|

Numbers of the Week

15.2%

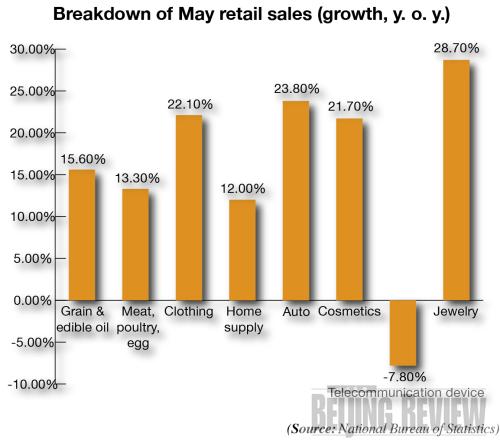

China's retail sales grew 15.2 percent in May year on year to 1 trillion yuan ($146 billion).

494.7 billion

Chinese insurers collected 494.7 billion yuan ($72 billion) in premiums during the first five months of this year.

TO THE POINT: Foreign media slammed the Chinese Government's proposal that its ministries and agencies should purchase only Chinese products. But the government was forced to make such suggestion because domestic producers said they have been treated unfairly in bidding for government-supported projects. A World Bank report said China's economy was respectably sound during the first half of the year given the global financial meltdown. The country's fiscal revenue ended its seven-month decline and gained an encouraging 4.8 percent year on year in May. Home appliance sales under the government's stimulus scheme amounted to 15 billion yuan ($2.2 billion) in the first five months. China sold $4.4 billion worth of U.S. treasury bills as of the end of April when most of them had matured. Foreign direct investment in May dropped for the eighth consecutive month.

By LIU YUNYUN

"Buy-China" Decree Confusing but Necessary

Analysts indicated mixed feelings about the government's "Buy-China" proposal in a June 4 notice jointly issued by nine Chinese ministries.

The notice said government procurement officials should give priority to domestic products and services unless they are not available in the country or cannot be acquired by reasonable commercial and legal terms.

As a follow-up, the National Develop-ment and Reform Commission (NDRC), the nation's top economic planner, justified the proposal by citing domestic entrepreneurs' complaints that they had encountered unfavorable treatment when completing for part of the 4-trillion-yuan ($586 billion) stimulus package, because buyers preferred to purchase foreign products which are believed to be more advanced.

Even though this made some sense, "given how important free trade is for the economy, this is not the right message for them to be sending to the rest of the world right now," said Tao Dong, chief economist for China at Credit Suisse First Boston, in an interview with the Financial Times.

Well-performing foreign companies seemed unfazed by the proposal. "It is understandable that some measures may be taken to ensure a strong drive for the economy as long as protectionism does not become the overall tendency," said Richard Hausmann, President and CEO of Siemens Ltd. China, in an interview with Beijing Review.

In a developing country such as China, businesspeople are inclined to associate "made-in-China" products with inferior quality, especially when buying hi-tech products and new technologies. A "made-in-Germany" or "made-in-Japan" label is believed to add strength to and improve the quality of major projects. For instance, Chinese Government procurement officials for years have purchased German-made Audis as a designated luxury brand for high-rank government officials.

So Far, So Good

While China's economy continues to bear the brunt of the global crisis, very expansionary fiscal and monetary policies have kept its economy growing respectably, according to the World Bank's latest China Quarterly Update released on June 18.

The update, a regular assessment of the Chinese economy, finds that the government's fiscal stimulus efforts center on the infrastructure-oriented 4-trillion-yuan ($586-billion) stimulus plan, while the monetary stimulus has led to a surge in new bank loans.

The report also noted that while government-influenced investment has soared, market-based investment has lagged, although positive signs have emerged in the real estate sector.

Consumption has held up well. Very weak exports have continued to be the main drag on growth, while import volumes recovered in the second quarter of 2009 as raw material imports rebounded.

The report also noted that China's global growth prospects remain subdued even as signs of stabilization have emerged. Financial markets have become less strained, and there are prospects for stabilization of activity. But a rapid global recovery seems unlikely and uncertainty remains. The risk of global deflation seems low, although spare capacity will continue to put downward pressure on prices of manufactured goods.

The report said monetary policymakers in major countries should in principle be able to prevent inflation from rising in the medium term, although risks remain.

China Sheds U.S. Securities

China reduced its U.S. Government securities holdings in April for the first time in a year by a mild $4.4 billion, but it remained the biggest creditor of the debt-laden country.

The securities were mostly treasury bills that matured in or before April. But in the same month, China purchased $17.42 billion of medium- and long-term Treasury securities.

"One thing is for sure that the future reduction, if there is any, will be moderate, because if China slashes its U.S. securities too aggressively, the global financial market will suffer acute dollar depreciation," Zhang Bin, a researcher at the Institute of World Economics and Politics under the Chinese Academy of Social Sciences, told Xinhua News Agency. He also said seven of the eight biggest U.S. securities holders reduced their positions in April.

China is looking for ways to diversify its colossal dollar reserves, but given the current financial distress, no other currency appears to be safer than the U.S. dollar.

China held $763.5 billion in U.S. treasury securities at the end of April, according to the U.S. Treasury Department.

Fiscal Revenue Rebounds

The country's fiscal revenue for the first time this year saw year-on-year growth in May, reflecting a moderate revival in the national economy and a consumer-spending spree.

National fiscal revenue grew 4.8 percent in May year on year to 657 billion yuan ($96 billion) with consumption tax surging 91.2 percent year on year, according to the Ministry of Finance.

Liu Shangxi, a researcher at the Ministry of Finance, attributed the consumption tax takeoff to the government's stimulus measures such as subsidizing the purchases of home appliances and cars by rural consumers.

Although the May figure scored, it did not mean the economy had emerged from the doldrums, because the most important measurement for company profit-value-added taxes and corporate income taxes-continued to slide in the past few months.

In the first five months, fiscal revenue declined 6.7 percent year on year due to the economic slowdown, corporate income decline, tax breaks and increased export tax rebates, according to the Ministry of Finance.

Rural Consumption Noteworthy

The government's stimulus measures for consumption seem to be paying off. The sales revenue of home appliances under government's rural subsidy scheme surpassed 15.3 billion yuan ($2.2 billion) as of the end of May.

Under the scheme, farmers who buy home appliances, including televisions, refrigerators, washing machines, air conditioners and computers, receive local government subsidies of approximately 13 percent of an appliance's purchase price.

Yao Jian, spokesman of the Ministry of Commerce, said the types and prices of home appliances eligible for the discount will be readjusted, because farmers have demanded higher quality products. For instance, the government has capped the prices of color televisions at 2,000 yuan ($292), but the sets sold do not meet the demands of younger buyers who want high-definition or LCD TVs.

Fading FDI

Ministry of Commerce figures indicate that some foreign direct investment (FDI) had left China, as reflected by a consecutive eight-month year-on-year decline.

FDI in May plunged 17.8 percent year on year to $6.38 billion. It was the first time in 11 years that the three indexes that measure foreign investment-paid-in FDI, newly established foreign-invested enterprises, and contractual foreign investment-had all declined.

The Ministry of Commerce was reportedly working with the NDRC and Ministry of Finance on policies to stabilize foreign investment, which are considered paramount to increasing employment. Foreign investment in energy-conservation and environmental protection will win big support from the government. In the meantime, the FDI approval procedure will be relaxed. |