| Editor's Choice |

| Injecting Impetus | |

| China continues to drive up consumption to boost the economy | |

|

|

Visitors view a concept vehicle at an exhibition in Haikou, south China's Hainan Province, on January 10 (XINHUA)

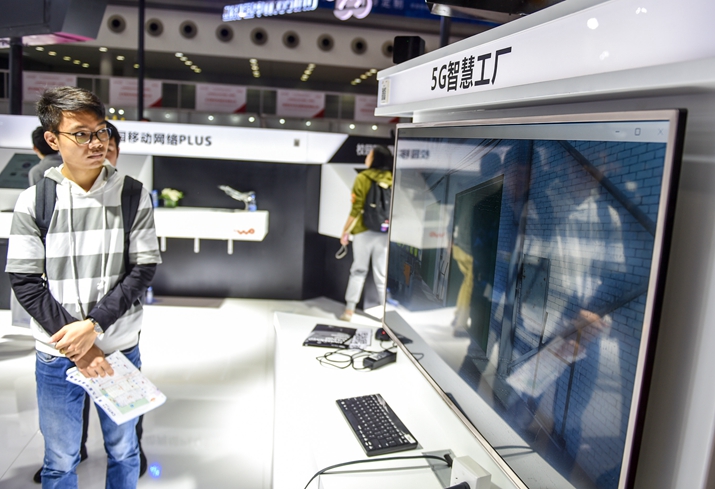

As China steps into the Year of the Pig, which symbolizes good fortune, it is also striving to achieve prosperity commensurate with its implications. Before the Lunar New Year on February 5, the country unveiled measures to stimulate consumption in 2019, which is expected to more comprehensively draw out the effects of domestic demands to ensure stable economic growth. The plan, jointly issued by 10 ministerial-level authorities including the National Development and Reform Commission (NDRC) on January 29, focuses on boosting the sales of big-ticket items such as automobiles and home appliances, upgrading domestic consumption, and releasing the potential of urban and rural demands. With one of the largest markets in the world, China is increasingly moving toward bolstering the domestic economy through its large consumer base given uncertainties in the external market. According to data released by the National Bureau of Statistics (NBS), consumption contributed 76.2 percent to China's GDP growth in 2018, significantly up 18.6 percentage points from the previous year, making it a major driving force of the economy. China's per-capita consumer spending reached 19,853 yuan ($2,954), increasing 6.2 percent year on year in real terms in 2018, obtaining an increase of 0.8 percentage points faster than the previous year, according to the NBS. NBS data also showed that total retail sales of consumer goods rose 6.9 percent year on year to 38.1 trillion yuan ($5.6 trillion) in 2018, with online retail sales rising 24 percent. Noticeably, total retail sales of consumer goods grew at double-digit rates for the previous 14 years. According to Wang Bin, an official with the Ministry of Commerce (MOFCOM), consumption is expected to contribute 65 percent to China's economic growth in 2019 with a 9-percent increase in total retail sales of consumer goods, even though pressure facing the consumer market will mount and domestic consumption growth is likely to see a further slowdown. The medium- to long-term contradictions and risks facing China's economic development may become more prominent in 2019, Wang said, making it difficult to accelerate the growth of consumption. However, the upgrading demands of China's middle-income consumers still provide great potential for the domestic market. "Consumption will remain the largest contributor to China's economic growth in 2019," he projected. Car sale boost The new pro-consumption measures target sectors that saw weaker growth in 2018, giving special attention to the automobile industry. China will push ahead with car replacement, especially in rural areas, improve second-hand car markets and provide subsidies to encourage the purchase of new-energy vehicles (NEVs), the plan says. It also will improve infrastructure facilities such as parking lots and NEV charging stations. Liu Yunan, an official with the NDRC, said the slowdown in auto sales led to 66.7 percent of the decline in the growth of total retail sales of consumer goods. Data from the China Association of Automobile Manufacturers showed that the country sold 28.08 million cars last year, down 2.76 percent year on year. "The traditional auto market is on a downward trend, with limited room for growth," Xu Hongcai, Deputy Chief Economist at the China Center for International Economic Exchanges, told Beijing Review. He called for efforts to tap into new markets to cushion the slowdown in purchases. The number of vehicles owned by every 1,000 Chinese people was about 170 in 2018, according to official data, which still lags behind developed economies. Liu said domestic vehicle sales can be propelled through upgrading car consumption in rural areas by encouraging rural residents who still drive unsafe three-wheel vehicles to buy cars or trucks with subsidies. Meanwhile, as NEVs become the new craze among Chinese vehicle consumers, they have become a growth driver of the auto industry. According to Dong Dajian, an official with the Ministry of Industry and Information Technology (MIIT), China's production and sales of NEVs are expected to exceed 1.5 million units this year, helping the auto market to register stable growth across the board. "Considering the growth of China's economy, its ongoing urbanization process, as well as its improving standards for energy conservation and environmental protection, the auto market still has much room for further growth," Dong said.  Telecome carrier China Unicom showcases its 5G technologies at the 19th China Hi-Tech Fair in Shenzhen, south China's Guangdong Province, in November 2018 (XINHUA)

Smarter, quality consumption The plan also proposes improving the domestic consumption infrastructure, enhancing the quality of products and services, and optimizing the consumer market. According to Liu, China's home appliance industry, with the world's largest production and sales volume, is another key driver of the country's consumption growth. Thus, the promotion of green and smart home appliances will push the industry toward upgrading to meet people's demands for higher-quality products and further cutting emissions. "Once the policy encouraging the purchase of energy-saving and smart home appliances is launched across China, some 150 million appliances are expected to be sold from 2019 to 2021, totaling about 700 billion yuan ($104 billion)," Liu said. According to MIIT, China's information consumption reported a rapid increase last year, while the total business volume of the telecommunications sector improved 137.9 percent from the previous year. Measures by Chinese telecommunications operators to increase the speed of Internet connections and cut connection costs have contributed to the rise of domestic information consumption, the ministry said. According to Dong, China needs to boost information consumption by speeding up the construction of the telecommunications infrastructure and the commercial use of the 5G network. Following test runs of 5G-equipped buses in some regions, an indoor 5G network will be installed in the Shanghai Hongqiao Railway Station by the end of 2019. In addition, MIIT announced China will move faster to deploy the 5G network and carry out trials for 5G commercial use this year. "Currently, the 5G industry is experiencing accelerated development around the world. With initial full-fledged network facilities, it is expected that China's 5G terminal chips will be rolled out in the first half of 2019, and 5G smartphones will be launched in the middle of the year," Dong said. Within five years of commercial deployment in China, 5G will create an economic output of 10 trillion yuan ($1.5 trillion) and generate 3 million new jobs, relevant estimates showed. "Since China has a large smartphone market, the promotion of 5G technology will undoubtedly help propel domestic consumption," Xu said.

Releasing potential To fully unleash the potential of domestic consumption, both urban and rural markets will be further developed to expand demands and reduce regional disparity. According to the plan, the renovation of old apartments, the real estate rental market, as well as children and senior care services will be promoted to augment urban consumption. Meanwhile, rural areas will strive for faster development of online shopping, e-commerce and tourism. Consumption growth in rural areas is still hindered by problems such as underdeveloped markets and infrastructure. Therefore, e-commerce will be further promoted to develop new markets in rural areas and improve local consumption, Wang said. So far, the development of e-commerce has improved rural residents' income, which is crucial for boosting consumption. Official data showed that online sales from rural areas exceeded 1.3 trillion yuan ($190 billion) in 2018, providing 28 million local residents with jobs. "Accelerating agricultural modernization is also significant for boosting rural consumption, which can help increase household income," Xu said. According to NBS data, the real growth of per-capita disposable income in rural areas was faster than that in urban areas in 2018, suggesting a narrowing urban-rural income gap. China's per-capita disposable income stood at 28,228 yuan ($4,165) in 2018, up 6.5 percent year on year in real terms. Urban and rural per-capita disposable income was 39,251 yuan ($5,840) and 14,617 yuan ($2,174), up 5.6 percent and 6.6 percent, respectively, with price factors deducted. The income gap between cities is also on the decline. According to a Morgan Stanley report, per-capita disposable income for households in China's smaller cities was 55 percent lower than those in top-tier cities a decade ago, but in 2017, the gap shrunk to 45 percent and is likely to go down further to 36 percent by 2030. "Serving as a driving force for economic growth, consumption is also directly driven by economic growth," Xu said. "The key to achieving stable consumption growth is to ensure employment, which will expand the middle-income group and improve the living standards of the low-income group." Copyedited by Rebeca Toledo Comments to lixiaoyang@bjreview.com |

|

||||||||||||||||||||||||||||||

|