|

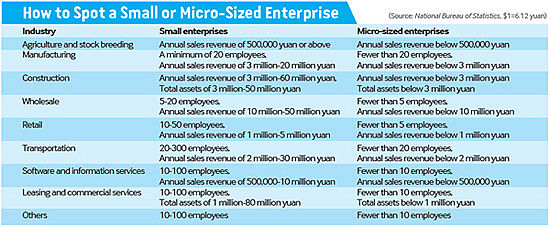

During a fact-finding mission in south China at the beginning of July, Premier Li Keqiang held an informal discussion with local small business owners in Guangxi Zhuang Autonomous Region on July 8, saying that the government will unleash several favorable policies to support small and micro-sized enterprises.

Economic restructuring

Shi Wei, a researcher with the Institute of Economic System and Management of the NDRC, says that since China is in the midst of economic restructuring and transformation, supporting the development of small and micro-sized enterprises is key.

The Chinese Government has been emphasizing the need to expand domestic demand, and achieving that goal will involve reducing taxes for small and micro-sized enterprises. Cutting or exempting value-added taxes and turnover taxes for small and micro-sized enterprises can create more competition in the market, says Shi. This will directly benefit Chinese consumers.

At present 75 percent of Chinese employees work for small and micro-sized enterprises. Once tax alleviation comes, salaries would—the government hopes—increase, and the higher consumption that should result would far more than make up for losses in tax revenue for the government. The tax-free policies will also encourage the creation of more small and micro-sized enterprises and create more jobs.

"The tax-free policy is a good start, but it is not enough. I suggest the government consider reducing the value-added and turnover taxes by 50 percent for small and micro-sized enterprises with monthly sales of 20,000 yuan to 100,000 yuan ($163,018). The government should also appropriately lower the social security fees paid by small and micro-sized enterprises for their employees," said Shi.

Heavy tax cuts would lead to an expansion of production and sales, create more jobs and encourage college graduates to start their own businesses, says Shi.

In 2009 the State Council issued a document on facilitating development of small and micro-sized enterprises, saying taxes for them would be cut by the end of 2010. Altogether 37 tax items and fees were reduced or exempted. This is the second round of tax cuts by the Chinese Government for small and micro-sized enterprises after the global financial crisis.

Shi says in 2009 the major problem these enterprises faced was reduced exports due to lower global demand. But at present they are faced with even worse conditions: Many of them are suffering a severe shortage of cash flow.

The government is obviously considering the establishment of a long-term support system. At a press conference held on July 24, MIIT spokesman Zhu Hongren said the ministry would implement policies supporting the development of small and micro-sized enterprises. In the meantime, it will issue new measures to alleviate the tax burden on small and medium-sized enterprises, especially for the micro-sized businesses.

Email us at: lanxinzhen@bjreview.com

|