| Opinion |

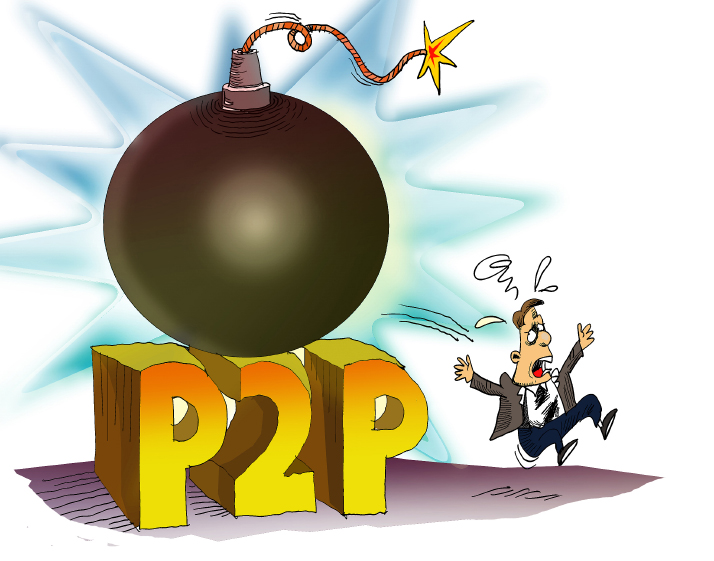

| P2P Risks Should Not Impede Financial Innovation | |

|

|

(VCG)

The peer-to-peer (P2P) lending industry is facing waves of crises. In June, a total of 16 Internet-based financial platforms closed their doors, and 63 were found to have serious problems; in July, another two P2P platforms with annual transaction volume of more than 10 billion yuan ($1.47 billion) shut down. In the meantime, financial technology is becoming essential to enhance financial supervision. Since April, seven local financial supervision authorities have equipped themselves with risk control models similar to the one developed by Ant Financial, an Alibaba affiliate, and more local financial supervision authorities are preparing to cooperate with financial technology innovation firms. The recent P2P crisis was caused by both the tightened monetary supply and the malpractices of P2P platforms. The risky operations of P2P platforms are the core reason for their problems. In China's Internet-based finance industry, there are firms that are fully compliant and capable of controlling risks by fully using financial technology. Some industrial leaders are even able to sell their technologies and solutions. Under such circumstances, P2P platforms must make improvements not only for themselves but for the whole industry. Supervision must be enhanced to lead the industry out of difficulties. Upgrading supervision through technology-driven financial innovation can solve the most urgent issue in the Internet-based finance industry: information asymmetry between the supervisor and the industry. In the P2P industry, malpractices are often highly disguised, so without the help of financial technology, it would be impossible for the supervisor to detect them and realize dynamic and precise supervision. This is why the financial technology committee of the People's Bank of China vowed, when it was set up in May 2017, to increase the use of regulatory technology to boost the capabilities in identifying, preventing and dissolving financial risks. This includes both cross-sector and cross-market risks, using technology such as big data, artificial intelligence and cloud computing. Upgrading supervision through technology-driven financial innovation will also provide future options for the development path of the Internet-based finance industry. China has now become a world leader in many sectors of financial technology, such as mobile payment, so the application of similar technologies is very promising. For the above reasons, to prevent financial risks with technology-driven innovation will be greatly conducive to the formulation of development plans and innovation paths, the decision of supervision orientation and details as well as the identification of risks in the Internet-based finance industry. For this industry, with its distinct nature of technology and rapid growth, appropriate and targeted industrial supervision is what we really need for future development. After competition weeds ineligible players out of the market, financial technology will be the only focus for the development of the industry of Internet-based finance. Technology evolution follows its own laws, and we need to be optimistic about it. In the meantime, since industrial leaders are very likely to participate in the formulation of industrial standards, their openness to technology will facilitate not only the development of the industry, but also the upgrading of supervision. This is also part of their social responsibility. This is an edited excerpt of an article written by independent financial commentator Yang Guoying and published in National Business Daily Copyedited by Francisco Little Comments to zhouxiaoyan@bjreview.com |

|

||||||||||||||||||||||||||||

|