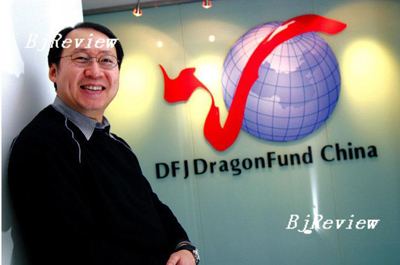

Though he has ancestry in Nanjing, Jiangsu Province, Tony C. Luh, Managing Director of the DFJ Dragon Fund China, was born in Japan, spent his childhood in Thailand and moved to Argentina with his parents after finishing middle school.

Later he attended college in the United States. Thanks to this experience, Luh is well versed in many languages and the cultural, historic and economic background of these countries, an experience that has laid a solid foundation for his future engagement in the venture capital business and one that has helped him operate with ease.

"In every phase of my life, I have worked for fun," said Luh in an exclusive interview with China Venture. "The most important thing is to have fun at whatever you do because even a bit of reluctance or discomfort will detract you from the significance of the thing you do." This is the credo he has kept even when he was under great pressure during the launch of the DFJ Dragon Fund China last year.

Pain becomes gain

The mid-to-late 1990s saw the emergence of Internet investment fever. Luh came up with the idea of founding a company for Internet investment, thanks to his job with Acer that allowed him to meet many industrialists and establish contacts with them. His idea was immediately echoed by his old friend K. Bobby Chao, another managing director of the DFJ Dragon Fund China. Without deliberation, Luh, a chip and semiconductor expert, and Chao, an Internet pro plunged into the Internet venture capital world.

"But a pressing question facing us was where to build the bridge," said Luh. "The Internet had to overcome the linguistic obstacle but despite that it has transcended conventional physical boundaries of time and place."

Luh chose China to bridge different parts of the worldwide web.

At that time, China's Internet industry was just taking off, and promised great market potential. The two founded Dragon Investment in 1999 and the Dragon Fund a year later with a focus on the IT sector, paying particular attention to companies set up by Chinese in science and technology, information and the Internet.

But things did not go as expected. Working and having fun did not necessarily mean "smooth sailing." Soon after the fund was founded, it was subject to a harsh trial by the U.S. economy. The objective of raising a fund of $100 million ended up reaping only $30 million. At that time, venture capitalists in China were taking a rather conservative approach, far from being as confident, proactive and progressive as they are now. Moreover, the Dragon Fund suffered further in the Chinese market after April 2000, with the Internet, venture capital investments and related sectors sliding into a four-year downturn.

"At that time, though the enterprises we had invested in performed well, it proved it was not a good time as the entire Chinese market was at an ebb," recalled Luh. "The enterprises just didn't see a glimmer of hope for development. My colleagues and I were very upset and under great pressure."

Things have changed in the past two years. Of the eight companies they funded, OSA Technologies was sold to Avocent for $100 million, a return of six to seven times. InphoMatch acquired Mobileway and renamed it Mobile 365 before it was sold to Sybase for $425 million. Legend Silicon became pretty influential in China's wireless broadband communication and digital TV world, and has recently secured $40 million in investments from Intel. From the respective of return on investment, the three cases were all rather successful.

Striking at start-ups

In 2004, the investment craze in China revived. Chao and Luh started to think about setting up a fund focusing on Chinese companies. However, they found themselves short of experienced individuals either with a good understanding of China and of different industries, or with expertise in certain fields.

"Therefore, we set out to look for like-minded institutions and experts to join us," said Luh.

By July 2006, the team had added two strong players, Andrew Tang and Larry Guangxin Li, and had gained the backing of Timothy Draper from the world-renowned DFJ Fund, all of whom are now managing directors of the DFJ Dragon Fund China. That led to the official inception of the the DFJ Dragon Fund China with an initial fundraising of $100 million. The fund looked primarily at enterprises with world-leading technologies in the areas of TMT, semiconductors and finance, and was only engaged in early-stage investment of less than $2.5 million.

The selection criteria for entrepreneurs were also demanding. For instance, a candidate had to have passion, attend to long-term development and maintain considerable ethical standards. It is known that the DFJ Dragon Fund China has so far invested in a host of projects including Lianlong Science and Technology, Device VM, YeePay, Tongcard and Miartech.

Luh was very proud of projects he had invested in. "Take Tongcard for instance, it is a company dealing in loyalty marketing through distribution of reward cards," he said. "I was deeply moved by the team and thus was prompted to invest without hesitation."

The cozy four-person team sifts through piles of cases every day, and has been able to work together quite well, sharing a similar understanding of the business. They often compare the venture capital business to the job of a detective or a policeman. "Should a crime occur, an immediate identification of a suspect could very likely lead to a big error," said Luh. "The best approach is to put together all the evidence, both passive and positive, and sort them out one by one." Basically, everybody has his own specialty, according to Luh. Geographically, Luh is responsible for Beijing, Tang and Li are taking care of Shanghai, and Chao travels between China and Silicon Valley.

Enterprise and brand power

"The DFJ Dragon Fund will modify its approach to suit the times, and follow the trend of China's overall economic development, thereby putting its focus on areas such as finance, medical equipment, wireless, alternative energy and environmental protection," said Luh. "We will focus on enterprises that combine new and traditional technologies to become market leaders."

"Currently, a few banks and insurers that have already gone public lack good financial products and a sound product chain. As the securities market grows and prospers, the need for financial products will grow rapidly, and banks and insurers will also launch more diversified products," said Luh. "Companies specializing in design and production of financial products are absolutely needed. This has offered venture capitalists a fairly good opportunity to invest in these companies."

"Secondly, the solar energy segment has boomed in recent years. But domestic solar energy companies have, to some extent, to depend upon government subsidies to grow, so there is much room for venture capitalists to use their creativity," Luh added.

|