| Lifestyle |

| What role can an individual pension system play? | |

|

|

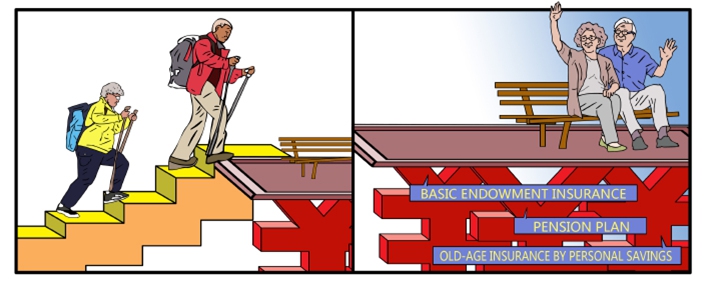

The basic pension system The enterprise annuities The individual pension system (LI SHIGONG)

China currently has a three-pillar pension system in place to manage eldercare. The first pillar is the basic pension system that covers nearly 1 billion people, on which regular workers and residents depend. The second pillar, namely enterprise annuities, is taking shape, now covering more than 58 million people. The third pillar, the individual pension system, is still in the early stages of development. It corresponds to the overall social security system based on voluntary participation and the defined contribution principle by providing a supplementary income during retirement through various money management and investment programs. In this sense, the third pillar has a big role to play in ensuring that the elderly can get sufficient financial support to maintain a decent lifestyle, especially at a time when Chinese society is experiencing accelerated aging. As for the importance of the individual pension system and how should it move forward in China, people contributed their opinions. Zhou Yanfang (economy.gmw.cn): The individual pension system is expected to combine one individual's accounts across banks, insurance companies and fund firms, so that their financial assets can be more efficiently managed. This way, various financial institutions will get more enthusiastically involved in the designing and providing of pension products, which in turn will encourage individuals to participate in this program. Solid financial reserves constitute a crucial foundation to cope with society's rapid aging as well as to ensure quality of life for the elderly. The third pillar means to further strengthen the elderly's ability to enjoy a financially secure life by transforming the conventional practice of paying pension contributions to pension accounts into a certain type of financial investment. Long-term market-based operation and management will not only preserve, but even increase the value of their investments, subsequently providing them with a better quality of life during retirement. Qi Jian (new.qq.com): At a time when the population's aging is accelerating, it is of the utmost urgency to set up a multi-layered pension system aiming to create an overall sustainable system. The aging of a population is closely related to the pension system. When an increasingly large fraction of the overall population leaves the labor force, this will inevitably result in the weakening of a nation's workforce. Gradually, the people withdrawing pension benefits from the pension fund pool will outnumber those contributing to it. This type of model is unlikely to help the elderly through their autumnal years. The third pillar is an important complement to China's pension system. The country needs a multi-layered pension system to ensure people from all walks of life are eligible for financial support as they grow older. A pension system based on personal voluntary participation and market operation, further supported by state tax benefits, is the only way forward. Zhang Yinghua (www.dzwww.com): When participants put their earnings into an individual pension account during their working years, the state will grant certain tax benefits. Apart from this perk, the individual pension system can also help to cut financial investment risks, as people are free to choose an investment product based on their individual risk preferences and current asset portfolios. To ensure its smooth and efficient management, relevant financial watchdogs will determine the criteria for pension-related financial products and standardize the market to counter fraudulous or misleading information. Additionally, when entrusting financial institutions with the management of their individual pension accounts, people will be shielded from uncertainties such as yield fluctuation. Nowadays, a lot of people make their money through social media and short video platforms. The individual pension accounts are connected to them wherever they may go and whatever jobs they may take, even if they are never employed by regular units or companies. Copyedited by G.P. Wilson Comments to lanxinzhen@bjreview.com |

|

||||||||||||||||||||||||||||

|