|

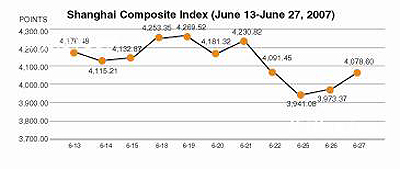

TO THE POINT: In the final week of June, the Chinese stock market relaxed from its previous buoyant spirit as the Shanghai Composite Index lingered around 4,000 points. It is widely suspected the index might not surpass the peak 4,334 points soon though institutional investors remain optimistic about the bullish trend. Large industrial enterprises reaped record profits in the first five months of this year. The consumer price index of June is expected to be lower than 3 percent due to decreases in grain prices. Government financial revenue soared 24 percent in the first five months. In the meantime, China Development Bank sold 5 billion in yuan bonds to Hong Kong in an effort to boost mainland infrastructure construction. In the retailing sector, the Wahaha vs. Danone dispute over trademark issues hasn't ended and Wahaha decided to file a countersuit against Danone.

By LIU YUNYUN |

June CPI Could Decline

A bumper harvest of grains this summer coupled with abundant supplies pulled the price of corn and wheat futures to a record low this year. Experts believe the price fall could result in a lower-than-expected consumer price index (CPI) in June, which soared 3.4 percent in May.

As China's two major grains, the drop in corn and wheat prices have dragged prices of other futures like soybean, soybean oil and rapeseed oil down, reversing the rising trend in May.

Ma Mingchao, a futures analyst with Qingma Investment Co., said that the ample supply of corn and wheat this summer could help stabilize prices in the next two months, although year-end grain prices may still be up.

Statistics from the Ministry of Commerce show that egg prices have also dropped since the beginning of June. The average retail price of eggs decreased by around 2 percent in the past several weeks. The Ministry of Commerce predicts a further fall in egg prices in the short term.

Food prices account for 33 percent of China's CPI, and rising food costs in the past few months, especially in May, have caused excessive growth of the CPI.

If food and food commodity prices continue to fall, it will diminish the chances that the central bank will increase interest rates in the near future.

Marketing Yuan Bonds to Hong Kong

The China Development Bank (CDB), one of China's three policy banks, will sell up to 5 billion yuan of two-year, yuan-denominated bonds in Hong Kong-the first-ever batch to be sold outside the Chinese mainland.

The one-week offer beginning on June 27 is available to both institutional and retail investors with interest to be determined by the market.

The funds raised from the offering will be used to finance China's "key infrastructure projects," said Chen Yuan, CDB's Governor. The bonds will be issued at par and have a coupon rate of 3 percent.

The long-awaited offering of yuan bonds coincides with the 10th anniversary of Hong Kong's reunification with the mainland and marks a milestone in financial cooperation between Hong Kong and the mainland, Henry Tang, Hong Kong's Financial Secretary, said at the launch.

Analysts expect that CDB's yuan bonds will be well received by investors on expectations of further appreciation in the Chinese currency. The yuan has risen 2.4 percent since the beginning of the year

This effort demonstrates the Central Government's dedication to enhancing Hong Kong's status as an international financial hub and to broadening the yuan market.

The distributors of the bonds comprise 14 banks with branches in Hong Kong, including Bank of Communications, Bank of China (Hong Kong), China Construction Bank (Asia), CITIC Ka Wah Bank, HSBC, the Industrial and Commercial Bank of China (Asia), Nanyang Commercial Bank, Standard Chartered Bank (Hong Kong), Wing Hang Bank and Wing Lung Bank.

Cutting Interest Tax

Amid consistent calls for the suspension of the interest tax-currently standing at 20 percent-Chinese lawmakers have finally decided to take action.

In response to a request from the State Council, the Standing Committee of the National People's Congress has deliberated the State Council's proposal to reduce or cancel the interest tax.

This move marks the government's latest attempt to make the real interest rate positive and discourage the diversion of bank deposits to the stock market.

Currently, benchmark one-year deposits carry an interest rate of 3.06 percent. But, given the 20-percent interest tax, the actual yield is just 2.45 percent. Meanwhile, CPI hovered over 3 percent in the first five months, further dragging the interest rate to negative levels.

Finance Minister Jin Renqing said the interest tax has played a positive role in regulating personal incomes and increasing the state's fiscal revenues since it was levied from November 1, 1999. The implementation of interest tax also helped trim tremendous deposits and boost consumption.

|