| Business |

| How a Chinese cross-border platform captured American attention | |

|

|

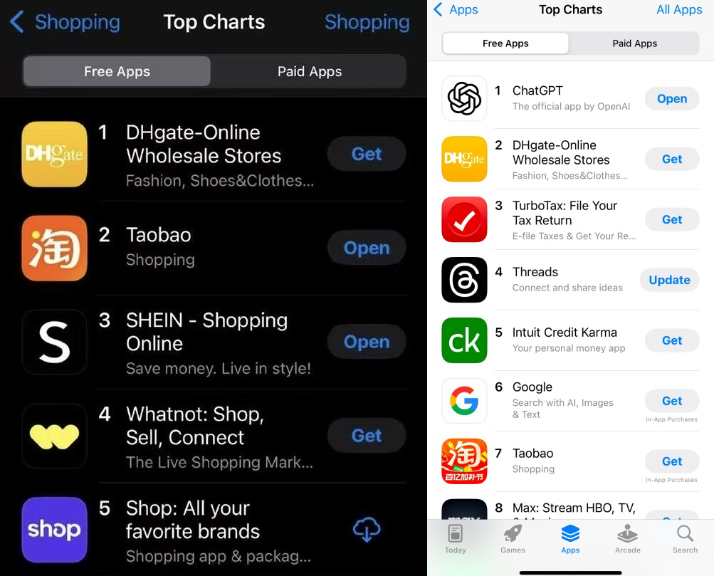

Apple's U.S. App Store free app download ranking chart on April 15

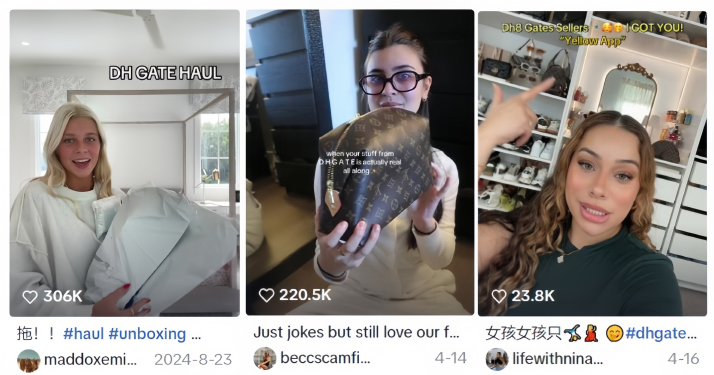

'This is from the yellow app?" "Yes, the 'gate'." These cryptic exchanges have flooded TikTok comment sections lately, as American users secretly hunt for shopping tips on DHgate, China's cross-border e-commerce platform, using "yellow app" as their code. Until recently, most mistook DHgate for a municipal portal in northwest China. By April 15 (Beijing time), DHgate had catapulted to second place on the free download chart of the Apple App Store in the U.S., trailing only ChatGPT. The ascent was meteoric: On April 11, it ranked outside the top 300. In just three days, it skyrocketed—reaching No.6 on April 13, No.3 on April 14, and directly to No.2 on April 15, where it remained at the time of writing. A video released on DHgate's cross-border e-commerce official account reveals that its downloads surged 800 percent month on month in April. On April 13 alone, downloads on the Apple App Store hit 117,500—a 732-percent spike from its 30-day average, with 65,100 downloads in the U.S. Notably, Chinese apps now dominate the top three spots on Apple's U.S. App Store shopping chart. The U.S. market has fueled over half of DHgate's viral growth, driven by U.S. President Donald Trump's tariff hikes on Chinese imports and TikTok influencer marketing. "To survive tariffs, U.S. retailers are cutting out traditional importers and buying directly from Chinese manufacturers. DHgate caters to small businesses with lower minimum orders than business-to-business (B2B) giant Alibaba," John Pang, a senior fellow of the Belt and Road Initiative Caucus for Asia Pacific in Malaysia, told Beijing Review on April 17. From pioneer to overnight sensation, DHgate's 20-year journey underscores the enduring power of Chinese manufacturing on the global stage. The rise of DHgate Named after Dunhuang, a historic Silk Road trading hub, DHgate was founded to revive China's trade legacy in the digital age. "We aim to build a 21st-century online Silk Road, rekindling China's glory in global trade and culture," said Wang Shutong, DHgate's founder and CEO, once explaining the platform's origin. Wang's story mirrors China's Internet evolution. A former professor at Tsinghua University in Beijing, she co-founded Joyo.com—one of the largest online bookstores in China at that time—together with Lei Jun, founder of China's tech giant Xiaomi, in 2000, which Amazon later acquired. In 2004, she pivoted to DHgate—the country's first B2B cross-border platform. With just 10 staff, the team likely never imagined their platform would one day serve 25.4 million suppliers and 59.6 million buyers, and operate 14 overseas warehouses across 225 countries. Unlike flashy newcomers like e-commerce website Temu, fast fashion retailer SHEIN or TikTok Shop, DHgate has long toiled in obscurity. Launched in 2004, it specialized in small-scale B2B trade, connecting Chinese manufacturers directly to global buyers—circumventing intermediaries with end-to-end services from order management to logistics. Profitability, however, remained elusive until 2020, as DHgate navigated the challenges of early cross-border commerce. In 2020, DHgate incubated MyyShop, a social commerce platform. "MyyShop bridges the world's hottest marketplaces with China's supply chain," Wang said. By 2022, DHgate Group had formalized a dual-engine strategy around DHgate and MyyShop, investing in marketing, logistics and merchant support to empower factories and brands. The group has also launched a special support plan. On the one hand, it assists companies with cross-border businesses in increasing sales abroad and, on the other hand, it helps manufacturing enterprises further explore overseas markets. DHgate mainly operates in categories such as 3C electronics [computers, consumer electronics and communications], fashion and household items. It attracts users with extremely low prices and high quality. In the past, as a B2B platform, it mainly circulated within the foreign trade community, but it has recently entered the public eye due to the tariff storm.  Screenshots of recent TikTok videos related to DHgate, one of China’s cross-border e-commerce platforms

Tempestuous times

Trump-era tariffs roiled global trade, stoking U.S. consumer anxiety about rising prices. The University of Michigan's consumer sentiment index plunged 11 percent in April—the second-lowest rating since 1952. April's reading was lower than anything seen during the Great Recession (2007-09). Amid this uncertainty, TikTok influencers ignited a DHgate craze. Videos exposing "#LuxuryExposed" went viral, showing Chinese factories producing goods for global brands. One user, @kimba1468, bragged: "I've bought [Canadian fitness apparel retailer] Lululemon and [French luxury fashion brand] Celine direct from China for years—glad everyone's catching on!" Another, @lauratellsjokes, showcased a handbag she bought on DHgate: "Quality was legit! It came in about two weeks," she said, "They [DHgate] are not paying me for this. I just thought I'd give a real life example of using it." TikTok user @nikkisviews1, after showing off a made-in-China handbag she'd just received, said: "That's really amazing. But what I really, really want is one of their cars. I swear I'm trying to figure out how to get this and get it over to America." Under hashtags like #BuyingFromChina, users share guides to Chinese manufacturer websites, while #LuxuryExposed highlights brand markups. Even with tariffs, DHgate prices often undercut U.S. retailers. Many American users have even taken the initiative to compile guides on "how to buy directly from China," listing Chinese manufacturer websites, introducing them and helping others make informed choices. Meanwhile, numerous Chinese suppliers and manufacturers have created videos introducing the original equipment manufacturer model to overseas consumers. These videos have directly driven huge traffic to DHgate, with a large influx of American users flocking there to make purchases. On April 10, DHgate launched the Stock & Save promotional campaign in the U.S., citing tariff uncertainty and stockpiling consumer demand. The platform pledged resource allocation, traffic boosts and targeted marketing to connect merchants with more buyers. As early as 2018, Wang expressed her hope in a media interview for the emergence of a new generation of online platform enterprises with unique characteristics, emphasizing that these should not only be innovative in their business model or boast a large transaction scale. Instead, the enterprises should embody a philosophy of empowerment and win-win cooperation, avoiding the fear often associated with large entities. "We hope to see a new type of online platform that represents China and the values we advocate—consultation, collaboration and shared benefits—to better facilitate global synergy and development," she said. Today, Americans are embracing Made in China on platforms ranging from lifestyle and e-commerce app RedNote to DHgate. They are actively seeking Chinese products. Perhaps smart consumers prioritize value in this world. BR Printed edition title: Silk Road Surge Copyedited by Elsbeth van Paridon Comments to taozihui@cicgamericas.com |

|

||||||||||||||||||||||||||||||

|