|

Numbers of the Week

3.35%

China's energy consumption to produce per unit of GDP dropped 3.35 percent year on year in the first half, said the National Development and Reform Commission.

4.3%

China's registered urban unemployment rate was 4.3 percent at the end of June, staying flat at the end of March, according to the Ministry of Human Resources and Social Security.

TO THE POINT: China's power consumption in the first half of 2009 fell 2.24 percent year on year. The National Bureau of Statistics explained the drop was due to power efficiency improvement in many energy-depleting sectors. The real estate market continues to burn hot, but a number of uncertainties lingered to quench the fire. Newly approved funds in July flew into markets to catch fading glows of the stock euphoria. The Aluminum Corp. of China Ltd. raised spot alumina prices by 4.35 percent, in a reflection of the healing markets. Apple Inc. agreed with China Unicom to officially launch the iPhone handset on the Chinese mainland this autumn.

By HU YUE

Power Progress

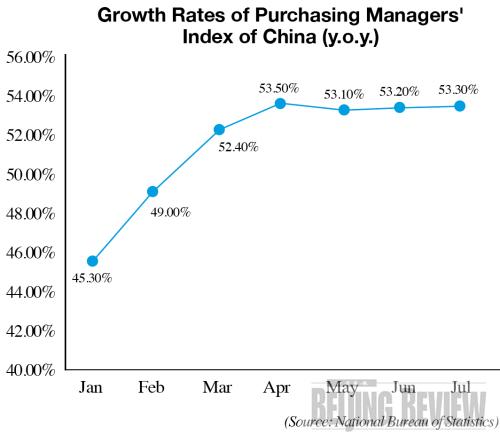

As the deep economic gloom loses ground to a vibrant upturn in a number of sectors, China's economic comeback appears to be on the horizon. But there is one indicator seemingly out of place in the warming economic climate—power consumption.

Widely seen as a gauge of economic activities, the country's power consumption surprisingly fell 2.24 percent year on year in the first half of 2009, according to data from the National Development and Reform Commission. So does the power crimp signal a shaky foundation of the economic upswing? Probably not.

A recent report from the National Bureau of Statistics (NBS) attributed the decreasing figure to tempered growth in several energy-guzzling industries. For example, momentum of steel-making, non-ferrous metal, chemical materials and electricity have fizzled appreciably, putting a curb on power depletion, said the report. But a sharp uptick in other areas, such as agriculture and the service sector effectively picked up the slack, it added.

More importantly, the downturn is accelerating a quiet shift of the industries, already unnerved by rising costs and heavy pollution, toward more promising energy-efficient productions. The power consumption per ton in terms of cement and steel output have both seen a significant drop, according to the NBS.

Economists believe the rapid improvement in power efficiency highlights the quickly recovering health of the real economy. At a time when power shortages grip the planet, the energy-efficient sectors will be bright spots in the future economic landscape, they said.

Worries Over Property Market

Coming off a very low fiscal floor about a half year ago, China's real estate market is riding an upward spiral. Potential homebuyers are jumping off the sidelines for fear that they may miss out on the start of a new bull market, and real estate developers are bumping up prices to make a considerable profit. But analysts point out three underlying risks that may reverse the housing gains at any time.

The first are sales fluctuations. When sales started to gain momentum this April, a virtuous self-reinforcing cycle of optimism was quickly set in motion. Consumers began spending more on homes as rising prices made them feel richer. But the latest report of China Index Academy showed housing areas sold in July in 15 cities fell appreciably month on month, signaling the inability of the demand to sustain price rises.

The second is policy environment. At a time when inflationary pressures are building up, investors are piling into the real estate market to ensure their asset value. That was likely exaggerated by easy access to mortgages in the boom, which could be used to fund expenditures.

However, it is less likely for the regulators to turn a deaf ear to the soaring mortgage loans. The China Banking Regulatory Commission has recently warned commercial banks of simmering mortgage risks. The Chinese Academy of Social Sciences also has found that the unaffordable house prices are choking off consumptions as many bread-earners save every penny to buy a home. If the policy makers actually tighten the mortgage policies, a return of the housing gloom may not be a long way off.

|