| Business |

| Auto Shanghai 2025 offers glimpse into present and future of China's automotive industry | |

|

|

The booth of German automaker Volkswagen at Auto Shanghai 2025 on May 1 (XINHUA)

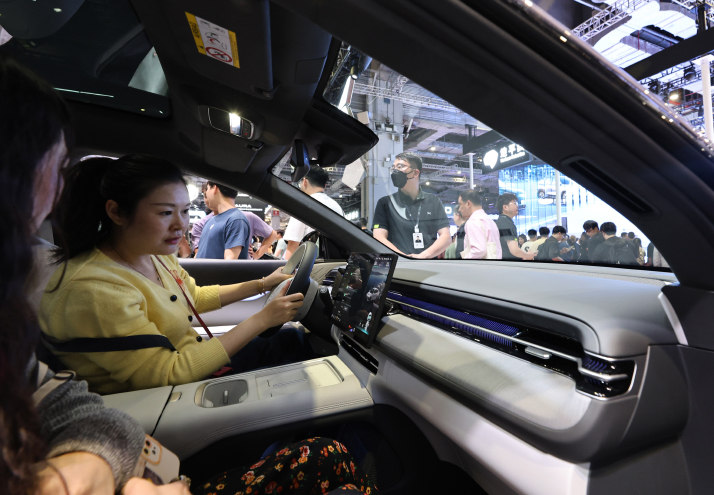

T he 21st Shanghai International Automobile Industry Exhibition, or Auto Shanghai 2025, highlighted the latest innovations and trends driving the future of the global automotive industry. The event showcased 1,366 vehicles, with over 70 percent being new-energy vehicles (NEVs), and 163 of them making their world debut. NEVs are automobiles that are fully or predominantly powered by electric energy, including plug-in vehicles, battery electric vehicles, plug-in hybrid electric vehicles and fuel-cell electric vehicles (EVs). Running from April 23 to May 2, with an exhibition area exceeding 360,000 square meters, Auto Shanghai 2025 attracted nearly 1,000 leading domestic and international companies from 26 countries and regions, and drew over 1 million visitors. China's total auto output reached 7.56 million units in the first quarter (Q1) of this year, a 14.5-percent year-on-year increase, while sales grew 11.2 percent on a yearly basis to 7.47 million units, according to the China Association of Automobile Manufacturers (CAAM) on April 11. According to the CAAM, China's NEV production surged 50.4 percent year on year to 3.18 million units in Q1. NEV sales soared 47.1 percent year on year to 3.08 million units, accounting for 41.2 percent of total vehicle sales in the period. Stride and strength The event mirrored how the use of intelligent technologies is becoming a major trend in the EV industry, Zhang Hong, a member of the China Automobile Dealers Association Expert Committee, told Beijing Review. "China's homegrown brands have taken an early lead in the research and development (R&D) of NEVs, and developed competitive edges in technologies on power batteries, drive motors and intelligent vehicle control systems in the world," he said, adding that NEVs, with growing consumer awareness of environmental issues, are increasingly embraced in China . According to Zhang, China has built a complete auto part supply network covering petroleum-fueled vehicles, NEVs and intelligent connected vehicles. With a well-established NEV industrial chain, domestic brands can offer cost-effective products. Chinese automakers are moving up on the innovation chain. BYD, the world's largest EV maker with global sales exceeding 4.2 million units in 2024, has introduced blade battery with long life and plug-in dual mode hybrid technology that improves energy efficiency and lowers fuel consumption. China's auto exports saw a year-on-year increase of 7.3 percent in Q1. Specifically, NEV exports soared 43.9 percent year on year to 441,000 units, the CAAM said. In Q1, EV manufacturer Xpeng announced plans to enter 60 international markets by late 2025. The company reported strong overseas pre-orders for its newly launched X9 model, reinforcing its global ambitions. EV producer NIO's founder William Li has also revealed that the company's Firefly brand, which focuses on compact smart models for urban mobility, will enter 16 international markets this year, including the Netherlands, Norway and Costa Rica, using a hybrid sales model that combines local dealership networks with NIO's service standards. On April 23, China FAW Group Co. Ltd. announced a development plan for its premium Hongqi brand, targeting operations in more than 100 countries and regions with 1,000 sales and service outlets within five years. A major differentiator at Auto Shanghai 2025 was advanced driver assistance systems, with Chinese tech titan Huawei standing out as a key player. Models from its Harmony Intelligent Mobility Alliance, including the AITO M8, Stelato S9 and Maextro S800, demonstrated smart features that transform cars into fully connected tech hubs on wheels. The innovations include adaptive driver assistance, intelligent cockpits, smart keys and customizable welcome-light displays. Huawei's collaboration with traditional automakers, such as EV maker Seres, has injected the industry with new momentum. At the event, Huawei's executive director Yu Chengdong and Jia Jianxu, President of Shanghai Automotive Industry Corp., jointly unveiled the new Harmony Intelligent Mobility Alliance brand, pledging deeper cooperation in connected vehicles, electric drivetrains and smart vehicle controls. Established in 2023, the Harmony Intelligent Mobility Alliance is an ecosystem focused on intelligent vehicle technologies. Rather than manufacturing cars itself, Huawei plays a central role in product planning, design, marketing, user experience and quality control, as well as the supply of advanced software and hardware solutions to traditional automakers. As of mid-April, over 700,000 vehicles had been delivered under the Harmony Intelligent Mobility Alliance. Huawei's smart automotive solutions business generated 26.35 billion yuan ($3.66 billion) in revenue in 2024, up 474.4 percent year on year.  An Xpeng G6 electric car on display at the 21st Shanghai International Automobile Industry Exhibition (Auto Shanghai 2025) in Shanghai on April 26 (XINHUA)

Global players Riding the wave of China's technological progress, many international automakers are deepening their cooperation with Chinese companies to enhance smart technology and electrification efforts. At the auto show, renowned foreign brands unveiled over 10 NEV models for global customers for the first time, including Mercedes-Benz's long-wheelbase version of its all-electric CLA saloon and Lexus ES sedan's hybrid and all-electric versions. Oliver Zipse, Chairman of the Board of Management of BMW AG, said in an interview with Xinhua News Agency that China is crucial for BMW's next-generation intelligent vehicles, reaffirming plans to integrate AI technology from Chinese startup DeepSeek into its latest models in China later this year. In March, BMW announced that it will join forces with Huawei to develop a smart in-car digital ecosystem specifically for the Chinese market. Later that month, it partnered with Chinese e-commerce giant Alibaba to incorporate the latter's large language model, a type of AI algorithm, into its next-generation vehicles. BMW has also expanded cooperation with ByteDance, owner of Douyin, the Chinese version of TikTok. Both sides will jointly improve AI applications in marketing and customer service, according to their plan unveiled in April. The first Neue Klasse models, BMW's next-generation vehicles, will enter production at its plant in Shenyang, Liaoning Province in northeast China, in 2026, the company added. Volkswagen Group, another leading German automaker, is also increasing its focus on China. Just before the Shanghai auto show, the company introduced a highly automated, AI-powered driver-assistance system developed by CARIZON, its joint R&D venture in China. The first model featuring this technology will be launched later this year, and starting in 2026, the system will become a standard feature in Volkswagen's next-generation fully connected compact-class vehicles. Market outlook China's NEV market still faces multiple challenges. According to Zhang, major consumer concerns, such as driving range, charging speed and battery lifespan, persist. While progress has been made, fundamental breakthroughs will take more time. Insufficient and unevenly distributed charging facilities negatively affect user experience, particularly in lower-tier cities and rural areas. "China's NEV industry also faces supply chain vulnerabilities due to its reliance on imported critical minerals like lithium, cobalt and nickel, which increases cost and risk. Additionally, rising global trade protectionism has posed challenges to Chinese NEV exports," Zhang said. He suggested homegrown auto brands enhance market competitiveness by improving R&D investment, and develop complete industrial chains for more efficient production and cost control. "Competition is intensifying as more traditional automakers and new entrants join the NEV market, making differentiation a challenge for all players," Zhang said, adding that the companies also need to strengthen their global presence through exporting technologies and building overseas production facilities. BR (Print Edition Title: In the Driver's Seat) Copyedited by Elsbeth van Paridon Comments to lixiaoyang@cicgamericas.com |

|

||||||||||||||||||||||||||||||

|