|

Ladies and gentlemen, it's 10.7 percent! All estimations, guesses and doubts came to a close after the National Bureau of Statistics issued the 2006 GDP growth rate. Ladies and gentlemen, it's 10.7 percent! All estimations, guesses and doubts came to a close after the National Bureau of Statistics issued the 2006 GDP growth rate.

Backed by the booming domestic market, China Mobile has been fearless, determined even to buy a loss-generating Pakistani telecommunications company. Well, all our blessings.

As domestic giants spare no effort to "go out," foreign tycoons show their keen interest in "coming in." Swiss company UBS AG has seen its dream come true in that it finally won approval from the government to provide comprehensive brokerage services to Chinese customers. Similarly, New York-based insurance company Marsh & McLennan Companies happily announced that it will become the  first wholly foreign-owned insurance company operating in China. first wholly foreign-owned insurance company operating in China.

Meanwhile, there are a lot of mergers in China, but some messy divorces too. Look at this one. The seemingly happy merger of Changjiang Securities and BNP Paribas broke up soon after their not-so-sweet honeymoon ended.

In the transportation sector, Delta Air Lines Inc. is applying for a direct flight between Shanghai and Atlanta in an effort to tap into the vast potential of air services between the two countries.

GDP Unveiled

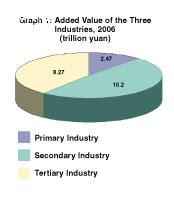

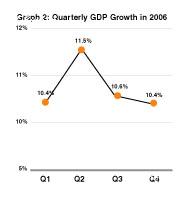

Behold! China's 2006 growth rate broke the annual GDP record high, reaching 10.7 percent to 20.94 trillion yuan in spite of a series of macro-control policies last year to cool off the economy (see graph 1 & 2).

Xie Fuzhan, Commissioner of the National Bureau of Statistics, pointed out that the growth of housing prices in major cities dropped 2.1 percentage points from 2005, to 5.5 percent, but were still higher than they should be. Xie also noted some problems existed in the economic performance, such as the irrational relationship between excessive investment and moderate consumption, the imbalance of international payments and excess liquidity in the banking system. According to Xie, fixed assets investment totaled 10.987 trillion yuan in 2006, up 24 percent over the previous year, and the CPI (consumer price index) rose 1.5 percent.

China Mobile on the Move

China Mobile, the largest telecommunications service provider in China, has taken a bold step forward: It agreed to buy Paktel Ltd. at a price of $460 million (including debt). This is meant to be a breakthrough for China Mobile Communications Corp. as it is the first overseas acquisition.

But will the acquisition generate a profit for China Mobile?

Paktel is a loss-making Pakistani telecommunications company that was abandoned by its previous owner, Luxemburg-based Millicom International Cellular. The Wall Street Journal cited analysts saying that intense competition in Pakistan, where six operators fight for subscribers, has made it difficult for Millicom there.

People still remember Lenovo Group's purchase of IBM's loss-making PC business in 2005 and are witnessing how the company stumbles to get recognition from the market both at home and abroad.

This raises doubts whether a growing Chinese communications company can successfully make a profit out of a loss-making foreign company in a completely foreign and brand new market.

Secured Securities

After two years of harsh negotiation with the securities supervisory department, UBS AG finally got its ambitious securities business approved by the Chinese Government.

UBS purchased 20 percent of Beijing Securities and the new company-UBS Securities-will start operating in the first quarter of this year.

Though Beijing Securities was on the edge of bankruptcy, UBS Securities might have a better chance at success. For one thing, the Chinese securities market is booming and UBS' expertise in that area could certainly help others-and in turn, help itself.

|