| TO THE POINT: The National Bureau of Statistics released major economic figures for February on March 11. The bureau's spokesman said the Chinese economy had no signs of overheating. The mainland continued to take the lead in global car sales with domestic brands taking the largest share. The first inland duty-free zone will be built in Chongqing to encourage growth in the upper Yangtze River region. Airline companies worry the rapidly expanding high-speed railways may absorb 60 percent of their market.

By LIU YUNYUN

Major Economic Figures in February 2010

CPI and PPI

The consumer price index (CPI), a main gauge for inflation, grew 2.7 percent year on year in February, nearing the 3-percent threshold dividing inflation and non-inflation.

Producer price index (PPI), a barometer for inflation at the wholesale level, rose 5.4 percent in February compared to last year.

The growth in both index accelerated from that of January.

The CPI has been on the rise since the third quarter of last year. Su Ning, Vice Governor of the People's Bank of China, said the biggest present concern for the government is imported inflation caused by the rapid increase of international commodity prices.

The moderate CPI and PPI growth rates diminished interest rate hike expectations.

Housing Prices

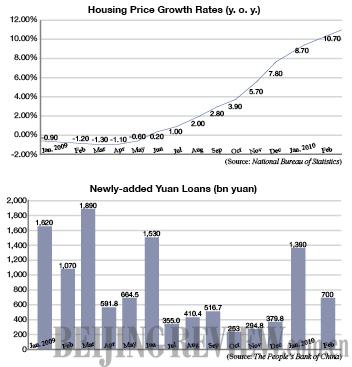

Chinese housing prices continued to rise in defiance of repeated government warnings of an overheating market.

In February, house prices in 70 large and medium-sized cities soared 10.7 percent year on year.

Minister of Housing and Urban-Rural Development Jiang Weixin said the housing prices will keep increasing in the next 20 years because of rapid urbanization and industrialization efforts as well as the shortage of land in urban areas.

Retail Sales

Retail sales in January and February totaled 2.5052 trillion yuan ($300.9 billion), rising 17.9 percent year on year.

Investments in Fixed Assets

China's investments in fixed assets were 1.3 trillion yuan ($190 billion) in the first two months of this year, recording a robust growth rate of 26.6 percent from a year ago. Investments have been a driving force of the economy, making up for the drooping trade front.

(Data source: National Bureau of Statistics)

Loans and Deposit

Newly-added renminbi loans in February stood at 700 billion yuan ($102.48 billion), half that of January's total, according to statistics from the People's Bank of China.

Chairman of the China Banking Regulatory Commission Liu Mingkang said February loan growth was reasonable and should not follow last year's lending mania.

In the same month, a total of 958.9 billion yuan ($140 billion) was deposited into banks.

Export and Import

Exports in February totaled $94.5 billion, representing an increase of 45.7 percent year on year, according to data from the General Administration of Customs. Figures also showed initial signs of economic recovery in the developed world.

Imports grew 44.7 percent year on year to reach $86.9 billion in February, a reflection of vibrant domestic demands. The February surplus was $7.6 billion, compared with $14.15 billion in January.

Auto Market Cooled

The auto purchasing spree on the mainland cooled down in February compared with January this year, as reflected in the month-on-month 27.2-percent dip in sales.

Figures from the China Association of Automobile Manufacturers (CAAM) showed a total of 1.2115 million automobiles were sold in China in February. Analysts attributed the sales setback to the seven-day Spring Festival, which fell on February 13-19, when people stayed at home enjoying family get-togethers.

However, on the year-on-year basis February 2010 sales surged 46.25 percent, continuing to lead the global growth. China's auto sales nearly doubled those of the United States.

Domestic brand autos took up half of the market share, followed by Japanese autos which accounted for 19.8 percent of the Chinese market.

Xiong Chuanlin, Secretary General of CAAM, estimated China's auto sales will maintain their 10-15 percent annual growth through 2015, while the total sales volume will reach 16.5 million this year.

Inland Duty-Free Zone

The State Council approved to set up the first inland duty-free zone in Chongqing Municipality, said Bo Xilai, Secretary of the Chongqing Municipal Committee of the Communist Party of China, on the sidelines of the Third Session of the 11th National People's Congress (NPC) held on March 5-14. The duty-free zone will cover 10 square km.

In Chongqing's duty-free zone, foreign merchandise can be brought in without import duties for further processing or re-exporting. Import duties must be paid on these goods if they are released into the local market.

Bo said Chongqing's economic strength is undermined by its geographic location—in the vast western part of China. The inland municipality is essentially a mountainous city surrounded by steep hills on all sides.

Shanghai is the economic powerhouse in the lower reach of the Yangtze River. Bo said the Central Government's decision to set up the duty-free zone in Chongqing has in effect set in motion a major strategy to make Chongqing the economic center in the upper reach of the Yangtze River.

Bo said further opening to foreign trade is a necessary path to achieve this goal. Chongqing's GDP lags far behind the other three municipalities--Beijing, Shanghai and Tianjin.

Airlines Under Pressure

The fast development of the nation's high-speed railway network is expected to devour 60 percent of the airline market, said Liu Shaoyong, General Manager of China Eastern Airlines Corp. Ltd., on the sidelines of this year's NPC session.

The high-speed railway network, scheduled to be completed in 2012, will cover most of the economically developed and densely populated areas in China.

Liu said the railway network will pose "direct and prolonged" pressure on domestic airlines.

The bankruptcy of Japan Airlines Corp., who saw its flight numbers decimated by its own domestic high-speed railways and fierce international competition, serves as a reminder to China's domestic airlines of the threat railways present.

But Liu said the airlines have an absolute advantage over railways in distance travel greater than 1,200 km. The annual passenger traffic growth of 15-20 percent might also ease pressures to some extent. |