|

Numbers of the Week

151%

Air China Ltd., the country's biggest air carrier, posted a profit of 2.93 billion yuan ($428 million) in the first half of this year, up 151 percent from a year earlier, according to its half-year financial report.

686.2 billion yuan

China's state-owned enterprises logged a combined profit of 686.2 billion yuan ($100.4 billion) from January to July this year, down 22.8 percent year on year, according to the Ministry of Finance.

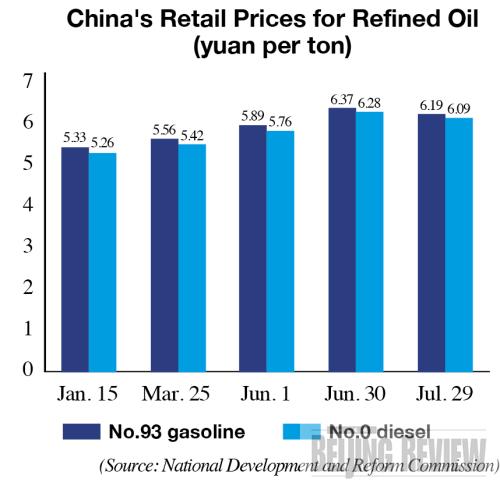

TO THE POINT: China's shipbuilders are reeling from the economic gloom as new orders are slowing to a trickle. Dire labor shortages put manufacturers in eastern coastal areas in a tight spot. Chinese traders turn a cold shoulder to the pilot program of renminbi trade settlement, but more government support measures are believed to spark some interest. The aluminum maker Chalco struggles to spill less red ink for the remainder of the year, while Sinopec gains momentum from a new fuel pricing mechanism. The oil refiner has reported a huge profit of 33.2 billion yuan ($4.9 billion) for the first half of this year, quadrupling that of 2008.

By HU YUE

Shipbuilding Woes

While most Chinese industries will greet a swift upturn at their doorstep, one appears yet to see light from the other end of the tunnel—shipbuilding, which is facing chilly headwinds, as drying orders exacerbate overcapacity ailments.

New orders received by the country's 70 key shipyards in the first six months of 2009 plunged a steep 80 percent year on year to 5.46 million metric dead weight tons, according to the China Association of the National Shipbuilding Industry (CANSI).

When the effects of the collapsing economy were felt around the world, Chinese ship-makers that source their orders largely from the United States—in addition to Europe and Japan—had nowhere to hide. Many buyers have been depressing prices, or are calling off orders altogether, as they have no cargo to ship. What rubbed salt into the wounds was a lack of financing that helps keep the industry afloat.

"More disturbingly, though, is the prospect that an even deeper downturn is still on the way, as excessive capacity may take years to absorb," said Wang Jinlian, Secretary General of CANSI, in an interview with China Economic Weekly.

"The good news is we still have some advantages like cheap labor and advanced technologies," added Wang, "The government stimulus measures will also provide some respite."

Since earlier this year, China has put a handle on new capacities in the industry, and forced replacement of outdated ships. Moreover, it has encouraged qualified shipbuilders to float shares, and asked banks to step up financing for ship exports.

The China Shipbuilding Industry Corp., for example, has obtained approval for an initial public offering (IPO) on the Shanghai stock market and is expected to raise more than 6 billion yuan ($877.8 million).

Labor Crisis

The labor surplus that has kept China's export machines humming, meanwhile, seems to be losing its fizz.

Late last year, the worldwide economic slump led to the shuttering of numerous Chinese factories in eastern coastal provinces, sending millions of migrant workers back home. But as the plants reopen this year, their managers are reluctantly discovering that they do not have enough employees.

Wenzhou of Zhejiang Province, the beating heart of China's private economy, is just now feeling the pinch of the labor shortfall. There remain nearly 100,000 job vacancies yet to be filled in the city, mostly with small and medium-sized manufacturers, according to the Bureau of Labor and Social Security of Wenzhou Municipal Government.

In south China's Guangdong Province, the labor shortages were no less acute. "Our new orders have rebounded sharply since this June," said Xiao Senlin, President of Ha Yi Dai Toys Co. Ltd., based in Dongguan, in an interview with Shanghai Securities Journal. "But the question is the workforce, those skilled and experienced ones, are far from enough to resume full capacity."

|