| Voice |

| The Chinese economy has made real strides toward renewed long-term growth | |

|

|

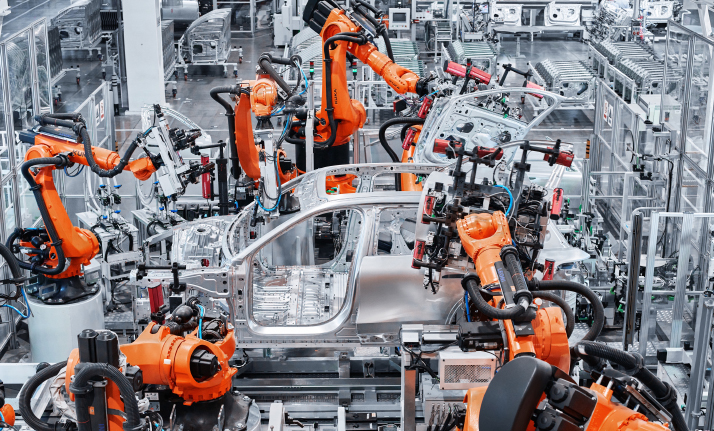

A factory of Chinese electric carmaker NIO in Hefei, Anhui Province, on October 10, 2023 (XINHUA)

Despite internal and external headwinds, China is on a path of focused, strategic, long-term recovery and growth. The Chinese economy managed to grow 5.2 percent in 2023, healthy even when considering the lower base for growth caused by three years of COVID-19 difficulties. The story of China's economy in 2023 is one of resilience in the face of considerable challenges. And that is expected to carry over into 2024 and beyond. So what can we expect in 2024? China has set a goal of around 5 percent growth for the year ahead. The target was announced at the Two Sessions. No major stimulus program has been announced, signaling that China's leadership is confident in organic growth supported by focused and strategic government initiatives. Leading indicators There are two examples the world is unaware of or is underestimating that illustrate China's entry into the next phase of its development. China exported more than 5 million automobiles in 2023, passing Japan as the largest exporter of cars in the world. These exports included electric vehicles (EVs) as well as traditional combustion engine vehicles and were produced by the old guard powerhouses like Dongfeng Motor Corp. and SAIC Motor, as well as fast growing disruptors like BYD and NIO. These brands have been called "Tesla Killers" in the Western media. As impressive as the total number of exports is, the bigger story may be how China's automakers have achieved this type of growth. A combination of factors that have proven successful in other industries over the last 35 years are at play. China has shown the ability to understand the long game and the patience to take the necessary steps to achieve market success in a given category. China's government has provided support and boosted investment for growing this critical industry. According to the National Bureau of Statistics (NBS), in 2023, fixed assets investment in car manufacturing increased by 19.4 percent year on year, much higher than the 6.5-percent increase of overall investments in the manufacturing sector. Chinese automakers are also achieving speedy, cost-effective production models that produce quality cars at prices people around the world can afford (as opposed to more expensive U.S., Japanese, European and Korean cars), and making investments in the development of EVs with a keen sense of the global market potential of the category. Even Elon Musk, CEO of Tesla, has said that he thinks EVs will be dominated by Tesla and "the Chinese brands" going forward. The automotive industry is a leading indicator of how China's economy is adapting to the market changes and disruptions brought about by the COVID-19 crisis, new paradigms in the global economy and the role that technology and innovation will play in ensuring economic success by meeting the needs of domestic and foreign consumers and companies. Temu, the international version of China's budget shopping app Pinduoduo, and China's fast-fashion e-commerce platform SHEIN have also had massive success on the global stage. In 2023, these two homegrown Chinese e-commerce companies experienced exponential growth around the world, and especially in the U.S., to become the two most downloaded and used shopping apps, and are redefining what is possible in e-commerce. They followed a similar playbook to the automakers. Innovate and move fast, put the consumer first, offer a unique experience and provide great prices to consumers who want and/or need to save money. Dealing with headwinds Externally, downturns in regional and national economies have decreased demand for consumer products across a large swath of industries, including apparel, furniture, consumer electronics, toys, hardware and more, putting pressure on China's manufacturing sector. As Gao Ruidong, chief economist at Everbright Securities, stated in an interview with Xinhua News Agency on January 17, in the short term, the scarring effect of the pandemic, the overall downturn in overseas demand, and the "de-risking" measures adopted by Europe and the U.S. are among the factors leading to enterprises' low consumption expectations and the weak investment confidence, which necessitates more policies to stabilize both expectations and growth overall. Citing mounting geopolitical tensions, lower demand in developed countries, an uptick in trade-restrictive measures, and elongated supply chains, the United Nations Conference on Trade and Development said the outlook for global trade in 2024 remains "highly uncertain" and "generally pessimistic." Through a number of key policies, the Chinese economy is boosting the competitiveness of Chinese-made goods and providing incentives for importers from around the world. The consumer sector remains a concern both externally and internally. While some metrics indicate growth in certain consumer sectors, others that are important for building GDP through consumption have not fared as well. The average Chinese consumer is spending considerably less on discretionary items, while increasing purchases of necessities and perceived necessities. However, there are still encouraging signs that consumption at home is improving and providing a much-needed boost to the economy. Research from Boston Consulting Group shows that middle-class and affluent consumers (MACs) in China will grow in number by 80 million people by 2030. Also, of the 80 million new MACs, 70 percent will be from third-tier and smaller cities. This highlights the increasing growth in prosperity across China and the improvements in living standards at all levels. Other positive signs for the economy are the positive effects that fiscal stimulus will have in 2024. According to the government work report submitted on March 5, a proactive fiscal policy will be continued this year, with the deficit-to-GDP ratio set at 3 percent and the government deficit to rise by 180 billion yuan ($25 billion) from the 2023 budget figure, to reach 4.06 trillion yuan ($560 billion). The Chinese Government also vows to integrate the strategy of expanding domestic demand with efforts to deepen supply-side structural reform and better coordinate consumption and investment, so as to more effectively drive economic growth. No need to panic In some corners of the global political-media-business complex, there has been some misinformation and lack of understanding, or outright panic about the state of the economy in China and its prospects for adaptation, growth and resilience in the coming five years. The reality is that other developing and developed economies have faced multiple challenges and have not fully worked them out yet. Some examples include the cost-of-living crisis and Brexit issues in the UK, lingering inflation and permanently higher consumer prices in the U.S. and trade and logistics disruptions in the Suez and Panama canals. The heart of the current state of recovery and the cause for optimism for the future is China's focus on and investment in hi-tech products, processes and services, ranging from EVs to the further development of a high-end, tech-driven manufacturing sector, to the rapid development and deployment of artificial intelligence across a wide range of industries. The NBS notes that "investment in China's hi-tech industries increased by 10.3 percent year on year in 2023. Specifically, investment in the sectors of hi-tech manufacturing and hi-tech services expanded by 9.9 percent and 11.4 percent, respectively. This continued investment in technology and innovation, and adapting products and industries for the world as it is and not as it was, will be crucial to China's continued recovery in 2024. The rest of the world must recognize the connectedness and interdependence of the Chinese economy and their own, and that predictions of doom and collapse are a case of "be careful what you wish for." The author is founder and CEO of U.S.-based consulting firms 5 New Digital and China BrightStar (Printed Edition Title: Rebound and Resilience) Copyedited by G. P. Wilson Comments to yushujun@cicgamericas.com |

|

||||||||||||||||||||||||||||||

|