| Editor's Choice |

| Late entrant pips front-runners on 2020 Fortune Global 500 | |

| The success of Chinese enterprises comes despite mounting challenges at home and abroad, notably the COVID-19 pandemic and China-U.S. tension | |

|

|

Alibaba's research and development center in Shanghai, east China, on July 3 (XINHUA)

While companies worldwide grapple with the novel coronavirus disease (COVID-19), Chinese tech giant Huawei has to contend with other challenges as well. Under growing pressure by the U.S. Government, some countries have banned its equipment and now it faces an additional block on its sourcing of chips. But despite the headwinds, the company has maintained dogged progress, which has been acknowledged by the new Fortune Global 500 list.

"Telecommunications giant Huawei leapt from 72nd to 49th place on this year's Global 500 ranking, breaking into the top 50 for the first time," the U.S. business magazine said as it announced the 2020 list on August 11. The annual ranking of the top 500 corporations worldwide by revenue noted that Huawei, which held 41 percent share in the smartphone market in China in the first quarter (Q1) of 2020, saw its revenue grow 13.1 percent year on year in the first half (H1), "despite the company's persistent geopolitical entanglements." The rapid growth of Huawei since it was founded in 1987 reflects the rise of Chinese enterprises despite external and internal challenges. They surpassed the number of American companies on this year's Global 500 list for the first time, with 124 companies from the Chinese mainland and Hong Kong making the cut. With Taiwan-based enterprises included, the total reaches 133. The U.S. came at second place with 121, the same number it had last year too, followed by Japan with 53 enterprises on the list. Fortune attributed the rise of Chinese conglomerates to the reform and opening-up policy initiated in 1978. More specifically, the progress is due to consistent mergers and acquisitions of state-owned enterprises (SOEs) in recent years, which have improved resource allocation and driven their rapid expansion. "Domestic SOEs show great potential to be stronger. As China promotes SOE reform by reducing taxes and fees and advancing industrial restructuring, the return on equity (ROE), productivity and profitability of the enterprises have been steadily improving," Zhang Monan, a senior researcher with China Center for International Economic Exchanges, told Beijing Review. Besides, China's steady economic growth and expanding market have also driven the development of its enterprises, he added. Chinese companies have ranked high mainly in industries like petroleum and metal production, banking, trade and engineering. The top 10 companies on the list include three Chinese firms and two U.S. ones. Following Walmart, which headed the list, Sinopec, State Grid and China National Petroleum Corp. came second, third and fourth. Among the 25 new and re-listed companies on the list this year, there are eight newly listed Chinese companies. Hong Kong-based insurer AIA Group moved up fastest among all Chinese enterprises, rising by 138 spots to the 250th place. Their improved innovation of technologies and business modes has enhanced their competitiveness and revenue, Liu Xingguo, a researcher with the research department of China Enterprise Confederation, the officially designated employers' organization in China, told Beijing Review. "Backed up by great domestic demand, Chinese companies can manufacture their products at lower costs compared with those in developed countries and outperform many counterparts in other developing countries on technologies and supporting industries," Liu said.  Workers check meltblown non-woven fabric for making medical masks in Beijing on March 7. The production lines were built and are operated by China's largest oil refiner Sinopec (XINHUA)

Performance details

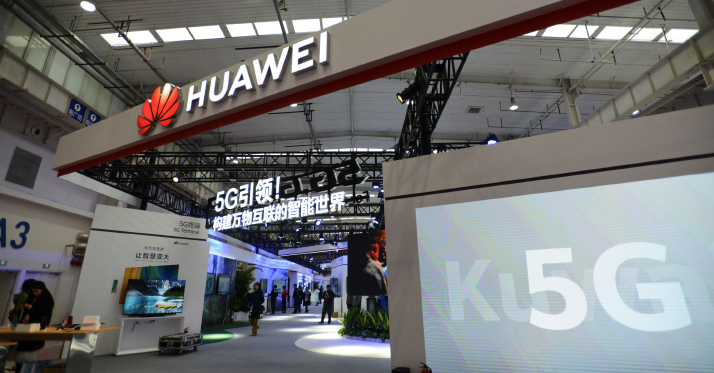

When the Global 500 was launched in 1995, only one Chinese company found a berth there, Bank of China. In 1997, the number rose to four and in 2001, when China joined the World Trade Organization, there was double-digit presence with 12 Chinese companies on the list. Since 2008, they have been steadily forging ahead, surpassing Germany, France, Britain and Japan. No other countries or regions have seen such a rapid increase as China, Fortune said. It said the Chinese enterprises on the list are mainly based in major cities and urban clusters. Beijing has the largest number, 55, while 21 are in the Guangdong-Hong Kong-Macao Greater Bay Area. Nine are headquartered in Shanghai. A total of 48 central SOEs and 32 local SOEs made it to the list. A large number of the enterprises are in the secondary industry, mostly in mining and petroleum production. "Since new industrialization is still to be fully established, traditional sectors remain the key driving forces of China's industrial growth," Liu said, adding that the advance of urbanization and emerging industries have also boosted Chinese real estate and Internet companies. All the five real estate companies on the list this year are based in China. Country Garden Holdings rose 30 spots to the 147th place, topping all real estate enterprises with a revenue of over $70 billion in 2019. Its ROE reached 26.2 percent last year, suggesting improved profitability. Banking and insurance companies also showed strong performance. The list has 10 Chinese banks, whose profits accounted for 44 percent of the total profits of all companies based on the Chinese mainland on the list. The four state-owned banks—Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China and Bank of China—are among the 12 Chinese companies in the top 50. Ten Chinese insurance companies made it to the list, with nine seeing higher ranking. Ping An Insurance climbed eight spots to the 21st place, the highest of the 10 enterprises. According to 2019 reports from the research institute of Swiss Re, one of the world's leading providers of insurance, China became the world's second largest insurance market in 2018, with total premiums reaching $575 billion. The enhanced income of Chinese and greater awareness of insurance can make China the world's largest insurance market in 10 to 15 years. The Asia-Pacific region is expected to represent 42 percent of global premiums by 2029, which will mainly be driven by the Chinese market, the institute said. The growth of Chinese Internet companies on the list has attracted widespread attention. Seven Internet companies made it to the list, of which four are Chinese: the Alibaba Group, Tencent, JD.com and Xiaomi. Along with their U.S. counterparts—Amazon, Alphabet and Facebook—all the four Chinese Internet giants have moved up in the ranking. JD.com ranked the highest among the four companies at the 102nd place. According to a financial report released by the enterprise this year, its net revenue reached 576.9 billion yuan ($82.9 billion) in 2019, up 24.9 percent year on year. Alibaba saw the biggest rise among the four, jumping 50 places to the 132nd position. The improved performance of Chinese Internet companies shows the development of the digital economy in China. As it booms, more such companies are expected to enter the list, Cao Heping, a professor with Peking University, told Science and Technology Daily.  Huawei's 5G technology exhibition booth at the 2019 World 5G Convention in Beijing on November 20, 2019 (XINHUA)

Overcoming odds The success of Chinese enterprises comes despite mounting challenges at home and abroad, notably the COVID-19 pandemic and China-U.S. tension. In the initial period of the COVID-19 outbreak in China, when there was a brief shortage of medical supplies, domestic enterprises, especially the SOEs, acted swiftly, shifting to producing much-needed items such as masks and protective clothing. According to the State-Owned Assets Supervision and Administration Commission (SASAC), the utility enterprises lowered electricity and gas prices and others rents to help small and medium-sized enterprises cope with difficulties. In H1 this year, the SOEs helped ease operation costs for virus-hit domestic businesses by over 120 billion yuan ($17.14 billion). Rent cuts exceeded 4 billion yuan ($578 million), SASAC said. With the resumption of business, many key economic indicators have started to show signs of recovery. Data from the National Bureau of Statistics showed that China's value-added industrial output rose by 4.8 percent year on year in July. Retail sales of commodities moved up by 0.2 percent year on year in the same month, registering positive growth for the first time this year. While COVID-19 has been largely curbed in China, the external situation is still severe due to its global spread, as well as the U.S. ban on selling chips to Chinese companies and the use of Chinese apps including TikTok and WeChat. Against these external challenges, Chinese enterprises have continued to explore more markets and improve independent research and development (R&D) to survive and thrive. Besides Alibaba, Xiaomi, which debuted on the list last year, also moved up considerably this year, up 46 places to the 422nd spot. Its financial report in Q1 this year showed 13.6 percent year-on-year growth in revenue amid the epidemic. Revenue from overseas markets totaled 24.8 billion yuan ($3.5 billion) in the period, up 47.8 percent year on year and accounting for half of all revenue. Despite external restrictions, Huawei said its sales revenue rose by 13.1 percent year on year to 454 billion yuan ($64.9 billion) in H1. Last year, its revenue was $124.3 billion and the input in R&D exceeded 130 billion yuan ($18.8 billion). "The improved input in R&D has allowed Huawei to maintain rapid growth, improve its global presence and rank high globally in terms of patent application. With its technological competitiveness enhanced, its growth will not be disrupted by U.S. restrictions," Liu said. Room for growth Although the list shows Chinese companies have come a long way, Fortune said they have to go still further to enhance profitability and improve competitiveness. According to it, the average sales revenue of the 124 Chinese enterprises stood at $66.9 billion in 2019. Their average net assets also reached the world's average level. However, they need to improve their profitability. Their average profit was less than $3.6 billion while the average of the other Global 500 companies was $4.1 billion. The figure for U.S. companies was $7 billion. While most Chinese enterprises on the list are in the traditional industry and banking sectors, the high-ranking U.S. firms are mainly from insurance, food and beverage, healthcare and wholesale, suggesting the domestic firms need to improve their consumption. While the average profit of U.S. non-banking enterprises was $6.3 billion, the figure for their Chinese counterparts was less than $2.2 billion. According to Liu, Chinese enterprises still face bottlenecks in developing key technologies and upgrading low-end industrial chains. They need to increase investment in R&D, improve the industrial and supply chains and upgrade production for stronger international competitiveness. "They should improve profitability and net assets and further tap into the domestic market. Moreover, the government needs to provide support through laws and institutions to better protect the interests of Chinese enterprises abroad," Zhang said. (Print Edition Title: Higher on the Ladder) Copyedited by Sudeshna Sarkar Comments to lixiaoyang@bjreview.com |

|

||||||||||||||||||||||||||||||

|