| Business |

| The New Hot Cake Sale | |

| Individual investors scramble to buy local government bonds as they become widely available at commercial banks | |

|

|

A client buys local government bonds at a bank in Jinan, east China's Shandong Province, on March 28 (CNSPHOTO)

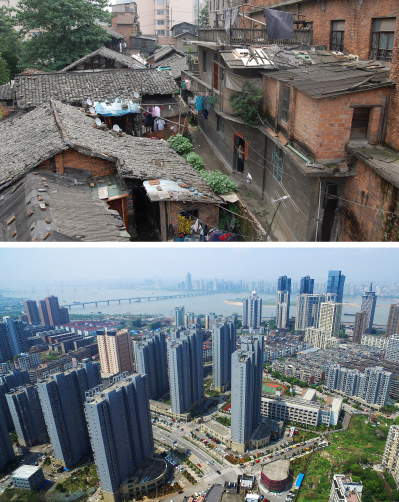

The Ministry of Finance (MOF) has approved the sale of local government bonds directly to individuals as well as small and medium-sized institutional investors at commercial bank counters, triggering massive investor enthusiasm. Following the reform, Zhejiang Province and Ningbo City issued the bonds on March 25, followed by Sichuan, Shaanxi and Shandong provinces as well as Beijing Municipality, becoming the first places to pilot the issuance of over-the-counter local government bonds. By April 3, several banks announced the first batch of local government bonds had been snapped up entirely. The Industrial and Commercial Bank of China (ICBC) said its quota of the bonds issued by Ningbo, Zhejiang, Sichuan, Shaanxi, Shandong and Beijing, worth 1.77 billion yuan ($263.39 million), had sold out. Indeed, its quota of the bonds issued by Ningbo, Zhejiang and Beijing sold out on the same day they were made available. The Industrial Bank announced it had sold 200 million yuan ($29.76 million) of local government bonds. Of them, bonds issued by Zhejiang, totaling 100 million yuan ($14.88 million), were grabbed by buyers within 10 minutes, and another 100 million yuan's worth, issued by Beijing, were gone within two days. Before, local government bonds were sold only on the interbank market and only financial institutions could invest in them. Though changes were made in November 2018, allowing individual investors to buy them on the interbank market, the high threshold was a deterrent. Lower threshold With the reform, the minimum investment needed to buy local government bonds at commercial bank counters is 100 yuan ($14.88). Individual investors no longer have to meet any minimum financial asset requirement to buy. Only risk evaluation is needed. The 2018 relaxation stipulated that to invest in local government bonds on the interbank market, an individual investor needed to have an annual income of at least 500,000 yuan ($74,405) and personal financial assets worth at least 3 million yuan ($446,429). They also needed at least two years of experience in securities investment, according to regulations by the People's Bank of China, the central bank. While the wealth management products issued by commercial banks require a minimum purchase of 10,000 yuan ($1,488), the local government bonds can be bought only for 100 yuan, which has attracted more individual investors, an ICBC sales manager, who declined to be named, told The Economic Observer newspaper. The stable return on the bonds also contributed to their brisk sale, the sales manager said. The repayment of the capital and the interest payment are incorporated in the budgets of the local governments. All the six local government bonds issued this time got the highest credit rating, AAA, indicating they have very low risk levels. The interest rate on them is around 3 percent. It is higher than the interest on time deposits—a sum of money deposited for a specific period and earning interest—but lower than the interest rate on savings bonds issued by the Central Government. According to the MOF, the coupon rate or yield for the bond issued by Ningbo is 3.04 percent for a three-year term. The money generated from the bond sale will be used to buy land. The coupon rate for the bonds issued by Zhejiang for a five-year period is 3.32 percent. The money raised will be used to renovate shantytowns. The current benchmark interest rate for three-year time deposits is 2.75 percent, and the interest rate for three-year savings bonds issued in March 2019 is 4 percent, according to the central bank. The PBC has no benchmark interest rate stipulation for five-year time deposits, while the interest rate for five-year savings bonds is 4.27 percent.  High-rise buildings dot the skyline of a former shantytown (above) in Nanchang, east China's Jiangxi Province, in April 2017 after its renovation (XINHUA)

Benefits and risks

The MOF said by buying local government bonds, investors can enjoy a stable income from the interest and at the same time support the economic development of their hometowns. They can sell the bonds back to commercial banks at any time or pledge them for loans, so the liquidity of the bonds is high. "Issuing local government bonds via counters of commercial banks will further diversify the channels for issuing local government bonds, enlarge the group of investors, and better satisfy the investment demand of individuals and small and medium-sized institutional investors," the MOF said. Li Peijia, a senior researcher with the Institute of International Finance at the Bank of China, said expanding the channels through which local governments can issue bonds will provide individuals a new investment outlet that has low risks and medium returns. It will also diversify the structure of investors. "At present, the commercial bank counter market is still small and separated from the securities exchanges and interbank market. This will affect the liquidity of local government bonds and the general efficiency of the entire bond market," Li told the 21st Century Business Herald newspaper. "The market of commercial bank counters should be enlarged." However, experts have warned of some risks as well. Zhao Xijun, Deputy Dean of the School of Finance at Renmin University of China, said treasury bonds have the lowest risks because they are guaranteed by state credit. But with the ongoing reform to divide administrative powers between the Central Government and local governments, the credits of central and local governments may be separated in the future. So investors should not completely depend on the Central Government to ensure the safety of local government bonds. Dong Ximiao, deputy head of the Chongyang Institute for Financial Studies at Renmin University, said while local government bonds generally carry low risk, they are not bank deposits or treasury bonds. So defaulting on them can't be ruled out in the future. In an interview with The Economic Observer, Dong suggested that investors pay attention to the fiscal capacity of the local governments issuing the bonds and the use of funds and then take a calculated risk. Central and local government debt amounted to 33.35 trillion yuan ($4.97 trillion) at the end of 2018, representing 37 percent of China's GDP, according to Finance Minister Liu Kun. The ratio is lower than the 60-percent limit set by the European Union and that of other major market economies and emerging markets. Of this, local government debt totaled 18.39 trillion yuan ($2.74 trillion). Overall, local governments' debt risks are under control, Liu said at a press conference in early March. Copyedited by Sudeshna Sarkar Comments to wangjun@bjreview.com |

|

||||||||||||||||||||||||||||

|