|

THE MARKETS

Aluminum Corp. of China (Chinalco), the nation's largest aluminum producer, generated 3 billion yuan ($473.2 million) in net profits in the first 11 months of 2011, compared with 4 billion yuan ($631.9 million) in the first nine months.

"Commodities prices, including that of aluminum, are declining due to waning demands amid simmering the European debt crisis," said Xiong Weiping, President of Chinalco. "A bleak winter for the entire industry is arriving, though it is less likely for Chinalco to spill red ink," he said.

Xiong said that Chinalco's countermeasure was to diversify risks by pushing into new businesses such as copper, rare earths and iron ore.

Chinalco will also accelerate its overseas expansion to achieve its target of having foreign assets account for 30 percent of the total by 2020. In August 2011, Chinalco commenced construction on a giant copper mine in Peru. The project is expected to come in operation in 2013.

China's wealth management market will keep growing as the investable assets of Chinese individuals are expected to reach 62 trillion yuan ($9.8 trillion) by the end of 2011, an increase of 14.8 percent from a year ago, said a report of the Boston Consulting Group.

The number of high-net-worth households, or those with investable assets of more than 6 million yuan ($947,867), rose to 1.21 million at the end of 2011, up from 1.03 million in 2010.

Those households will see their combined investable assets reach 27 trillion yuan ($4.27 trillion), accounting for 44 percent of the country's total. The report also finds that 59 percent of that wealth comes from company profit, 14 percent from real estate investments, 12 percent from financial markets, 10 percent from deposit of salary and other welfare, and 5 percent from inheritance of property.

56

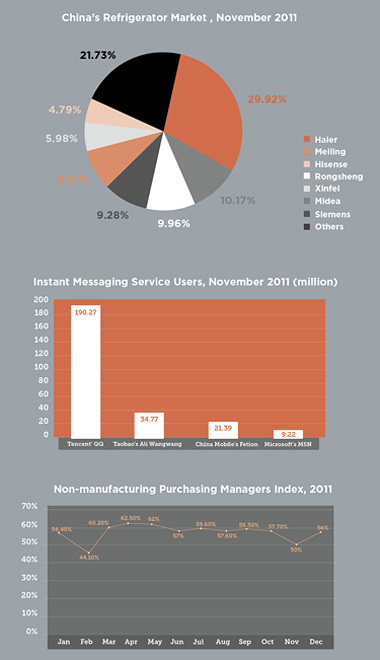

China's purchasing managers index for the non-manufacturing industry stood at 56 percent in December 2010, higher than the boom-and-bust line of 50 percent, said the China Federation of Logistics & Purchasing.

190.27

Tencent's instant messaging tool QQ had a total of 190.27 million users in November 2011, accounting for 72.9 percent of total instant messaging users in China, said the Shanghai-based consulting firm iResearch.

29.92

China's home appliance giant Haier Group topped the domestic refrigerator market in November 2011, with a market share of 29.92 percent, according to data from Cheaa.com, an electronics information website.

|