|

|

|

NEW STRATEGY: Taobao.com, China's largest customer-to-customer e-commerce market place embraced the business-to-customer (B2C) surge by launching its own B2C online mall last April (CFP) |

The financial crisis inadvertently provided a boon to e-commerce development in China. While e-commerce platforms offered export-oriented manufacturers an alternative, cheaper channel for sales lift in the domestic market, online shopping attracted more, now price-sensitive, customers.

A growing acceptance of shopping online among Chinese and improvements to factors such as payment, logistics and credit management solutions have also contributed to the boom. The trade volume of China's online shopping skyrocketed 95.8 percent in the first half of this year, said a recent report compiled by iResearch, a Shanghai-headquartered online market research company.

Still, e-commerce platforms, either those that sell goods directly to customers or those facilitating such deals online, have had to rack their brains to come up with new ideas as the market potential for online shopping is far from being fully tapped in China. According to statistics from the China Internet Network Information Center (CNNIC), one of every four Chinese netizens shops online, although in countries with higher Internet penetration rates, two of every three buy products online.

Also, many local governments have counted on e-commerce as a solution to pressing problems such as shrinking overseas demands for Chinese products and unemployment. They encourage e-commerce platforms to help small and medium-sized enterprises (SMEs) find domestic customers and cut transaction costs through favorable policies.

Right time

The trade volume of China's online shopping, including deals concluded at customer-to-customer (C2C) or business-to-customer (B2C) platforms, soared 128.5 percent to hit 120 billion yuan ($17.57 billion) last year, an increase that was nearly 40 percentage points higher than the 2007 growth. This was in part due to the global financial crisis that wiped out a considerable number of overseas orders, allowing the e-commerce industry to play an active role in helping local manufacturers.

Major business-to-business (B2B) platforms, such as alibaba.com and made-in-china.com, have helped SMEs in such major export bases as Guangdong, Zhejiang and Jiangsu provinces to pull through the bitter winter by expanding sales in the domestic market and offering advices on talent pool development.

|

|

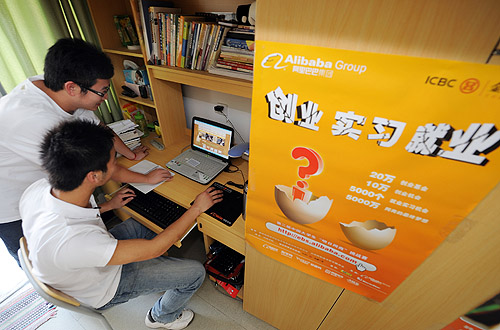

ONLINE ALTERNATIVE: Instead of going to a mall, Chinese shoppers look for products online. Local governments are promoting e-commerce to boost employment and help export-oriented companies find domestic demand (JIANG KEHONG) | Alibaba as China's largest B2B platform, taking up more than 85 percent of the market share, has allied with the Zhejiang and Guangdong provincial governments. The Zhejiang Provincial Government and Alibaba pledged last July, respectively, a subsidy of 30 million yuan ($4.4 million) and discounts worth nearly 300 million yuan ($44 million) to grant membership for 100,000 Zhejiang-based companies for Alibaba's services over the next three years. By then, more than 200,000 local companies will be able to find their suppliers or clients at alibaba.com.

The e-commerce landscape has also witnessed a number of newcomers. On the C2C front, baidu.com, the largest Chinese language search engine, launched a site youa.com last October to rival taobao.com, a leading online marketplace and the C2C site of Alibaba.

According to the market research company Analysys International, 360buy.com, the online retailer of digital cameras, mobile phones and computers, achieved sales of over 200 million yuan ($29 million) in March, which made it the only B2C company to record such a high monthly sales volume in China.

The company had sales of 1.3 billion yuan ($190 million) in 2008, establishing a goal for 2009 of realizing a year-on-year increase of 300 percent, reaching 4 billion yuan ($586 million) in sales, said the company's Vice President Yan Xiaoqing. The company could possibly realize this ambitious goal by expanding business into the domestic B2B market.

The latest CNNIC statistics showed the number of online shoppers had grown faster than the number of netizens in the first six months of this year. About 14 million Chinese became new online shoppers in the past six months, up 18.8 percent from that in the second half of 2008, while the number of Chinese netizens increased 13.8 percent during the same period.

B2C prevails C2C

While it is widely agreed that the e-commerce sector is slated to surge in the next few years in China, analysts contended that most online sales will be concluded at B2C platforms rather than at C2C sites by 2012.

"China's e-commerce sector is at a development phase similar to that in the United States a decade ago when the country's largest C2C marketplace, eBay Inc. had an annual turnover several hundred times larger than that of Amazon.com, Inc.," said Cao Fei, senior analyst at Analysys International. "The annual turnover of eBay Inc. today only stands at less than half of that of Amazon.com, Inc."

C2C business has witnessed explosive development in the first decade of China's e-commerce industry, but will see its growth rate decrease year on year in the next three years due to problems with the quality of goods, the credibility of sellers, as well as after-sale services, Cao said.

Taobao.com, for instance, currently holds more than 80 percent of the C2C market share in China largely because of its successful marketing strategies and unique payment solution called AliPay, which entrusts an escrow account to take the payment before the buyer receives his goods.

As popular as AliPay is, the much safer payment-on-delivery option and a number of other payment solutions are preferred by buyers. Although C2C marketplaces like Taobao generally offer a credit rating system of sellers and buyers and adopt certain kinds of customer protection programs, cases of abuse have surfaced and complaints about related services have remained constant.

Statistics from the Beijing Administration for Industry and Commerce showed online shopping constituted a large share of complaints they received in August, for a total of 222 cases. Major complaints covered disputes over the quality of goods, in addition to the lack of guarantees to after-sale services when goods were not delivered on time or the goods delivered were not what the buyer had ordered.

With guarantees of quality, brands and service, stores at C2C marketplaces are mainly competing for lower prices. "The C2C business is a price grinder, leaving no chance of making a profit for any newcomer unless you sell smuggled or fake goods," said Internet industry observer Hong Bo at the e-commerce panel of the Baidu World Forum 2009.

E-commerce turnover in July was around 130 billion yuan ($19 billion) in Beijing, of which 9 billion yuan ($1.3 billion) came from the B2C sector and 6 billion yuan ($878 million) from the C2C sector, Gong Minghua, Director of Beijing Information Solution Promotion Center, said at the e-commerce panel.

Innovations

With the presence of counterfeit products increasing on C2C marketplaces, a growing number of Chinese customers are willing to pay for values pertinent to customer satisfaction other than price. This will encourage B2C companies to model after large home appliances retailers such as Gome Electronics and Dazhong Electronics, said Yu Yang, President of Analysys International.

By promising customers "false failure returns" within two weeks after delivery, the two retailers have successfully won customers from small stores at Beijing's Zhongguancun district where fake products were rampant 10 years ago.

Comparatively, reliable credibility of B2C platforms will not only divert customers from C2C marketplaces, but also help B2C businesses attract more customers from "brick and mortar" stores, said Liu Xiaodong, Senior Vice President of CBSI Group, the owner of B2C website zol.com.cn.

B2C business now generates less than 2 percent of the total retail volume of consumer goods, but panelists are optimistic about the B2C future in China. "Export-oriented companies will count on B2B platforms to promote sales of their products to domestic customers in the coming three to five years, which could catalyze a revolution in sales channel building while providing an impetus to the B2B business," Yu with Analysys International said.

To embrace this revolution, some websites began to innovate services that combine the advantages of online and offline marketing.

Baidu's youa.com, for instance, is working on providing "one-stop" service at the site to customers, while allying with clients for precise marketing based at their search engine expertise.

Another possible innovation is online community-based marketing. Online community creates a bond between people sharing similar interests and thus creates trust and loyalty, a rare resource in the virtual world. |