Germany Left in the Dust

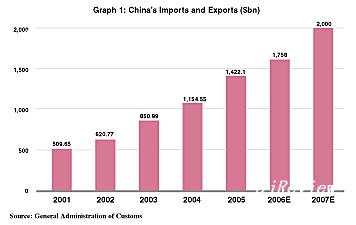

WTO estimated that by the end of 2007, China will have surpassed Germany in total foreign trade volume to be the second largest trading country in the world. The Ministry of Commerce estimates import and export volume can reach $2 trillion by the end of 2007.

General Administration of Customs (GAC) also forecasts that imports and exports volume in 2006 is expected to reach $1.758 trillion, a year-on-year increase of 24 percent.

Last year, with increasing pressure of renminbi appreciation, China adopted several measures aimed at slowing down export growth, including reducing export tariff rebates, and restricting exports of resources and goods with high-energy consumption and high pollution rates. However, exports still maintained fast growth. The GAC estimation shows exports in 2006 would total $963 billion, growing 27 percent, while imports also would grow 20 percent in 2006.

GAC analysts mentioned that it takes time for those measures to take effect. During that period, it's normal that exports will continue climbing. They forecasted export growth in 2007 will slow down, which is echoed by the Ministry of Commerce's estimated 15 percent for total trade volume in 2007.

China's foreign trade has kept a growth rate of over 20 percent since 2002, the first year after China's accession to the WTO (see graph 1). Trade volume soared by 37.1 percent and 35.7 percent in 2003 and 2004, respectively. Trade surplus has also surged since 2004, and surpassed $100 billion in 2005.

The Ministry of Commerce pointed out the expanding surplus is due to the steady growth of the world economy, the increasing competitiveness of Chinese products and macroeconomic control measures taking effect. In the meantime, the rapid development of the domestic economy stimulated the demand for imported goods.

Jiaozi Looking Pricey

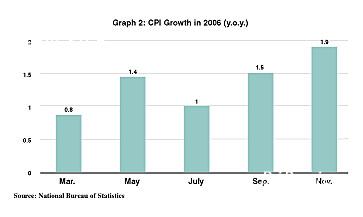

China's consumer price index (CPI) rose by 1.9 percent in November 2006 compared with the same period of 2005 (see graph 2).

Central bank economists noted the CPI will pick up next year to 2 percent, led by a rise in food prices based on growing urban demand and supply constraints.

"Food prices are on the rise, both in China and globally," said Stephen Green, Standard Chartered's senior economist, in the bank's latest economic report, which predicted a 3 percent increase in 2007. "This is important for China particularly since food makes up 33 percent of the CPI."

"Although the CPI is moderate with low inflation levels at present, the central bank is worried that inflation might occur," noted Zhou Xiaochuan, Governor of People's Bank of China, the country's central bank.

Zhou explained there are many factors contributing to inflation, for instance, the economic globalization also causes domestic price fluctuations.

The central bank's move to issue 100-150 billion yuan in fixed placement bills by year-end "was an indication of the concern (of inflation) out there," said Stephen Green from Standard Chartered.

Does Slower Property Growth=Cooling Market?

According to a joint survey of the National Development and Reform Commission and the National Bureau of Statistics, the price of newly built houses in 70 large and medium-sized cities went up by 5.8 percent in November 2006, down 0.8 percentage points compared with the growth rate of October.

Beijing has seen double-digit growth of newly built housing prices since June 2006. The price swelled by 10.7 percent in October, making Beijing the fastest market for price growth among all cities. However, it slowed down to 10.3 percent in November, and its price leadership was replaced by Fuzhou, capital of southeast China's Fujian Province, where the growth rate was 10.4 percent.

In Shanghai, the price of newly built houses has kept declining since December 2005, and in November 2006, it decreased by 0.1 percent.

|