|

Numbers of the Week

62.8 billion yuan

China will spend 62.8 billion yuan ($9.2 billion) on hi-tech research and development this year and in 2010.

100 billion yuan

Petro China Co. Ltd. will raise 100 billion yuan ($14.6 billion) by way of debt financing this year to explore key oil fields.

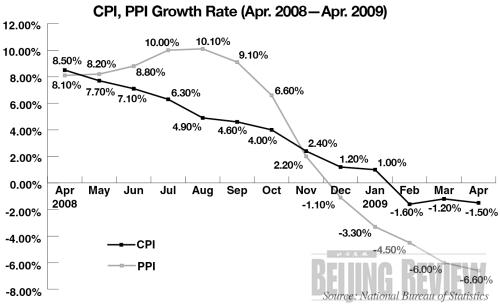

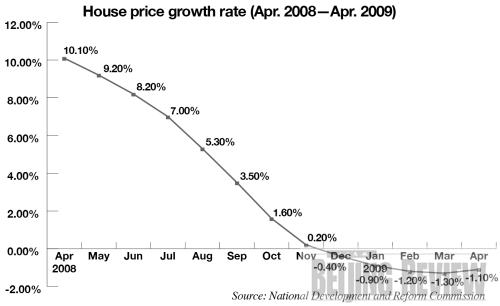

TO THE POINT: The Chinese economy is right on track for recovery, though downward pressure remains. Consumer and producer prices continued to fall in April, and both stayed in negative territory. Home prices also fell in April year on year. But the possibility of deflation was ruled out due to abundant money supply in the market. New loan growth returned to a reasonable level after an upsurge in March. Foreign trade fell year on year, but rose month on month. The government ordered cuts in iron and steel output as once again, the country was beset with steel overcapacity.

By LIU YUNYUN

Major Economic Figures in April

CPI

China's consumer price index (CPI), a main gauge of inflation, dropped 1.5 percent year on year, according to the latest data from the National Bureau of Statistics (NBS). It was the third decline in a row since February as the economic slowdown mounts downward pressure on consumer prices. The March CPI slipped 1.2 percent from the previous year.

Analysts attributed the April CPI decline to pork prices, which plummeted 28.6 percent from a year earlier as demand collapsed amid a global flu outbreak thought to be connected with pigs. It also reflected the high base of comparison since the CPI last April soared by a dizzying 8.5 percent.

But the figure is likely to come back into positive territory in the latter half of the year as the economy recovers its lost ground, said Zhang Yongjun, an economic researcher with the State Information Center, a government think tank based in Beijing. Government stimulus efforts and a commercial bank lending spree are expected to firm up producer prices, which will in turn drive up consumer prices, he said.

PPI

China's producer price index (PPI), a barometer of inflation at the wholesale level, fell 6.6 percent in April year on year, compared with a 6.0-percent drop in March, the NBS said. Among them, the factory-gate prices of iron and steel plunged by a hefty 18.7 percent year on year.

Unused inventories built up during past boom times are holding down domestic producer prices, Zhang Liqun, a researcher with the Development Research Center of the State Council, said in a statement. Meanwhile, looming industrial overcapacity and a freefall in overseas demand have also cast a pall over the industrial landscape, he added.

Despite continuous drops in both the CPI and PPI, economists dismissed fears of deflation, citing ample liquidity in the banking system and warming consumer confidence that are breathing fresh life into the economy. In a reflection of rebounding consumer markets, home and auto sales rallied in the first quarter this year.

The government stimulus package is taking effect to lift consumption and investments, though there will be a lag before the multiplier effect works throughout the economy, said Cao Jianhai, an analyst with the Chinese Academy of Social Sciences.

Housing Prices

Housing prices in 70 major Chinese cities declined in April by 1.1 percent year on year, 0.2 percentage points slower than in March, according to data from the NBS. New residential home prices fell 1.7 percent while those of secondhand homes stayed flat.

|