|

Numbers of the Week

9.99%

China's social security fund made a profit of 51.2 billion yuan ($7.53 billion), or 9.99-percent gains, from equity investment in the first half of this year, according to the National Council for Social Security Fund.

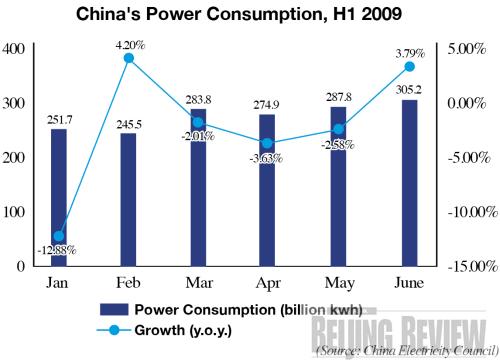

3.79%

China's power consumption rose 3.79 percent year on year to 305.22 billion kwh in June, according to the China Electricity Council.

TO THE POINT: The Chinese economy seems to be back on the fast track, with a number of first-half indicators released by the National Bureau of Statistics turning around. First-half GDP growth was better than expected in the absence of export contributions. Positive signs are everywhere, from a rebound in fixed-asset investment to surging domestic sales. The picture of a long-anticipated merger between China Eastern and Shanghai Airlines has become clearer, though they still face an uphill battle. Securities companies gained momentum from the stock market rally by collecting more brokerage fees in the first half of this year. The country's sovereign wealth fund, China Investment Corp., is making a push into the commodities sector.

By HU YUE

Major Economic Figures In the First Half of 2009

GDP

China's gross domestic product (GDP) grew 7.1 percent in the first half of 2009 compared with the same period last year, reaching 13.99 trillion yuan ($2.05 trillion). The GDP growth rate in the second quarter was 7.9 percent, 1.8 percentage points higher than the first quarter.

Industry

The added value of industrial enterprises with annual sales revenue above 5 million yuan ($732,000) increased 7 percent year on year in the first half of 2009, 9.3 percentage points slower than the same period last year.

Investment in Fixed Assets

Investment in fixed assets soared 33.5 percent year on year to 9.13 trillion yuan ($1.34 trillion), and the growth rate was 7.2 percentage points higher than the same period last year.

CPI and PPI

In the first half of 2009, China's consumer price index (CPI) decreased by 1.1 percent year on year while the producer price index (PPI) went down by 5.9 percent.

Domestic Sales

Retail sales of consumer goods in domestic markets increased 15 percent in the first half of the year to 5.87 trillion yuan ($858.97 billion).

Foreign Trade

China's exports dropped 21.8 percent year on year to $521.5 billion in the first half of this year, while imports fell 25.4 percent to $424.6 billion. The trade surplus stood at $96.9 billion, $2.1 billion less than the same period in 2008.

FDI

China's foreign direct investment (FDI) dropped by 17.9 percent to $43 billion in the first half of the year.

Forex Reserves

China's foreign exchange (forex) reserves hit a new high of $2.13 trillion at the end of June. Newly added reserves in the first half of the year reached $185.6 billion, down about $95 billion from the same period a year ago.

Residents' Income

Urban residents' per-capita disposable income in the first half of this year reached 8,856 yuan ($1,296), a year-on-year increase of 9.8 percent. Rural residents' per-capita cash income in the first half of this year was 2,733 yuan ($400), a year-on-year increase of 8.1 percent.

Money Supply

By the end of June, the broad money supply (M2) was 56.9 trillion yuan ($8.3 trillion), up 28.5 percent year on year, while the narrow money supply (M1) was 19.3 trillion yuan ($2.8 trillion), up 24.8 percent year on year. The cash in circulation (M0) stood at 3.4 trillion yuan ($497.4 billion), growing 11.5 percent year on year.

Loans and Deposits

At the end of June, outstanding loans denominated in renminbi at financial institutions stood at 37.7 trillion yuan ($5.5 trillion), an increase of 7.4 trillion yuan ($1.1 trillion) from the beginning of 2009. Outstanding renminbi deposits amounted to 56.6 trillion yuan ($8.3 trillion), an increase of 10 trillion yuan ($1.5 trillion) from the beginning of this year.

Air Deal Unveiled

After weeks of waiting, the debt-laden China Eastern Airlines Corp. Ltd. and Shanghai Airlines Corp. Ltd. have made a concrete step toward a proposed merger.

On July 12, China Eastern announced that both sides have agreed to a share swap to complete a merger deal worth about 9 billion yuan ($1.3 billion).

Under the deal, each share of Shanghai Airlines will be exchanged for 1.3 new issues of China Eastern. The ratio represents a 16-percent premium to the stock price of Shanghai Airlines on June 5, the last trading day before a transaction suspension. Shareholders who do not want to conduct a share swap will receive a certain amount of cash in return, according to the statement.

China Eastern will inherit all assets and liabilities of Shanghai Airlines, but its brand and operations will remain independent, said Liu Jiangbo, a spokesman for the task force overseeing the merger, in an interview with Xinhua News Agency. Shanghai Airlines will be delisted from the stock market after becoming a wholly owned subsidiary of China Eastern, Liu added.

Analysts believe the alliance will put China Eastern on a more solid footing to compete with domestic rivals Air China Ltd. and China Southern Airlines Co. Ltd.

The merger could help China Eastern gain an edge in ticket pricing and flight allocation, but the fate of the two withering airlines still depends on how the integration plays out, Li Lei, a transport analyst with China Securities Co. Ltd., said in a report.

Brokers' Spring

After a bleak season in late 2008, securities companies are now basking in the glow of an extended uptick in the markets that has enlivened stock trading.

All seven broker dealers that released their biannual reports by July 13 saw a significant rebound in earnings. The best performer was the Shanghai-based Haitong Securities Co. Ltd., which raked in a profit of 2.45 billion yuan ($358.4 million) in the first half of 2009, almost as much as the whole of last year. It was followed by another Shanghai broker dealer, Shenyin & Wanguo Securities Co. Ltd., and Xi'an-based Western Securities Co. Ltd.

Invariably, the securities houses relied on the brokerage business as a major source of growth. For example, the brokerage business contributed more than 70 percent and 80 percent to the earnings of Shenyin & Wanguo and Western Securities, respectively.

However, seeing a muddy market picture ahead, the securities companies have more or less reduced their stock exposure. The Tianjin-based Bohai Securities has scaled back its stock holdings to a minimum 6 percent of its financial assets, while the Shanghai-based Huaxin Securities Co. Ltd. has even cleared out all its positions, according to a report by National Business Daily.

CIC Eyes Commodities

After a series of failed investments in offshore financial institutions, China Investment Corp. (CIC), the country's sovereign wealth fund, is setting out on a buying spree again—this time in commodities.

The scarred investment powerhouse recently snapped up a 17.2-percent stake in the deeply indebted Canadian miner Teck Resources Ltd., which has interests in a number of gold, zinc, copper and coal mines in North America.

Analysts say this may be just an opening move by the investment titan in a strategy to secure long-term resource supplies needed for domestic economic growth. The financial crisis has made Chinese capital more welcome in a capital-starved world, they said.

In addition, unlike past high-profile moves, CIC has proceeded with the investment in a more considered and low-key fashion. In June, it went on a massive talent hunt for commodity-related vacancies in a move widely believed to be part of preparations for the new strategy.

The steep decline in overseas commodities prices has created attractive entry points to invest in foreign resource companies that offer a good level of earnings visibility, said Wang Jianxi, Executive Vice President of CIC, at the Global Think Tank Summit recently held in Beijing.

"We would like to make more balanced investments in a spread of asset classes that bring no controlling stake but ensure stable returns," he added. |