCO owns complete sets of equipment for mining, coking, sintering, iron and steel making and rolling, as well as all associated utilities.

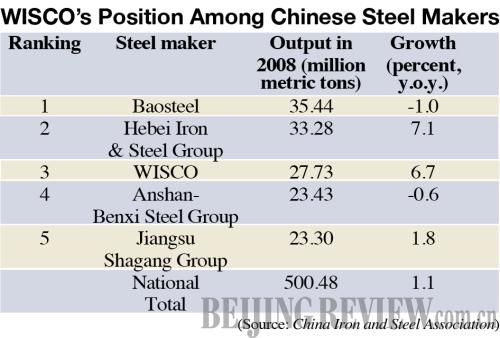

In 2008, WISCO produced 27.73 million tons of iron and steel, ranking third among the largest steel makers in China.

The agreement made between WISCO and CVG could help China gain a better position in iron ore pricing negotiations with the big three suppliers.

Driven by rapid economic development, the Chinese demand for iron ore continues to increase exponentially. In 2003, China started to take part in international iron ore price talks with Rio Tinto, BHP Billiton and Vale. Baosteel Group Co., now the largest steel maker in China, accompanied by a number of other mills, is the main negotiator for Chinese iron ore interests.

But the negotiation does not look promising. While China passively accepted the prices offered by the three major suppliers in past negotiations, even against the backdrop of the global financial crisis and economic recession, no agreement was reached concerning the Chinese price offers. Worse still, the price negotiation, which was supposed to set long-term supply prices for 2009, ended in vain, forcing Chinese mills to buy iron ore on the spot market.

The recent agreement with CVG will boost Chinese steel makers' confidence in upcoming negotiations with the three major ore suppliers for the 2010 price benchmark, some analysts said.

The timing of the agreement could also be a money saver for Chinese steel makers, since the three major suppliers have indicated that they would pursue paths to raise the 2010 long-term iron ore prices by 30 percent from their 2009 prices.

In an effort to break the quasi-iron ore monopoly, Chinese steel makers turned to alternative suppliers worldwide. In August, China reached an agreement with Anglo-Australian iron ore mine FMG with prices 3 percentage points lower than the benchmark prices agreed by Japanese mills and the three major suppliers. WISCO also has entered into agreements with iron ore companies in Australia, Brazil and Canada on importing or jointly mining iron ore.

Zhang Lin, an analyst at the steel industry consultancy firm LGMI, said the prices set by WISCO and CVG demonstrated the Chinese steel makers' effort in searching for alternative suppliers to reduce their reliance on more prominent suppliers.

Apart from WISCO, major steel makers and traders are also actively searching for new long-term ore suppliers.

Many experts, however, do not attach significance to the WISCO deal and said it will not exert much impact on the upcoming iron ore negotiations.

Zhou Chengxiong, a strategy researcher at the Chinese Academy of Sciences, said the output of Venezuelan mines and their proportion in the international iron ore market might make a difference for WISCO but would not provide benefits for all steel makers in China. The three major ore suppliers are also unlikely to allow the WISCO-CVG deal to alter the price negotiations for 2010, Zhou said.

Venezuela has estimated iron ore reserves of about 14.66 billion tons, with 4.18 billion tons of reserves verified. CVG is the only iron ore miner in the country with a production capacity of 23 million metric tons a year. Its iron ores feature high quality and low impurity compared with neighboring Brazilian ores.

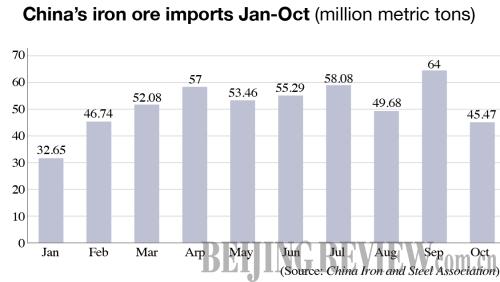

According to the General Administration of Customs, in the first nine months of this year Venezuela exported a total of 1.95 million tons of iron ore worth $150 million to China, ranking as the 14th largest supplier to China.

The China Iron and Steel Association stated it has already started price negotiations with the big three suppliers long-term prices in 2010. A person familiar with the association who declined to be named said the iron ore prices agreed by Chinese buyers and the three ore giants are likely to increase by about 10 percent. He pointed out three reasons: First, the worldwide demand far exceeds supply; second, the three suppliers are still in a dominating position, plus the iron ore spot prices are much higher than the long-term prices, making price hikes more likely; and third China has kept its robust demand for iron ore.

If this proves to be the case, the prices agreed by WISCO and CVG will probably be the lowest China will get during the 2010 production year.

|