|

TO THE POINT: Spring Festival comes, and Spring Festival goes. The nation’s biggest holiday was rewarding for consumer products manufacturers and retailers. The festival period consumption jumped 15 percent compared with that of last year. Right after the seven-day carnival, China’s central bank showed its concerns over excessive capital liquidity and raised the bank reserve requirement ratio another 0.5 percent, a mild move to calm down the white-hot investment and stock market speculation. Also after the festival, which has always been a big test for China’s transportation capability, Air China and Qunar.com had announced an online ticket search and booking service for travelers’ convenience. The last week of February was a black week for most traders in the stock market. February 27 saw the benchmark Shanghai Composite Index drop 9 percent, the sharpest of its kind in a decade and many lost their money. For newcomers to the stock market, what they have lost is probably confidence. In a country low in inflation, individuals are still keen on buying gold for family financial stability in case real inflation takes place. Though gold output in 2006 reached an unprecedented high, the amount was still insufficient and will face strong demand in the future. Meanwhile, by the end of 2006, total banking assets in China hit a record high, accounting for 5 percent of the world’s total. The Big Four state-owned commercial banks are still major players with relatively good performance.

Reserve Requirement Up Again

People’s Bank of China, the central bank, formally raised the renminbi reserve requirement ratio in depository financial institutions by 0.5 percent on February 25-the fifth increase in the past eight months. This means that about 160 billion yuan in bank capital will be frozen.

Currently, the reserve requirement ratio for domestic banks is 10 percent. The frequent adjustment of the reserve requirement ratio shows the central bank is aimed at curbing the excessive liquidity and over investment.

According to China Securities Journal, some banks have said this round of reserve requirement ratio increase won’t much affect banks’ operation. Apart from the reserve requirement ratio from the central bank, each bank has some proportion of excessive reserve up to 3-4 percent. Therefore, before the excessive reserve is absorbed, the reserve requirement lift will not curb banks’ ability to make loans.

Wang Zhihao, an economist from Standard Chartered, pointed out if the government decisively decides to control loan growth and investment scale, an interest rate hike would be unavoidable.

Wang estimated that the central bank is likely to increase the reserve requirement ratio once every quarter this year.

Consumer Week

In China, the most celebrated element of Spring Festival has become consumption.

According to the Ministry of Commerce, the total retailing revenue of social consumables in the 2007 Chinese lunar new year, which fell from February 18 to 24, totaled 220 billion yuan, up 15 percent compared with that of the 2006 Spring Festival.

The restaurant industry showed significant performance and grew 18 percent. Spring Festival has always been a holiday to indulge in food and beverage. Pressured by heavy workloads and in need of a total relaxation, more and more Chinese families have turned to restaurants for family reunion dinners, leading to a booming restaurant market.

Home appliances were bestsellers during the golden week as many families chose to upgrade their TVs, refrigerators and washing machines as a special treat. Digital products and membership cards to gyms, as gifts, were trendy too.

The farmers in rich coastal provinces like Jiangsu have benefited a lot from favorable agricultural policy, such as education incidental fee exemption and the elimination of agricultural tax. As a result, farmers’ consumption power has been enhanced and motorcycles, priced between 3,000 and 5,000 yuan, are their favorite vehicles at present.

Stock Market Plummets

The country’s stock market on February 27 suffered its sharpest daily fall in the past decade (as of press time) and the benchmark Shanghai Composite Index plummeted nearly 9 percent to close at 2,771 from 3,040 a day before. Partly in reaction to the mainland plunge, Hong Kong’s blue chip Hang Seng Index fell 360 points on the same day, or 1.8 percent.

He Jun, Vice President of Anbound Consultation Co. said, “Although the market index was at a high level and people were expecting a correction, what happened was astonishing.”

The nose-diving stock market resulted in a return drop in fund buyers and analysts estimated citizens’ previous enthusiasm for funds might wane.

“The stock market plunge will trigger selling [of funds] in fear of a continuing market slump,” said Zhou Liang, China research manager of Lipper, a Reuters company.

However, the index picked up a bit on the next day, and as usual, a plunge can mean a strategic opportunity for fund accumulation.

He believed the market would continue to be bullish this year.

Gold Fever

A report from National Development and Reform Commission (NDRC) shows that in 2006, gold output hit a new record high to 240.08 tons, rising 7.15 percent compared with that of 2005.

The skyrocketing gold price in the international market has greatly improved the value of China’s gold processing industry. The NDRC report said the average gold price in the international market stood at $603.9 per ounce last year, moving up 36 percent compared with 2005.

The total output value of the gold industry reached 53 billion yuan last year, up 34 percent.

Gold, of course, is not renewable. The report pointed out the good gold resources will gradually deplete after years of exploration. The average comprehensive production cost in China stands at $380 per ounce, $40 more than the international average.

When the gold market opened to individual purchase, many people turned to buy gold to keep their financial resources safe from depreciation. The strong demand, limited gold quantity, and freedom to purchase will probably push the gold price to a new high.

NDRC has vowed to issue new regulations on gold manufacturing and planned to produce 260 tons this year and further improve the market structure. In the future, the country will have to turn to less desirable places for gold exploration, which will be more costly.

Air China’s Online Presence Grows

Air China, China’s leading domestic and international airline, agreed to provide travel search engine Qunar.com a comprehensive list of flight information, availability and prices that will be marketed to travelers in China.

“We feel that Qunar provides Air China with an efficient way to reach China’s emerging class of frequent independent travelers, most of whom are comfortably using the Internet to find and purchase tickets,” noted Hu Fajin, head of Air China’s e-commerce business.

“Marketing to consumers directly is one of our tent pole strategies, along with, of course, maintaining our existing relationships with well-run and efficient online travel agencies.”

The partnership between Air China and Qunar is the first time that a major airline in China has elected to work with a travel search engine. Qunar will provide millions of Internet users with information about available flights and prices, and will lead customers directly to Air China’s website for online booking.

Domestic Banks Get More Goliath

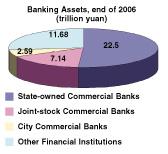

The Big Four state-owned commercial banks still hold more than half of the country’s total banking assets, and those assets keep on growing-big time-according to the China Banking Regulatory Commission (CBRC).

According to CBRC statistics, as of the end of December 2006, domestic assets of banking institutions in China (in both renminbi and foreign currencies) totaled 43.9 trillion yuan, an increase of 17.3 percent year on year (see graph).

As of the end of December 2006, total domestic liabilities (in both renminbi and foreign currencies) reached 41.71 trillion yuan, rising 16.5 percent year on year.

CBRC statistics also indicate the quality of banking assets has been improving. As of the end of 2006, the non-performing loan (NPL) ratio of commercial banks dropped to 7.09 percent, a 1.52 percent decrease from the end of 2005. The outstanding balance of NPLs was 1.25 trillion yuan. n

|