|

Numbers of the Week

80%

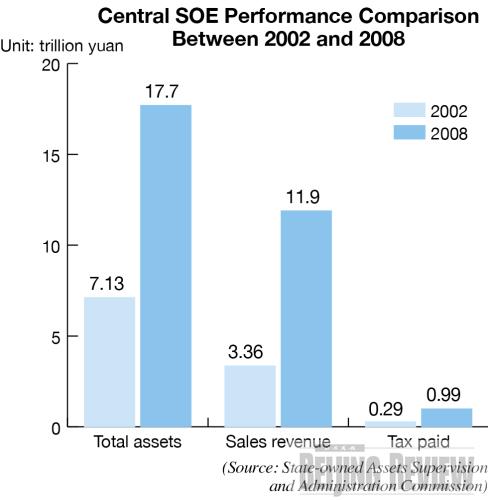

More than 80 percent of the assets of centrally administered state-owned enterprises (central SOEs) have been listed on stock markets.

3.74 billion yuan

The compulsory third party liability insurance for automobiles has recorded a loss of 3.74 billion yuan ($547 million) since its operation began two and a half years ago.

TO THE POINT: The mainland stock market rallied based on a brightening economic outlook, with major indexes climbing to a one-year high. The Chinese Government raised retail gasoline and diesel prices for the third time this year as a result of surging international crude oil prices. Chinalco agreed to participate in the Rio Tinto rights issue at the last minute. China and major iron ore suppliers failed to reach a long-term agreement as the former insisted on a 40-percent price reduction and would not compromise. Protectionism flared up in the economically-challenged United States, which made three anti-dumping and anti-subsidy charges against Chinese steel products. Airbus honored its commitment to localize 5 percent of airframe production on the mainland by setting up a joint venture in Harbin.

By LIU YUNYUN

Stock Market Rally

The mainland stock markets hit a one-year high and the benchmark Shanghai Composite Index (SCI) regained some ground after falling from its peak of 6,000 points in October 2007.

On July 1, the SCI stood at 3,008 points at its closing, the first time it climbed above 3,000 points since June 12 last year.

Judging from the recovered mood in stock trading, the China Securities Regulatory Commission reopened the gate for initial public offering, with Guilin Sanjin Pharmaceutical Co. Ltd. breaking the ice after a nine-month freeze.

Many economic indexes indicate that the Chinese economy is improving. Home prices are picking up with increasing trade volume in the first six months. The massive $586 billion stimulus package and loosened credit control have boosted investors' confidence in economic recovery.

But "hot money inflow is again becoming a problem," said Liu Jiazhang, an analyst with Minzu Securities Co. Ltd. He reminded investors of the potential risk of a sudden pullout.

He expects the SCI to rise above 3,200 points in the near future before it takes a break.

Costly Oil

The Chinese top economic planner raised the retail prices of gasoline and diesel on June 30, citing rising international crude oil prices. It was the third price hike so far this year.

The National Development and Reform Commission (NDRC) raised the prices of the two refined oil products by 600 yuan ($88) per ton, which pushed up gasoline prices to 6.37 yuan ($0.93) per liter and the price of diesel to 6.28 yuan ($0.92) per liter.

Media have criticized the NDRC for keeping the country's oil prices about 1.8 yuan ($0.26) higher per liter compared with the average price in the United States. Individual drivers also complain the frequent price hikes add to their transportation costs.

Zhou Dadi, Director General Emeritus of the NDRC Energy Research Institute, said drivers should now be accustomed to the frequent adjustment of oil prices and not make a fuss over it.

China adopted a "controlled" float refined oil pricing mechanism at the end of 2008. Under the pricing mechanism, China considers changing the benchmark retail prices of oil products when the international crude oil price rises or falls by a daily average of 4 percent over 22 consecutive working days.

Oil prices stood at $69 a barrel on the New York Mercantile Exchange on June 26, a 4.5-percent rise from $66 a barrel since the last adjustment on May 31.

|