|

The Central Economic Work Conference

An annual meeting of China's top leadership where they map out the country's macroeconomic policies for the next year. It has been held at the end of each year since 1994 and lasts for two to four days. Participants of the conference include members of the Central Committee of the Communist Party of China and the State Council, provincial leaders, heads of financial regulators and executives from centrally administered state-owned enterprises.

Central Economic Work Conference Themes

- 2014 Adapting to the "new normal" and keeping economic growth within a proper range

- 2013 Seeking steady economic progress by making more reforms in all areas

- 2012 Enhancing the quality of economic growth

- 2011 Making progress while maintaining stability

- 2010 Ensuring stable and relatively fast economic development while maintaining social stability

- 2009 Promoting the transformation of economic development pattern while maintaining stable and comparatively fast economic growth

- 2008 Maintaining stable and relatively fast economic growth

- 2007 Shifting monetary policy from "prudent" to "tight"

- 2006 Realizing sound and fast economic growth

- 2005 Maintaining the continuity and stability of macroeconomic policy and improving the quality of economic growth

- 2004 Improving macro-regulation, promoting reform and opening-up and pushing forward economic structural adjustment

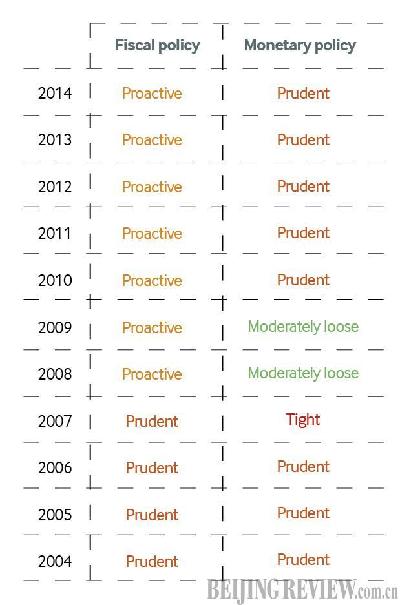

Fiscal and Monetary Policies

A prudent fiscal policy means balanced fiscal revenue and fiscal spending.

A proactive fiscal policy means increasing fiscal spending to stimulate domestic consumption, to spur private investment and to expand exports.

A prudent monetary policy means adjusting the policy according to economic fluctuations. When there is any sign of economic recession, the monetary policy will be fine-tuned toward loose; when there is any sign of overheated economic development, the policy will be fine-tuned toward tight.

A moderately loose monetary policy means increasing money supply by printing money, buying bonds in open markets, cutting reserve requirement ratio for commercial banks and lowering loan rates.

A tight monetary policy means expanding the money supply more slowly than usual or even shrinking it.

(Compiled by Beijing Review)

|