TO THE POINT: Robust economic figures for January 2010 showed the Chinese economy had rebounded to pre-financial crisis levels. Inflation indexes, CPI and PPI, were both within a positive territory. Foreign trade recently took off, with imports growing much faster than exports. Foreign direct investments in China have resumed positive growth. But skyrocketing housing prices, partly jacked up by excess liquidity in the market, pose an imminent risk to economic stability and development. China's sovereign wealth fund has started buying stocks in traditional companies, like hi-tech and media, instead of merely investing in financial institutions to diversify its portfolio. China will build more nuclear power reactors this year as part of its green efforts.

By LIU YUNYUN

Major Economic Figures in January 2010

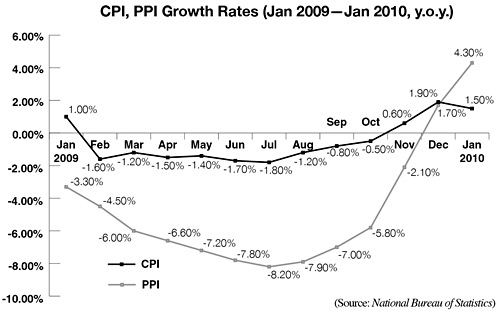

CPI

In January, consumer price index (CPI), a main gauge for inflation, rose 1.5 percent from a year earlier, the highest growth in nearly two years.

The price increase of food, rent, fuel and auto parts contributed most to the CPI growth.

Analysts estimated CPI growth would accelerate in the middle of this year when the economic recovery was reassured.

The mild CPI growth lowered people's expectations on imminent interest rate hikes. At present, the nominal one-year benchmark interest rate is 2.25 percent, still in the positive territory adjusted for inflation.

PPI

In January, producer price index (PPI), an inflation measurement at the wholesale level, grew 4.3 percent.

The upward trend of PPI indicated that the profits of enterprises would increase rapidly, said Wei Fengchun, a macro-economy analyst with China Securities Co.

The domestic price reform of major resource products and rising international commodity prices accelerated the PPI growth. The crude oil producer price soared 69.7 percent year on year in January, a major propellant for PPI growth.

Prices of ferrous metals and related products dropped 1.4 percent, led by price decreases in rolled steel plates and other rolled steel products.

Foreign trade

In January, China's foreign trade shrugged off the influences of the dismal global economy and picked up momentum of its own.

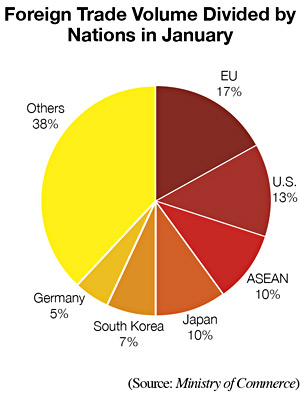

The total foreign trade volume in January this year rose 44.4 percent to $204.78 billion. The exports value stood at $109.47 billion, up 21 percent year on year. Total imports surged 85.5 percent to $95.31 billion.

The robust January figure was due to a low comparison base last year.

Due to strong imports, the trade surplus continued to decrease--to $14.16 billion, down 63.8 percent from that of January 2009.

In the first month of this year, the EU remained China's largest trade partner with bilateral trade reaching $35.18 billion, growing 26 percent. The United States was the second largest, followed by the Association of Southeast Asian Nations (ASEAN) and Japan.

FDI

In January, China acquired $8.13 billion in foreign direct investment (FDI), which grew 7.79 percent from a year earlier. Altogether 1,866 foreign-invested companies were approved to set up offices in China.

The January FDI in agriculture, forestry, animal husbandry and fishery industries grew the most--88.87 percent year on year. FDI in the service industry remained the biggest, accounting for 43.75 percent of total FDI.

Loans and Deposits

China's newly added yuan-denominated loans stood at 1.39 trillion yuan ($203.51 billion), which was 224.3 billion yuan ($32.84 billion) less than the same month last year.

The new loans were equivalent to the combined amount in the last quarter of 2009, igniting worries of excess liquidity and inflation pressure.

In spite of repeated efforts to reassure investors of the accommodative monetary policy, the central bank has in effect embarked on a journey to rein in bank loans. In January and February it hiked the reserve requirement ratio twice, freezing about 600 billion yuan ($87.85 billion). The ratio is the proportion of the money commercial banks must deposit into the central bank. At the end of February, the ratio for large financial institutions stands at 16.5 percent, while that of small financial institutions is 13.5 percent.

In January, newly added yuan-denominated deposits stood at 1.51 trillion yuan ($221.08 billion), down 4.2 billion yuan ($614.93 million).

Housing Price Surge

Housing prices in 70 large and medium-sized cities soared 9.5 percent in January year on year, the highest growth in 21 months, according to figures from the National Bureau of Statistics.

Cities with the highest growth included Haikou and Sanya on Hainan island. Fueled by the Central Government's plan to build Hainan into an international tourist destination, the housing prices in the two cities surged 35.1 percent and 31.2 percent respectively.

Jin Yanshi, chief analyst at Sinolink Securities Co. Ltd., predicted the housing prices will continue to grow and might double in the next five years.

Jin attributed the rising housing prices to excess money pumped into the market by the central bank. Jin said from 1992 until now, the money printed by the central bank grew 23 percent annually, while the economic growth was maintain around 10 percent, meaning a significant liquidity-pushed asset value.

(Figures from the National Bureau of Statistics, the Ministry of Commerce and the People's Bank of China)

CIC's New Game

China Investment Corp. (CIC), the $200-billion sovereign wealth fund, looked for alternative investment targets aside from its previous interest in financial companies.

Open information on the website of the U.S. Securities and Exchange Commission showed at the end of December 31, 2009, CIC held a total of $9.63 billion worth of U.S. stocks, including those of Apple Inc. and media guru Rupert Murdoch's News Corp. Both are NASDAQ-100 companies.

At the beginning of CIC's voyage onto the global arena in 2007, it held a special interest in investing in foreign financial institutions. The ensuing global credit crunch threw CIC into a quagmire as its invested firms encountered severe losses.

After the initial setback, CIC readjusted its aggressive investment strategy and focused on the real industry instead of financial institutions.

In 2008, the return on capital was merely 6.8 percent, while the figure for 2009 is expected to be around 10 percent.

Currently, a large proportion of China's foreign reserves are dollar-related assets. Most have been used to buy U.S. Treasury securities. CIC, with funding from foreign reserves, looks to diversify its investment portfolio to hedge against risks.

Expanding Nuclear Power

Three new projects have been added to the national list of nuclear power development. The new stations are located in Longyou, Zhejiang Province; Xudapu, Liaoning Province; and Ji'an, Jiangxi Province.

These stations will utilize the advanced Westinghouse-designed AP1000 pressurized water reactors to meet stringent safety and environmental standards, said Sun Qin, General Manager of the China National Nuclear Corp.

The installed nuclear power capacity is expected to reach 70 million kilowatts by 2020, 200 million kw by 2030 and 400 million kw by 2050.

Currently, China has 11 operating nuclear power plants with a total capacity of 9.1 million kw, said Zhou Zhenxing, President of Uranium Industry Co., a subsidiary of China Guangdong Nuclear Power Holding Corp. Another 12 units currently under construction have a capacity of 34.76 million kw.