|

Numbers of the Week

8.2%

The Asian Development Bank on September 22 raised its forecast for China's economic growth in 2009 to 8.2 percent, from its previous forecast of 7 percent.

30 billion yuan

China's Ministry of Railways has recently floated 30 billion yuan ($4.41 billion) in bonds in the inter-bank bond market to finance railway construction.

TO THE POINT: Controversies proliferate over Chinese automaker Geely's plan to buy the Swedish car brand Volvo, as analysts discount the prospect over its ability to integrate with the up-scale car manufacturer. China plans a pilot program that equalizes on-grid tariffs for hydro- and coal-fired power. Centrally-administered property developers join the real estate craze to scoop up land in big cities, adding to looming concerns over the property bubble that is waiting to burst. The domestic tourism market continues to gather momentum, offsetting downturns of inbound travel. Digital advertiser Focus Media loses its shine, reporting a painful loss between April and June.

By HU YUE

Look Before You Leap

Before moving in to snatch up struggling Western car brands, Chinese automakers should give the risky financial move a second thought.

The Hong Kong-listed Geely Automobile Holdings Ltd. reportedly confirmed rumors that its Hangzhou-based parent company is pursuing a Volvo purchase, making it the only firm potential buyer of the Swedish luxury car brand. The financially-strapped Ford Motor put the loss-making unit on sale in a bid to shore up its battered balance sheet.

Like the Sichuan machinery maker Tengzhong's deal to buy the Hummer brand, Geely's move is the latest attempt of a Chinese private company to step onto the global stage. Buying Volvo, a brand with worldwide recognition and distribution, would boost Geely's profile as a maker of low-end cars, but more importantly, bring the company access to the safety technologies of the upscale Swedish brand.

Geely's potential acquisition, like Tengzhong's Hummer deal, has come under heavy fire from analysts who question the viability of the purchase as Volvo may be too big a bite for the Chinese company to chew. Geely's sales revenue in 2008 was 4.29 billion yuan ($627.7 million) in 2008, barely 4 percent of Volvo's.

Multicultural integration would also be difficult for the less-experienced homegrown company. In March 2007, Geely teamed up with British car maker Manganese Bronze Holdings Plc. to construct an auto part manufacturing plant in Shanghai, but the joint venture has spilled nothing but red ink in the first half of this year, igniting worries over Geely's ability to facilitate another international operation.

Even if completed, Geely would face an uphill battle to achieve effective integration, said Gary Wu, former executive vice president of Volvo, in an interview with Caijing.

Walking a Tightrope

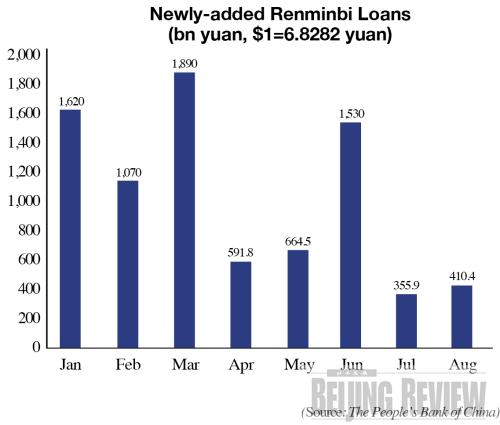

Housing prices hit a record high in many cities as pent-up demand exploded, leading many financial experts to believe that a real estate market bubble is blowing up. A flood of low-interest credit related to the economic stimulus package is believed to have found its way into real estate, allowing developers to restart projects abandoned during the gloom of the economic crisis. While some people are sounding alarms, more are eager to invest in the housing boom, as the woes of last year suddenly seem to be fading from memory.

Analysts believe policymakers do not want to pour cold water on the market euphoria before the economy can regain a solid footing, but if matters escalate, they may find many difficulties in deflating the bubble gently without causing a market crash.

Inflaming the worries is the speed that property developers are paying peak prices for land, especially when they are state-owned enterprises. In early September, China Overseas Land and Investment Ltd. agreed to pay an astronomical 7 billion yuan ($1.02 billion) for a plot of land in Shanghai, the country's biggest land transaction this year. Prior to that, Franshion Properties (China) Ltd., a subsidiary of the state-owned Sinochem Group, paid 4.06 billion yuan ($594 million) to acquire a 156,000-square meter site in Beijing.

Analysts say developer's hunger for expensive land may further escalate property prices and also sow the seeds of future financial risks. This echoed events in 2007, when a number of developers overextended themselves for land reserves, which exacerbated their financial distress.

With the government providing monetary support, cash-swash state enterprises are less concerned about their financial performance, putting them in a better position to seek windfall profits and create bubbles in the market, said Li Daokui, a senior economist of Tsinghua University, in an interview with the 21st Century Business Herald.

Tourism Rebound

China's domestic tourism market is reaping the benefits of renewed travel, though international travel seems yet to bottom out.

Up to 1 billion domestic trips were made in the first half of this year, up 12 percent year on year, as tourism revenues grew 11 percent to reach 497.9 billion yuan ($73.2 billion), according to data from the China National Tourism Administration (NTA).

The increase provided an effective cushion against the ongoing financial crisis that has forced overseas tourists to cut back on travel, said Du Jiang, Director of the NTA, at a recent meeting held in Hangzhou, the capital city of Zhejiang Province. The number of foreign tourists visiting China from January to June dropped 8 percent from the same period last year.

Analysts expect a stronger travel spree in the second half as broader economic recovery begins to take effect and the upcoming National Day holiday, the longest in China's history, gives travelers more time to enjoy the sights.

Policymakers also intend to offer more powerful incentives to bolster the domestic tourism market, added Du.

Hydropower Shines

A pilot program is gearing up that will raise the on-grid price of hydropower to the same level as electricity produced by coal-fired power plants, said Zhang Guobao, Vice Minister of the National Development and Reform Commission and Director of the National Energy Administration.

The price hike would be used to compensate people who were relocated or affected by hydropower projects, he said.

The on-grid price of hydropower is about 0.2 to 0.3 yuan ($0.03 to $0.04) per kwh in China, compared to 0.4 to 0.5 yuan ($0.06 to $0.07) for coal-fired power. The prices are based on the operational costs of producing the power. Hydropower projects require a larger investment than coal-fired generators but run at a lower cost upon completion.

The program, if expanded nationwide, will deliver a boost to the profits of the hydropower projects and provide a catalyst for stronger investments in that sector, said Jia Jinsheng, Deputy Director of China Institute of Water Resources and Hydropower Research. One hurdle that will need to be overcome is the increase in costs for grid operators the program will create, he said.

Policymakers will also need to take measures to ensure that the added profits are properly used to compensate relocated residents and repair damages to the environment, he added.

Focus on Challenge

The Shanghai-based digital advertiser Focus Media Holding Ltd. is facing serious headwinds as the advertising market sinks amid the financial crisis.

Red ink was spilled in the second quarter, as the company cited a drop in sales from ads on the Internet, billboards and movie theaters. The company reported a net loss of $23 million in the second quarter, compared to profits of $36.1 million a year earlier. Revenues also slid to $171.3 million from $211.7 million.

The NASDAQ-listed Focus Media is the country's largest publicly traded advertising company, running a handful of advertising networks in more than 90 cities in China.

The company had agreed to sell all its digital out-of-home advertising networks to Sina Corp., the operator of one of China's leading Web portals, in an all-stock transaction that was valued at $1.8 billion last December. The deal is still awaiting regulatory approval.

"We may consider extending the closing deadline for the transaction or altering the deal structure if we don't get approval from the Ministry of Commerce by the end of September," said the company in a statement.

While a clear picture of the advertising market has yet to be fully displayed, many emerging smaller rivals are encroaching on the foothold Focus Media has established, said Jiang Nanchun, Chief Executive Officer of the company, in a statement.

The company plans to recover its lost ground by taking tougher countermeasures through technological advancements and price wars, said Jiang. |