|

Gas Gouging No More

As the Organization of Petroleum Exporting Countries struggle to bring oil prices back to the normal track of steady increases, ordinary Chinese consumers have benefited from the latest round of oil price declines. As the Organization of Petroleum Exporting Countries struggle to bring oil prices back to the normal track of steady increases, ordinary Chinese consumers have benefited from the latest round of oil price declines.

Beginning January 16, refined oil prices were reduced between 0.17 yuan and 0.21 yuan per liter. It is the first time China cut its refined oil retailing price in 20 months. Lower gasoline costs and reduced fuel surcharges in air travel will certainly make life easier, though many citizens are not satisfied with the slight price cut.

The National Development and Reform Commission claims the best time to marketize Chinese oil prices according to international market price fluctuations is when the international oil price falls to $50-55 a barrel. But currently, the Chinese Government still holds the pricing right.

Citizens' reaction toward the price slide is only moderately favorable as a 0.2 yuan price cut is not a big deal, as most domestic newspapers reported.

Quality, Not Quantity FDI

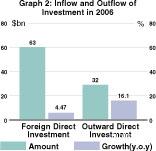

Statistics from the UN Conference on Trade and Development show that China maintained its position as the largest FDI recipient among developing countries in spite of a slight drop in inflows in 2006 to $70 billion from $72 billion in 2005. Non-financial sectors (sectors excluding banking, insurance and securities) absorbed FDI of $63.021 billion, up 4.47 percent compared with the previous year, according to MOFCOM (see graph 2). Statistics from the UN Conference on Trade and Development show that China maintained its position as the largest FDI recipient among developing countries in spite of a slight drop in inflows in 2006 to $70 billion from $72 billion in 2005. Non-financial sectors (sectors excluding banking, insurance and securities) absorbed FDI of $63.021 billion, up 4.47 percent compared with the previous year, according to MOFCOM (see graph 2).

However, it is not always nice to be the largest. China's think tank, CASS, issued a research report warning that the quality of FDI needs to be improved.

A large proportion of FDI is export oriented and flows to the manufacturing sector, which is detrimental to the development of tertiary industry. Meanwhile, some free ports increased FDI to China and likely pose more financial risks. A large proportion of FDI is export oriented and flows to the manufacturing sector, which is detrimental to the development of tertiary industry. Meanwhile, some free ports increased FDI to China and likely pose more financial risks.

Asian Trade Wrap-Up

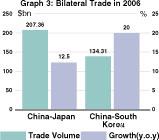

China and South Korea

MOFCOM statistics show that in 2006 the trade volume between China and South Korea totaled $134.31 billion, up 20 percent compared with a year earlier. After South Korea admitted China's fully marketized economy, their relations have been sweetening.

China exported commodities and services worth $44.53 billion to South Korea, and imported $89.78 billion. South Korea has become the sixth largest trading partner of China and China is the biggest trading partner of South Korea.

It's very likely the goal of total trade volume of $200 billion can be achieved ahead of schedule if their trade relations continue along a rosy path.

China and Japan

The $200 billion in trade volume is a lofty goal for China and South Korea, but China and Japan already surpassed that, hitting the $207.36 billion mark in 2006, up 12.5 percent compared with the year earlier, according to MOFCOM (see graph 3).

Japan is China's third largest trading partner and the second largest FDI investor as of the end of November 2006.

Considering historical tensions between China and Japan, it's good to see money bridging the cultural divide.

|