| Business |

| Investment Unlimited | |

| China scraps QFII, RQFII quotas to further open up the capital market By Li Qing | |

|

|

The Shanghai Stock Exchange (XINHUA)

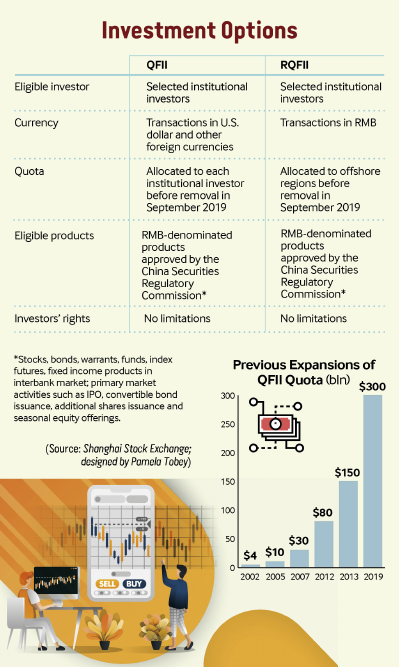

China has taken a new step to open up the domestic financial market and facilitate cross-border investment and financing by scrapping quota restrictions on two major inbound investment programs. The move will provide unrestricted access to the second largest capital market in the world. The State Administration of Foreign Exchange (SAFE), China's foreign exchange regulator, announced on September 10 that the U.S. dollar-denominated Qualified Foreign Institutional Investor (QFII) program, introduced in 2002 to allow specified licensed international investors to participate in the mainland's stock trading, and the Renminbi Qualified Foreign Institutional Investor (RQFII) scheme will no longer have any investment quotas. The RQFII program, introduced in 2011, allows the subsidiaries of domestic fund management companies and securities companies in Hong Kong Special Administrative Region to use renminbi-denominated funds raised in Hong Kong for investment in the domestic securities market after obtaining the approval of the China Securities Regulatory Commission (CSRC). The QFII quota was doubled to $300 billion in January, while the RQFII quota was set at 1.94 trillion yuan ($272 billion). More than 400 institutional investors from 31 countries and regions have invested in China's financial market through the two programs. SAFE said in a statement that the removal of the restrictions will "make it much more convenient for overseas investors to participate in China's financial market, making China's bond and stock markets more broadly accepted by international markets." In the future, foreign institutional investors will only need to register to remit funds independently to invest in securities. Signs of easing up The announcement came after earlier signs of the financial market being opened up. The QFII quota doubling in January followed four earlier expansions. Also, draft rules were published earlier this year to combine the QFII and RQFII schemes, while simplifying access for overseas investors. Last year, the lock-up period requirement for the investments was scrapped, allowing foreign investors to repatriate their money at any time. By the end of August, the QFII investment was $111.376 billion from 292 investors, along with 693.3 billion yuan ($97.5 million) invested by 222 RQFIIs. Since the quotas had not been used up, why did the government abolish them? Zhang Xin, Deputy Administrator of SAFE, told Xinhua News Agency that the caps were abolished on the recommendation of the People's Bank of China, the central bank, and SAFE to further open up the financial market. With the removal, the qualified foreign investor scheme can attract more long-term capital in the future, contributing to the stability of the yuan exchange rate and the balance of international payments. While the qualified foreign investor scheme is one of the main channels for foreign investment in China's financial market, the quota restriction hampered its utilization. Li Lifeng, chief strategist of Sinolink Securities, a Chinese financing and securities service provider, told China Daily that the policy will provide a strong impetus for the rebound of China's primary A-share market. As of August, the total market value of A shares held by QFIIs was 682.2 billion yuan ($95.5 billion), accounting for only 1.5 percent of the A-share market capitalization. The new reform is expected to optimize the investor structure and change investors' trading style, which is essential for the healthy development of China's financial market. In addition, the cancellation indicates that China's financial market is stable enough to withstand the impact of a large amount of foreign capital, Xi Junyang, an economics professor at the Shanghai University of Finance and Economics, told Global Times. "With this, we foresee the timeframe in accessing the mainland's financial sector to be shortened, foreign investors' financing needs being further supported, and investment demand into China continuing to grow," Patrick Wong, head of China business development and client management at HSBC Securities Services, told Global Custodian, a magazine covering the international securities services business. He said HSBC has a very strong pipeline of investors applying for new QFII/RQFII licenses or for increasing their investment quota and this relaxation will benefit them in speeding up their market access. Eugenie Shen, head of the asset management group at Asia Securities Industry & Financial Markets Association, said ending quotas was a "good way to preserve the attractiveness of the QFII and RQFII channels." In an interview with Reuters, Khiem Do, head of Greater China investments at Barings, also predicted that the scrapping of QFII and RQFII investment quotas would encourage inflows into China's onshore stock and bond markets. Strengthened supervision The investment demand of foreign investors in China's financial market has been on the rise, with China's stocks and bonds being included in main international indexes, such as the MSCI, FTSE Russell, S&P Dow Jones and Bloomberg Barclays Index, and its weight is steadily increasing, Wang Chunying, chief economist of SAFE, said at a press conference on September 10. According to People.cn, a note from a research team at Bank of Communications pointed out that China should further enhance the appeal of the domestic financial market to offshore investors. "Increasing investment convenience is just a first step. It must be accompanied by institutional improvement and other supporting reforms," the note said. To adapt to the opening up of the financial market, SAFE will strengthen regulation to prevent risks such as cross-border capital flows and safeguard national economic and financial security, Zhang said. "In recent years, the central bank and SAFE have taken measures such as the counter-cyclical adjustment of foreign exchange risk reserves." After the QFII and RQFII investment quotas are removed, he said, financial regulators will improve macro-prudential management and explore more matching regulatory approaches. SAFE and other agencies are conducting a study on QFII management, looking at such measures as providing long-term investors with a wider investment range, according to Zhang.  Copyedited by Sudeshna Sarkar Comments to liqing@bjreview.com |

|

||||||||||||||||||||||||||||||

|