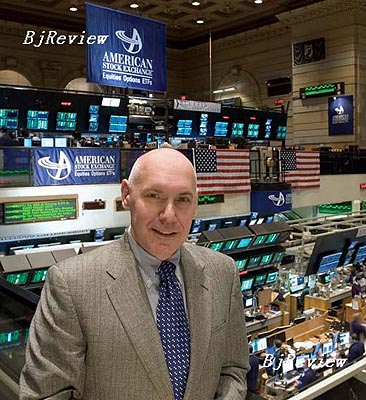

"I hope I can create a new AMEX," said Neal Wolkoff in April 2005 when he became Chairman and CEO of the AMEX. From the start he has been ambitious and determined to mold AMEX into a gateway for small and medium-sized enterprises (SMEs) entering the U.S. capital market. Wolkoff has more than 20 years of experience managing exchanges. Before taking over AMEX, he was Vice President and Chief Operating Officer of the New York Mercantile Exchange. At that time, many people did not understand why he took on the challenge. "In the eyes of many, AMEX was a mess," he said. "But for me, I saw opportunity and challenge. At that time, AMEX was plagued with technical problems that I wanted to resolve soon after my appointment."

In two years, AMEX introduced a new electronic trading platform-Auction and Electronic Market Integration (AEMI)-to provide a secondary market for small businesses to go public. "From a macro perspective, the reform measures worked as we expected," said Wolkoff with a smile.

Statistics testify to the excellent performance of AMEX. The AMEX Composite Index grew 22.6 percent, 97.2 percent and 145.8 percent compared with one year, three years and five years ago, respectively, outperforming the Nasdaq, S&P 500 and the Dow Jones Industrial Average indices.

How did Wolkoff create a new AMEX in just two years? Faced with fierce competition from the Alternate Investment Market (AIM) of the London Stock Exchange, how would he handle the situation? How would AMEX map and carry out its China plan? Chinese Venture reporter Tara Tao interviewed Wolkoff at AMEX's Wall Street headquarters in New York.

Chinese Venture: AMEX was in dire straits when you took over. You said you'd take on the challenge and create a new AMEX. What reforms have you made?

Neal Wolkoff: The greatest change was the introduction of the new trading system and technologies. We used to do the transactions manually but now we use a new electronic trading system that is quick and effective. This was probably the biggest change for AMEX over the past two years.

Moreover, AMEX is famous for its ETFs (Exchange Traded Funds) and, as a long-standing tradition, we constantly release new ETFs. In terms of enterprise listings, we target SMEs, particularly micro-enterprises (micro-chips). We hope we can provide these enterprises with a listing platform because they are a main part of our business.

What is your next reform strategy?

We'll continue to expand our technological reform to further computerize the transactions so that investors can trade more expeditiously. We'll also improve the liquidity of the transactions. In addition, we have filed an application to the U.S. Securities and Exchange Commission (SEC) to set up a secondary stock market for micro-chips. We call it TAP (The American Platform). These are our goals for the future.

AMEX was the cradle of many successful companies. But when they became strong and mature, they would switch to New York Stock Exchange or Nasdaq. How would you convince companies to stay?

We really want the enterprises to stay with us, and in fact many large enterprises have stayed with AMEX. We provide speedy electronic transactions and excellent services that contribute immensely toward our increasingly recognized reputation. I don't think we are just a springboard for going public. Instead, we're a haven for innovation and a cradle for starting and growing an enterprise.

If an enterprise wants to list on AMEX, how long does it take starting from the submission of the application?

It depends on the information the company provides and the speed of its response to requested information. It usually takes six to 12 weeks to be listed, depending on the completeness and timeliness of the materials the enterprise submits.

You said you hoped to make AMEX a gateway to the U.S. capital market for small businesses. How would you attract small enterprises to list on AMEX, especially international enterprises?

We haven't marketed AMEX internationally enough. Currently, we mainly rely on investment banks to introduce successful companies to us. These investment banks have a lot of investment experience; they are familiar with the investment environments in Asia, South America and Europe. Apart from this, many Asian companies have subsidiaries or offices in the United States. They know us already and we'll conduct our marketing to encourage them to list on the market.

There are other stock exchanges that focus on SMEs. For example, AIM of London Stock Exchange raised $29 billion last year and many Chinese enterprises went public on AIM in the past two years. How would AMEX handle the competition from AIM?

Relatively speaking, AIM is an easier place to go public. The problem is,

|