|

|

|

(WANG DINGCHANG) |

Numbers of the Week

10 billion yuan

China's social security fund plans to boost its investment in equity funds up to 10 billion yuan ($1.46 billion) this year.

0.6%

In May, home prices in 70 medium and large cities dropped 0.6 percent year on year, according to National Bureau of Statistics.

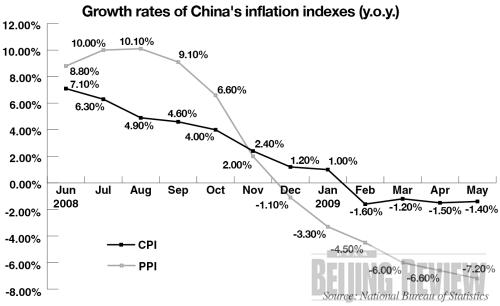

TO THE POINT: Inflation in China has long gone, as reflected in the consumer and producer price indexes in the first five months of this year, which were both in negative territory. The government raised export tax rebates for another batch of items to boost shrinking exports. The country was the biggest auto market in the world in the first five months of this year. Chinalco saw its deal with Rio Tinto collapse after the latter formed an alliance with BHP Billiton. The proposed merger of China Eastern Airlines and Shanghai Airlines is unlikely to go forward without government assistance. The Chinese currency watchdog loosened control over mainland companies' investments abroad and allowed more funding for their overseas subsidiaries.

By LIU YUNYUN

Inflation Down

Though economists worried the government's colossal stimulus packages might trigger inflation, the May inflation indexes suggest that their fears were unnecessary (see graph) and that the Chinese economy is still weak.

The consumer price index (CPI), the main gauge for inflation, dropped 1.4 percent year on year in May, the fourth straight month the index was in negative territory.

The price of pork, the bellwether leading inflation in the past two years, fell 32 percent year on year in May, due in part to the A/H1N1 flu outbreak, which has kept consumers vigilant when eating meat.

The producer price index (PPI), which measures inflation at the wholesale level, has continued to fall year on year since the middle of last year. It was down 7.2 percent in May.

"Both indexes have been lingering in negative territory for four months, which is not a good sign," said Xiang Songzuo, an independent economist, in an interview with CCTV. "It means our economy has not been dragged onto the right track and demand is weak, which makes it hard to achieve the targeted 8-percent GDP growth this year." The Chinese Government aims to maintain year-on-year CPI growth at around 4 percent.

A Helping Hand for Exports

The Ministry of Finance has decided to further raise export tax rebates to help exporters through the dreadful crisis period.

More than 600 export items benefit from the new tax rebate hike. It is the seventh hike in 10 months, showing the dismal situation the country is in.

Starting June 1, the ministry lifted export tax rebates to between 5 and 17 percent. Some products such as sewing machines and air conditioners received the full rebate of 17 percent. Rebates on items like juice, furniture and toys were raised to 15 percent.

But analysts argue that frequent rebate readjustment could jeopardize price negotiation with foreign buyers, who will bargain for lower prices once they know producers' costs are down. The rebate hikes, as a result, could eventually benefit buyers rather than give an edge to domestic producers.

Meanwhile, the aid could hinder structural reform of outdated production capacity. China's exports are mainly labor-intensive products without much technology innovation. Some economists hope the financial tsunami will wipe out small workshops while adding a competitive edge to industrial giants.

Exports, a major driver of China's robust economic growth in the past decade, have been shrinking since the second half of last year.

They plunged 21.8 percent year on year in the first five months this year, according to the General Administration of Customs.

The U.S.-led financial crisis threw Chinese exporters into a tailspin, resulting in huge job losses due to factory shutdowns.

The Biggest Auto Market

The Chinese Government's stimulus measures for the auto industry have paid off, as the country surpassed the United States to become the biggest auto consumption country in the first five months of this year.

China was a bright spot in the gloomy international market, which is suffering from company failures and a freefall in sales.

In May, a total of 812,178 autos were sold in China, surging 54.7 percent from the same month last year. It was the fifth month this year that auto sales in China exceeded those in the United States, according to the China Association of Automobile Manufacturers.

If the market remains this robust, this year China will become the biggest auto market in the world.

To boost auto sales on the mainland, the Chinese Government has adopted a string of stimulus measures including subsidies for auto replacement and a tax break on low-emission cars.

Topping the bestseller list are Shanghai Volkswagen, FAW Volkswagen and Shanghai General Motors.

Although the U.S. auto giant General Motors is filing for bankruptcy protection, its operations in China remain safe and sound. The future of Shanghai GM, however, is hazy.

The Chinalco-Rio Deal Domestic media expressed anger over news that Rio Tinto ditched its deal with Aluminum Corp. of China Ltd. (Chinalco) and entered a new joint-venture agreement with BHP Billiton.

|